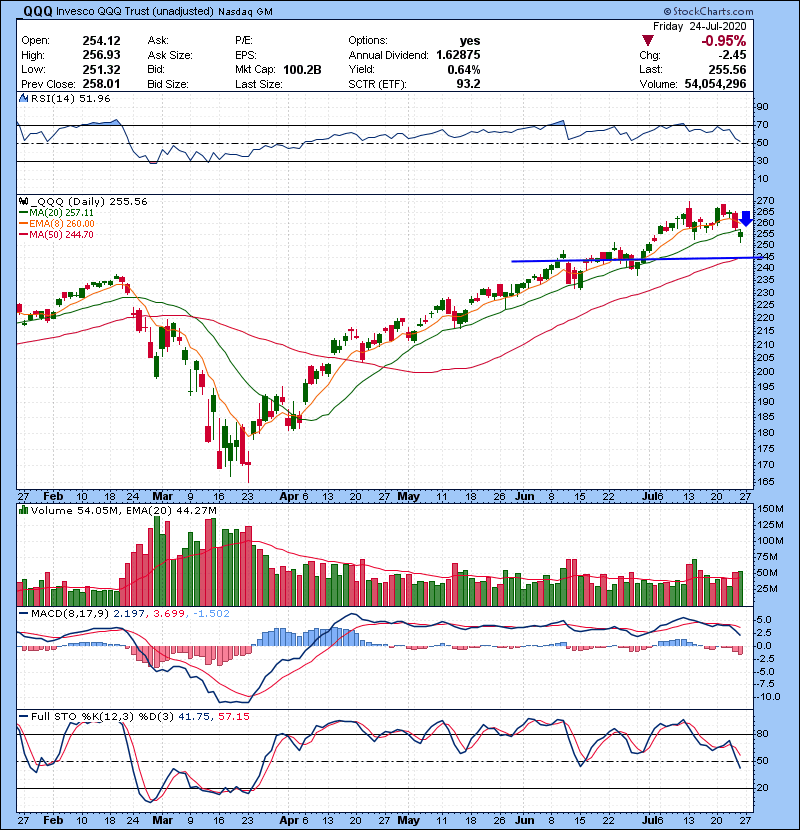

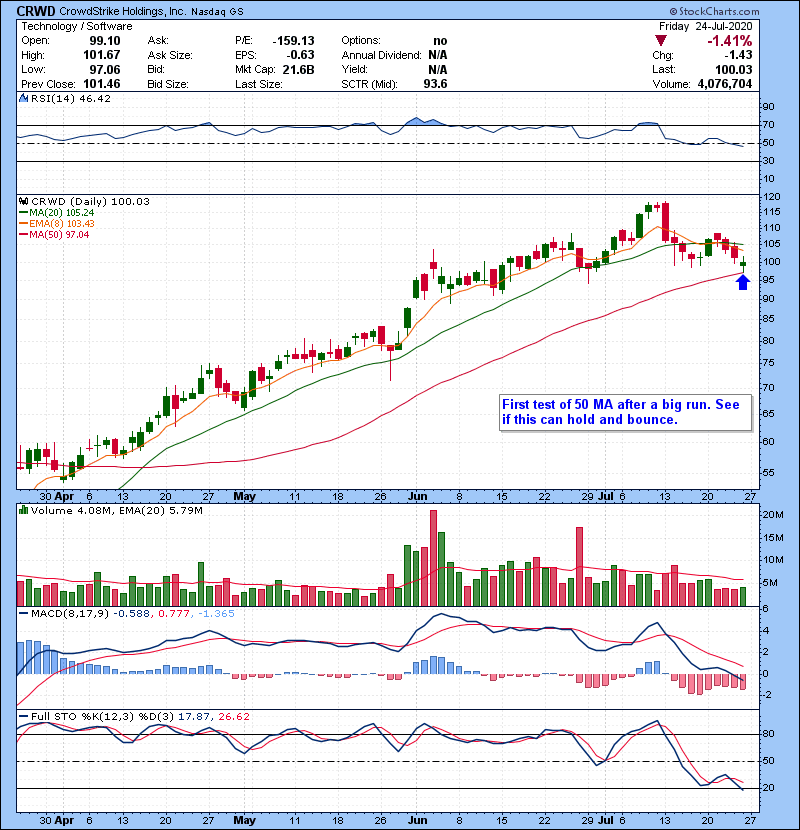

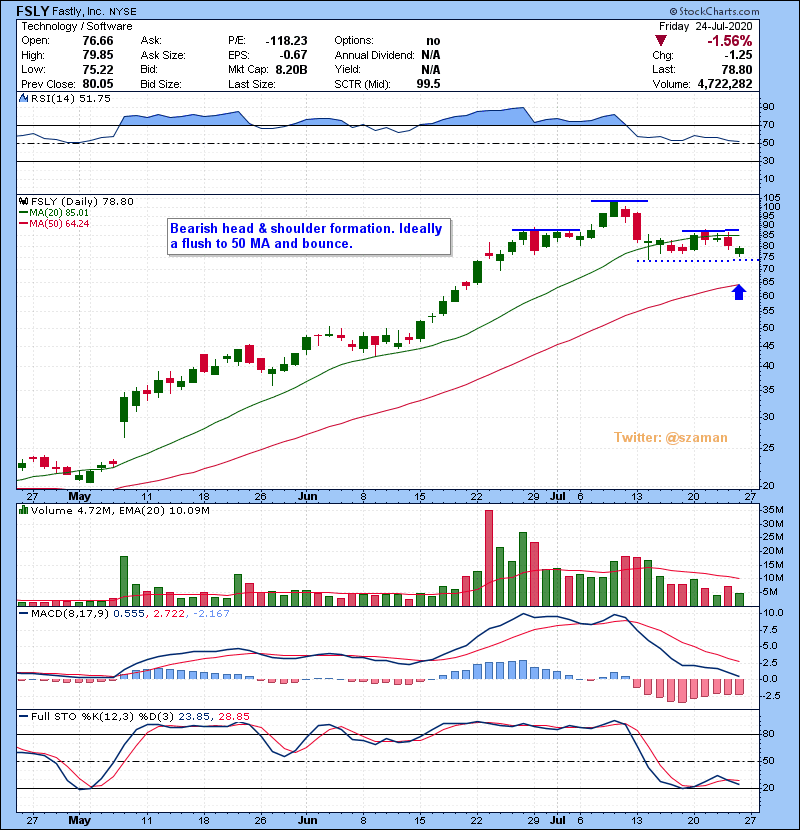

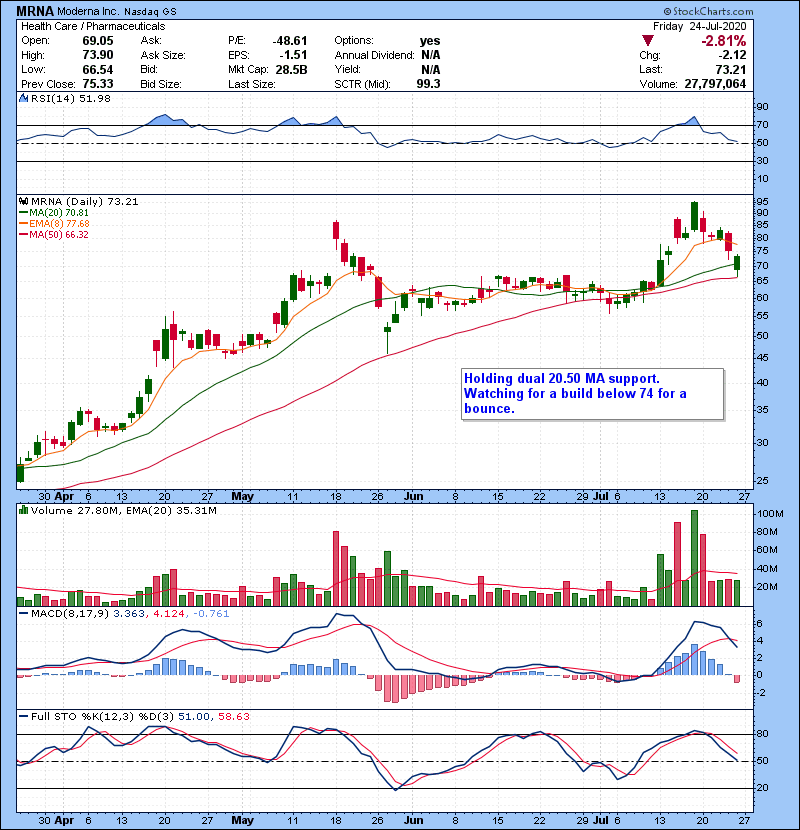

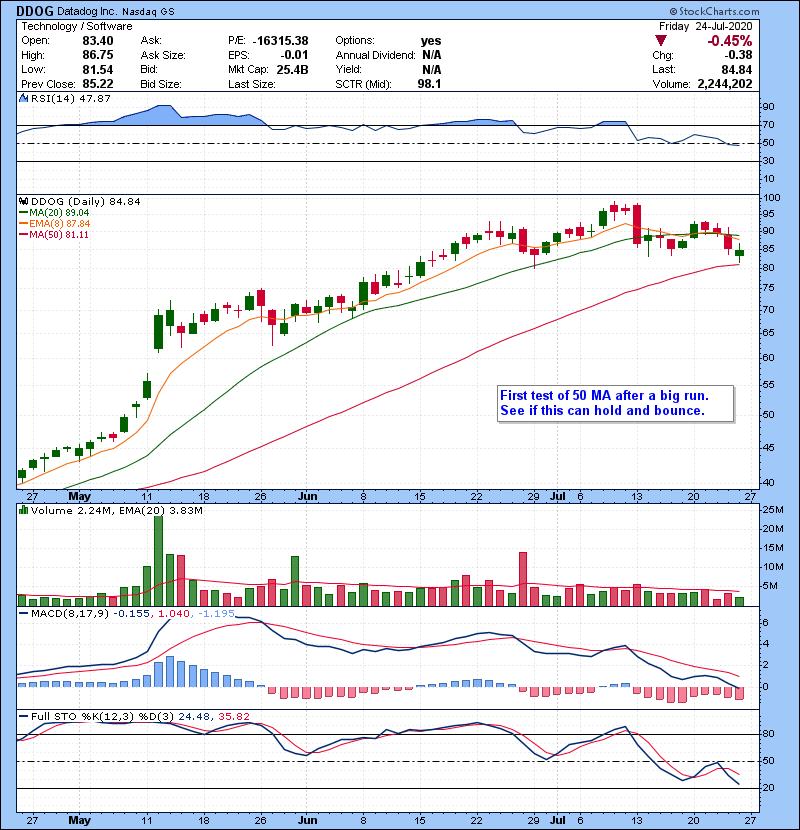

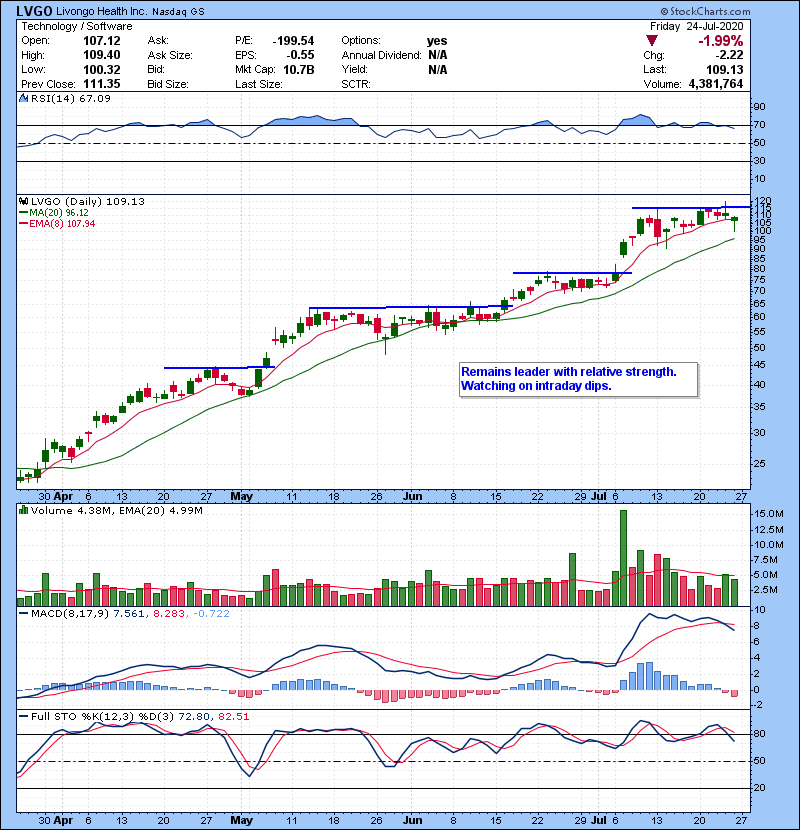

