Biggest red day of the year for SPY as stocks tumbled all across the board.

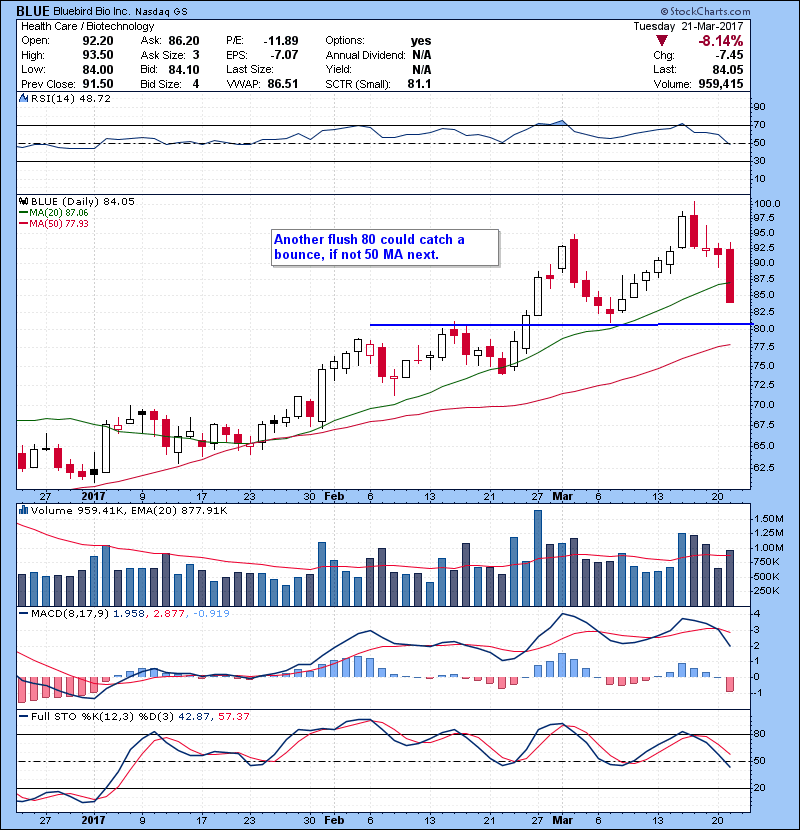

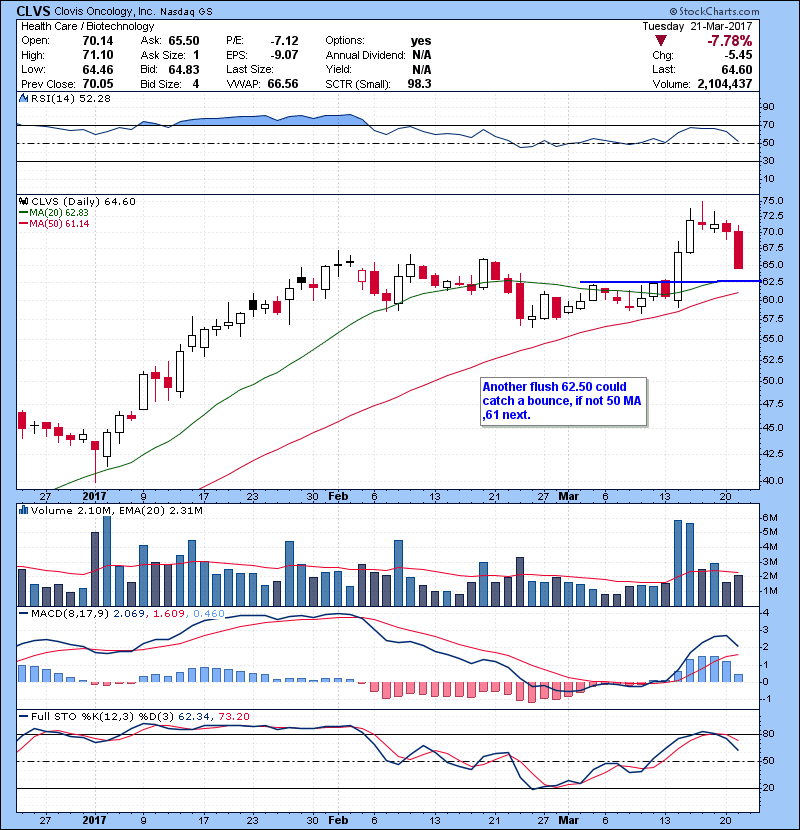

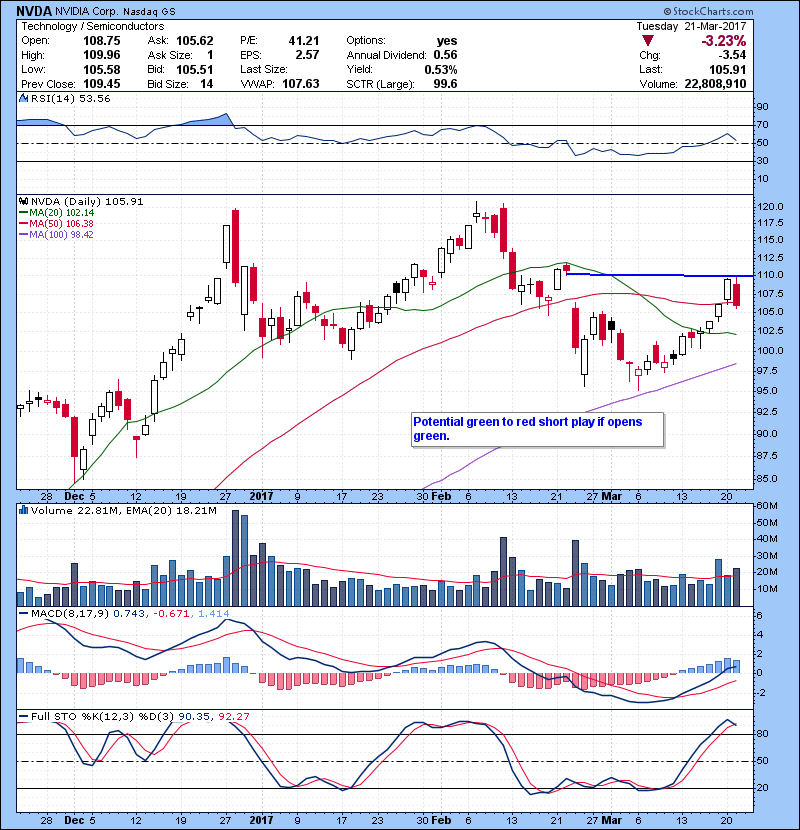

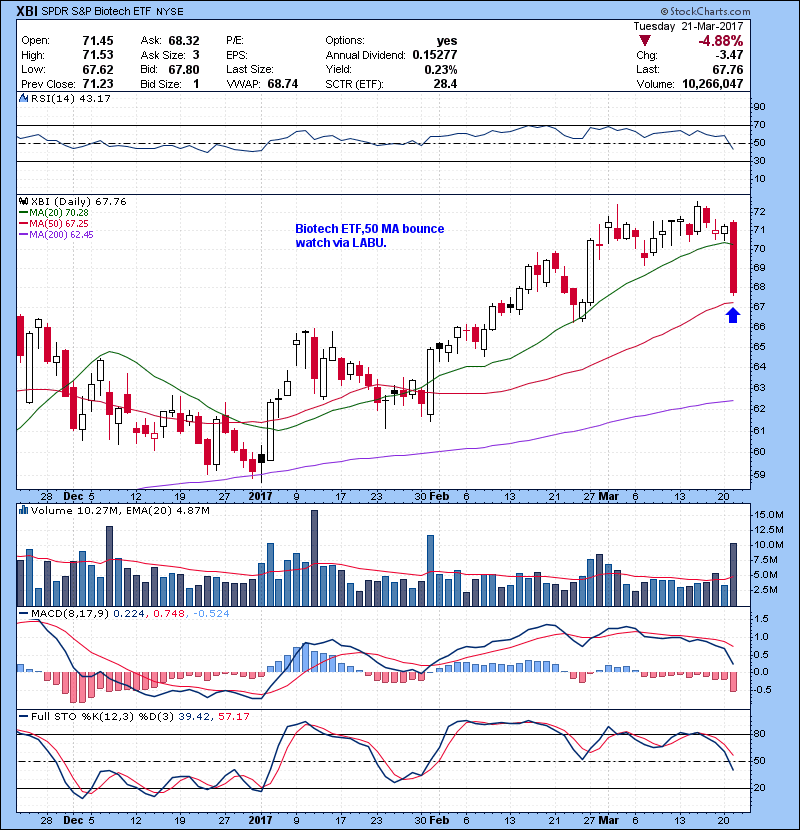

If your are a regular blog reader, I have been writing about how indices were masking underlying weakness in many individual names and sectors.Narrow leadership in stocks and sectors as market breadth( Number of advancing stocks vs. number of declining stocks) were continuing to deteriorate. SPY closed below both 9 and 20 day short term momentum moving averages ,Friday and Monday without any bounce attempt All those divergences finally caught up with indices with this strong sell off. Many eyes will be on SPY 50 MA. Game plan will be if market has another gap down open, I’ll be watching for some dip buys. If market opens green, I’ll be watching for potential green to red short plays.

If you are struggling with your trading or learn how to trade you need to check out our trading courses. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders. You can also check out the testimonials from our students.

Also if you are interested in our day trade alert services and chat room Check them out here.

Follow me on Twitter for real time trading setups@szaman and on StockTwits @szaman

Check out our newest Offering “Bulls Vision” ! A brand new screen share product! See through the eyes of

@kunal00 while he trades live everyday.