Big “V” shaped rally in the market after huge sell off, catching many late shorts off guard. As i wrote in the last blog “SPY needs to get back over that 9/20 EMA on 30 minute time frame and close there for Bulls to get some footings.” Bulls manged to close the SPY over both 9/20 EMA on 30 minute chart on Wednesday.

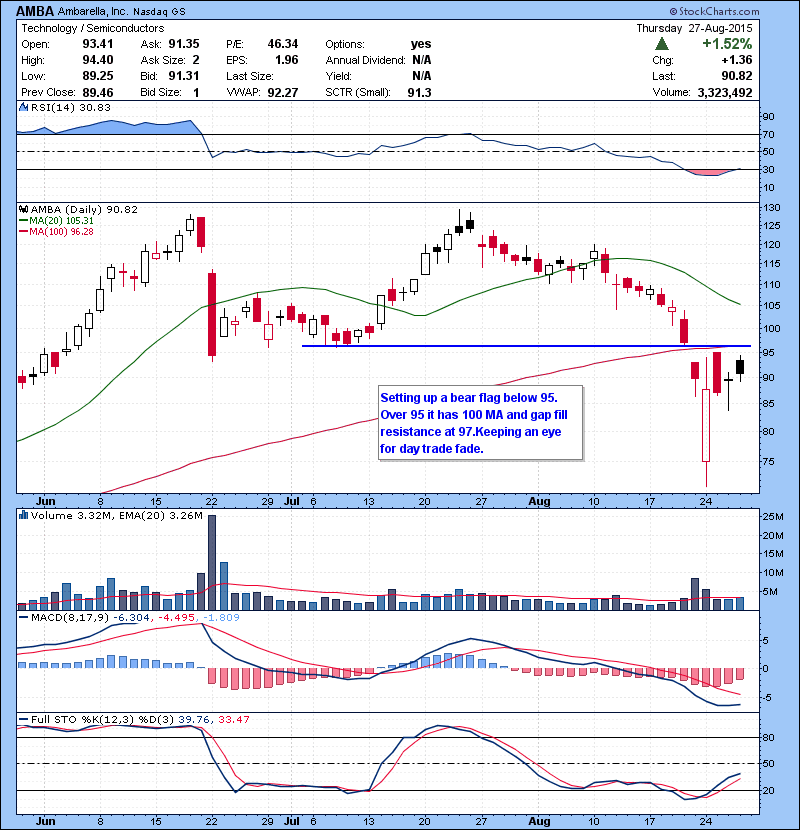

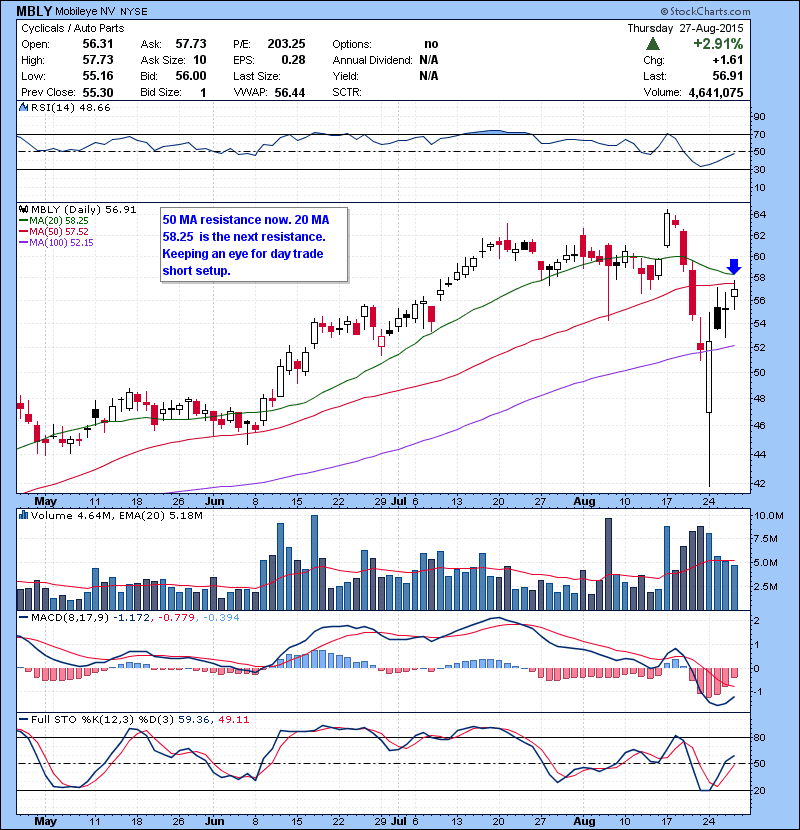

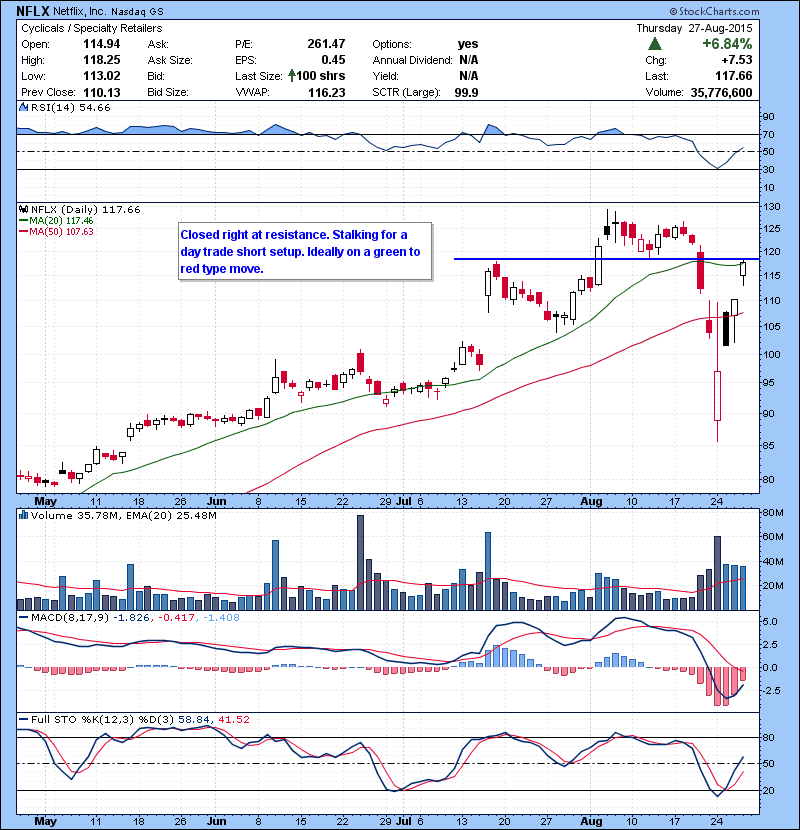

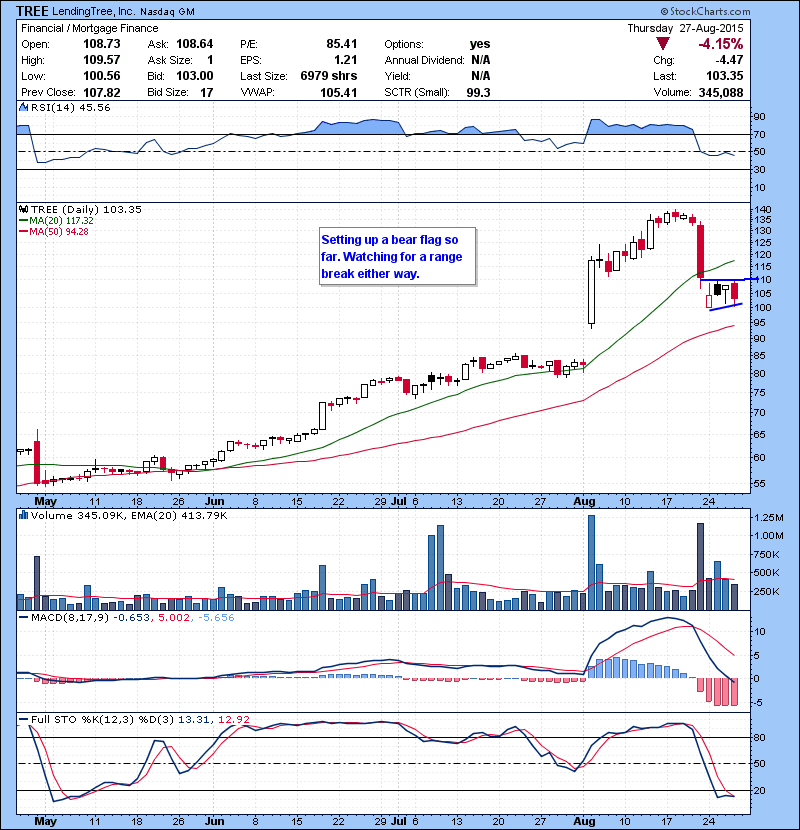

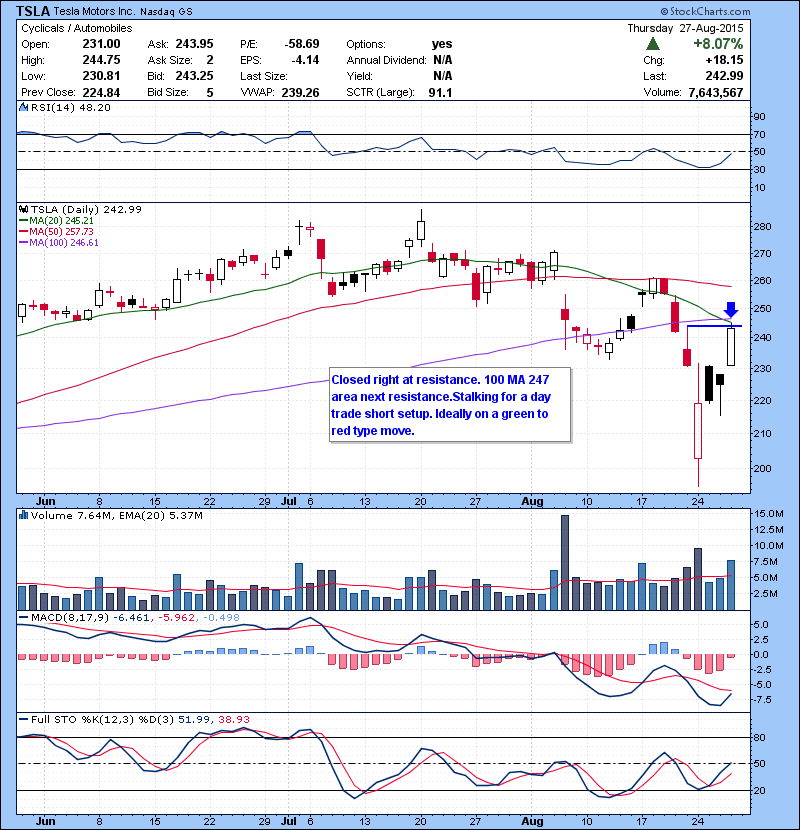

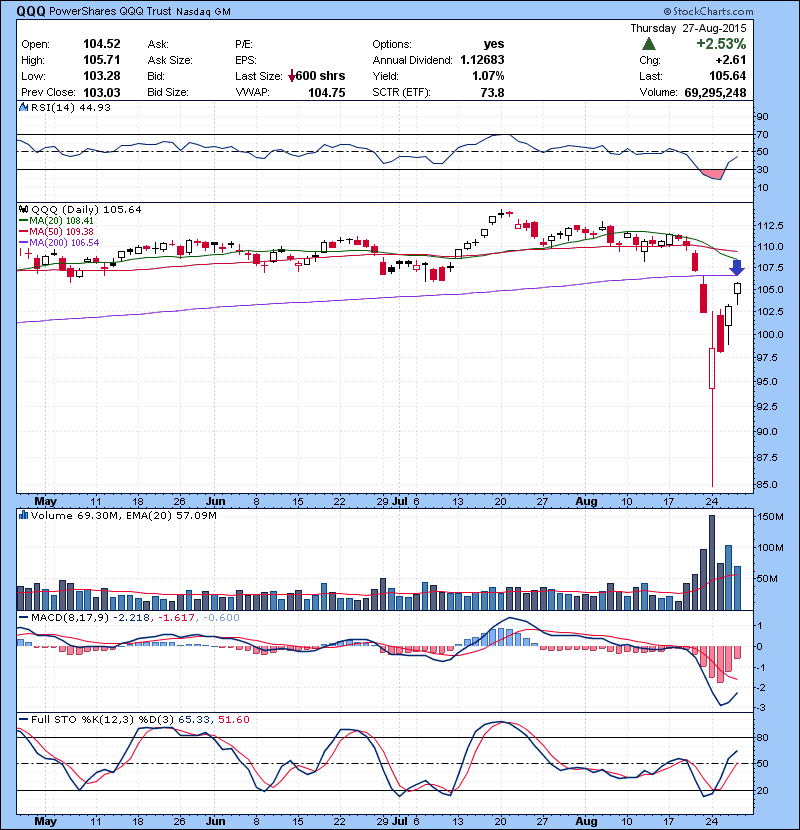

And a nice follow through on Thursday by Bulls with a gap up and go day. After this “V” shaped rally market needs some basing action to create new setups. Market hitting some overhead resistance here, so i will be focusing on some quick day trading shorts. Technology stocks came a long way since Monday and you can see QQQ has over head resistance at 200 MA.

Volatility creating some nice wide range for day trading. If you are day trader or day trading with proper education, this volatile market provides tremendous opportunity for profitable trading.If you are struggling with your trading or learn how to trade you need to join our 60 day Bootcamp course. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders. You can also check out the testimonials from our students.

Also if you are interested in our day trade alert services and chat room , take a free trial! Check them out here.

Follow me on Twitter @szaman and on StockTwits @szaman

Check out our newest Offering “Bulls Vision” ! A brand new screen share product! See through the eyes of @kunal00 while he trades live everyday.