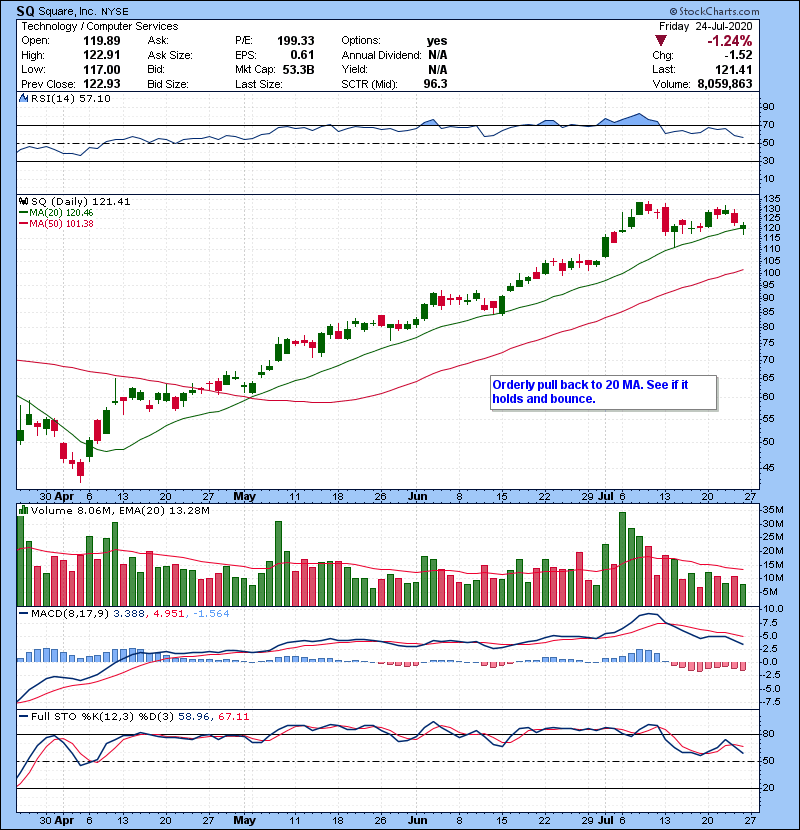

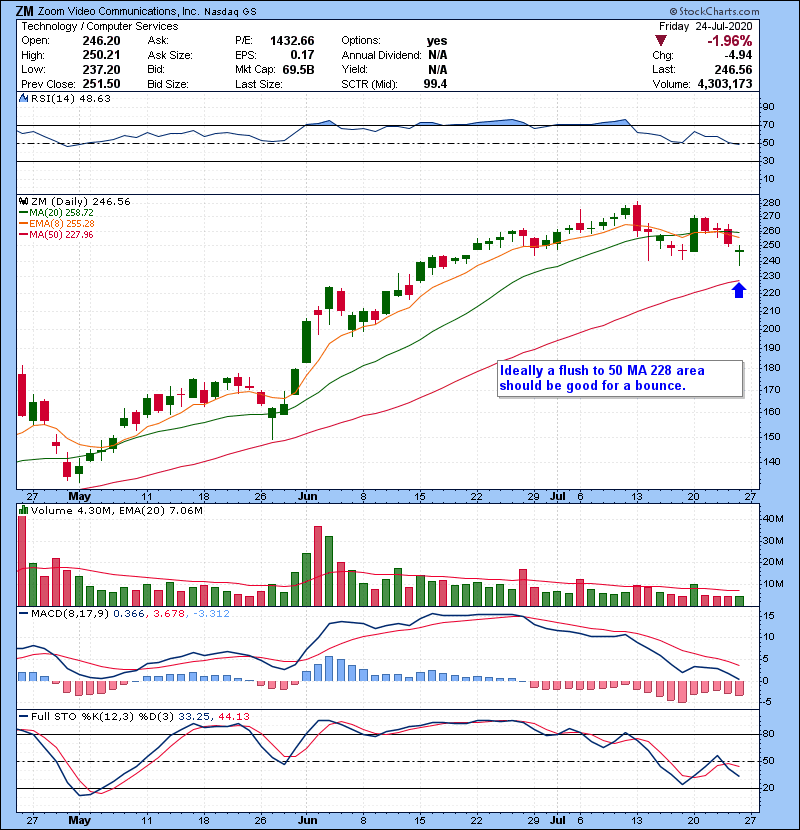

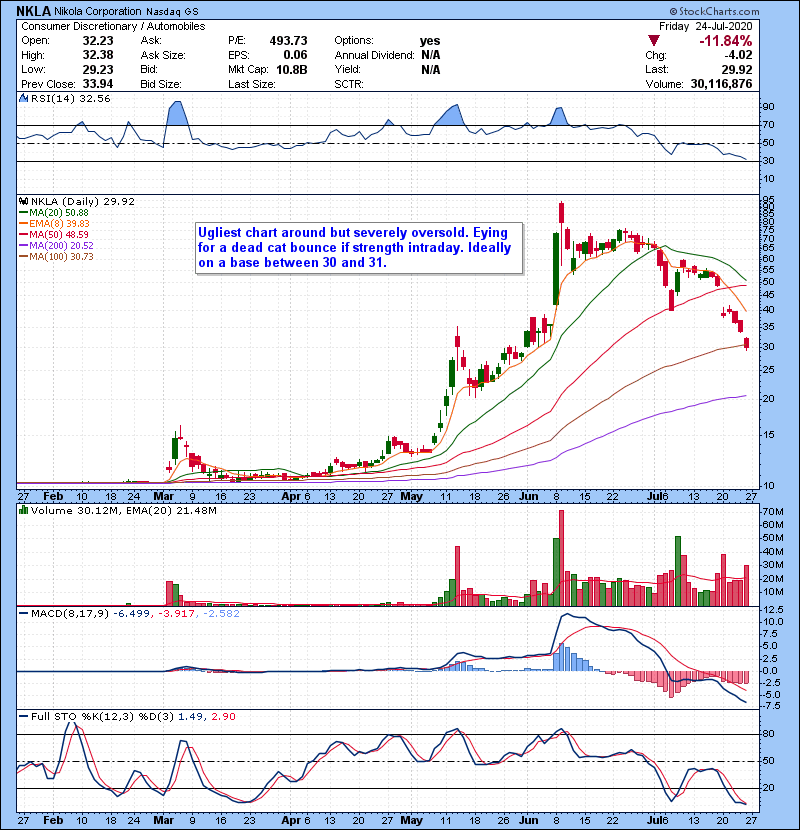

Couple of days of corrective action in the market. Many recent tech leaders found support in nearest moving averages. QQQ stalling below 20 MA. Bulls