SPY had it’s bounce after holding that 191 area we had talked about in last blog post.

However in terms of daily chart SPY is back within range again.

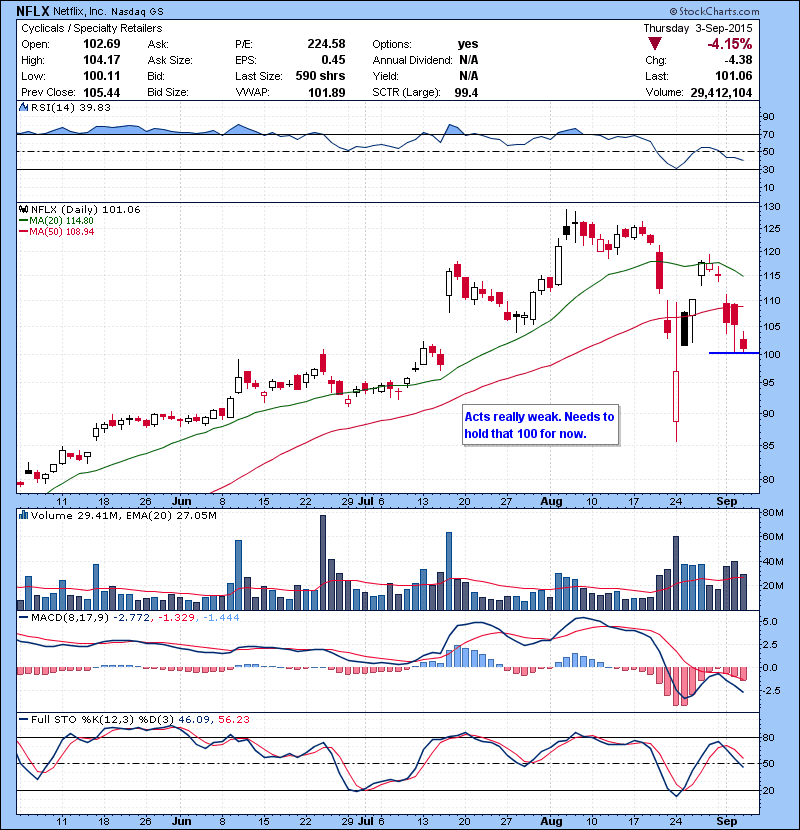

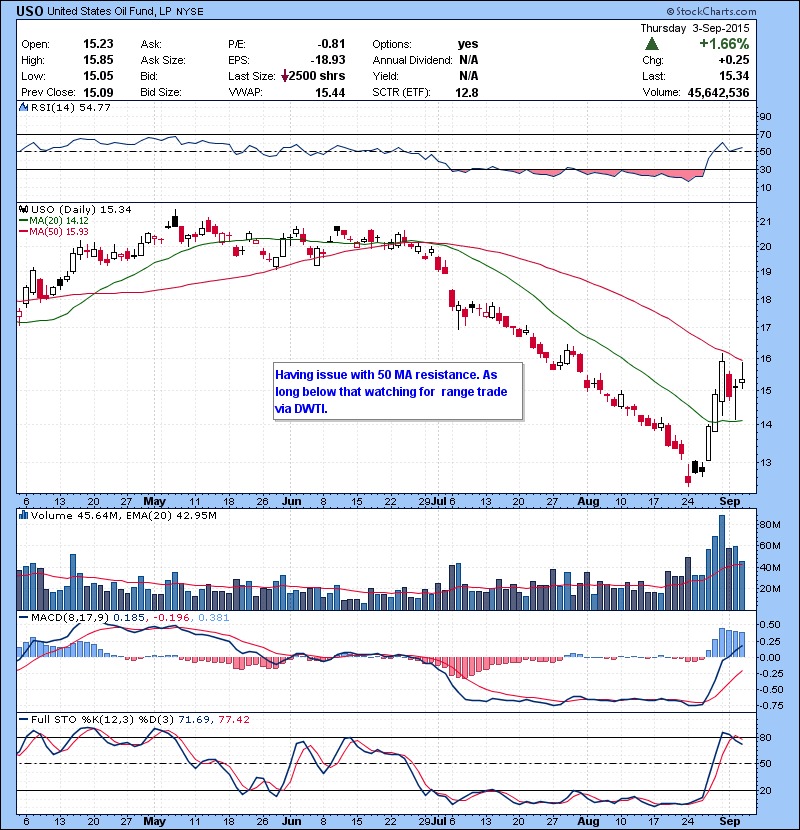

Bearish or one can also call it a neutral zone with not much edge .As far as trading this market, trading the range via shorting the resistance has been working really well for us. We are mostly trading liquid tech names like NFLX, TSLA, AMBA or ETF’s like DWTI and UVXY. This is the type of market to stick with big liquid names. They run with market direction and much easier to trade during turbulence . If your trading tool box only contains playing straight break outs, this is not market for you now. Breakout in this market most likely will fade.Be sure to have different trading technique and strategy where you can day trade or swing trade both ways. This volatile market providing big trading opportunities as we continue to have record daily gains in our chat room via trade alerts. If you are struggling with your trading or learn how to trade you need to join our 60 day Bootcamp course. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders. You can also check out the testimonials from our students.

Also if you are interested in our day trade alert services and chat room , take a free trial! Check them out here.

Follow me on Twitter @szaman and on StockTwits @szaman

Check out our newest Offering “Bulls Vision” ! A brand new screen share product! See through the eyes of @kunal00 while he trades live everyday.