want too see a remount of 20 MA ans bears want to see a push to 50 MA, 245 area.

Follow me on Twitter for real time trading setups@szaman and on StockTwits @szaman

Get started on the right path to trading success. Get access to our accelerated day or swing trading course with over 20 hours of content, access to our trading chatroom, live market commentary, and much more. Learn what it takes to succeed in the best profession in the world.

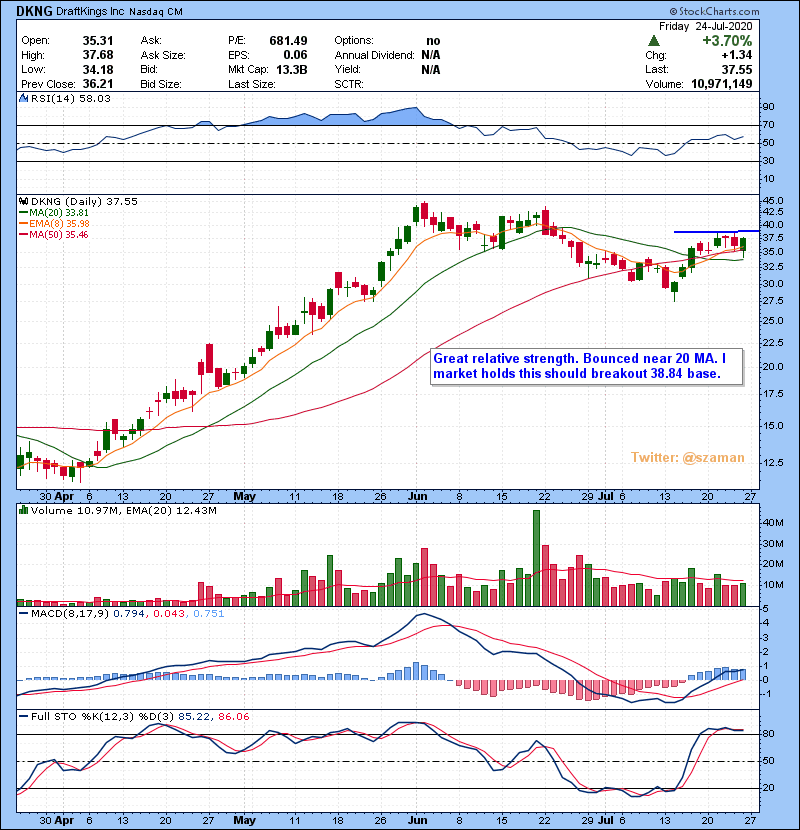

Here is the watch list and game plan:

Join Our Next Live Trading Boot Camp (13 Seats Left)

Learn all the day trading strategies we’ve been using for 2 decades in our Live Stock Trading Bootcamp. Class starts on August 9th, only 13 seats remain open.

Click here to apply for our next trading boot camp!