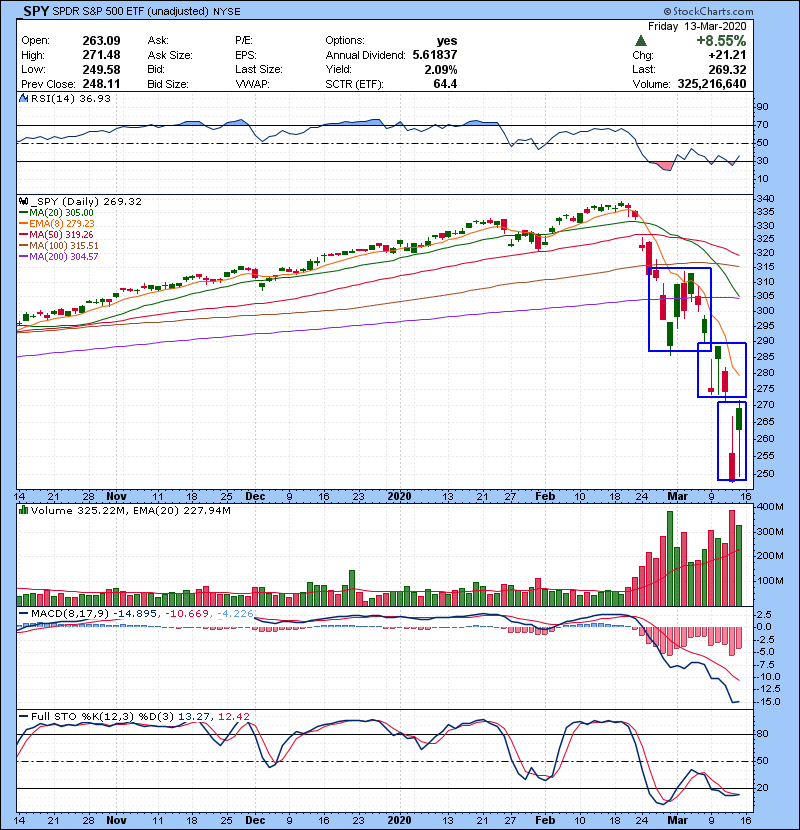

Brutal week for the market, ended with late day relief bounce. SPY major support now 247.68 area. A break below should see 235. Cluster of resistance at 273,280,300. 305. Broken/nervous,/headline news risk market under 200 SMA. Short term rallies to resistances should get faded.

Business as usual for active day traders, buy support, red to green and sell/short the rips with defined risk/reward in mind. As far as investing, we need to see range narrows, that will be a sign of stabilization. That will also give you much better support and resistance level.

Limited Time: Get 66% Off All Our Packages

We are seeing unprecedented volatility in the stock market right now.

We are getting hundreds of messages a day asking “What should I do?” “How do you trade these market conditions?” “How do I survive this?”

Prepare and educate yourself. Learn proven strategies from traders who have seen multiple bear markets.

Click Here to 66% Off Our Total Trader Package

Follow me on Twitter for real time trading setups@szaman and on StockTwits @szaman

Get started on the right path to trading success. Get access to our accelerated day or swing trading course with over 20 hours of content, access to our trading chatroom, live market commentary, and much more. Learn what it takes to succeed in the best profession in the world.

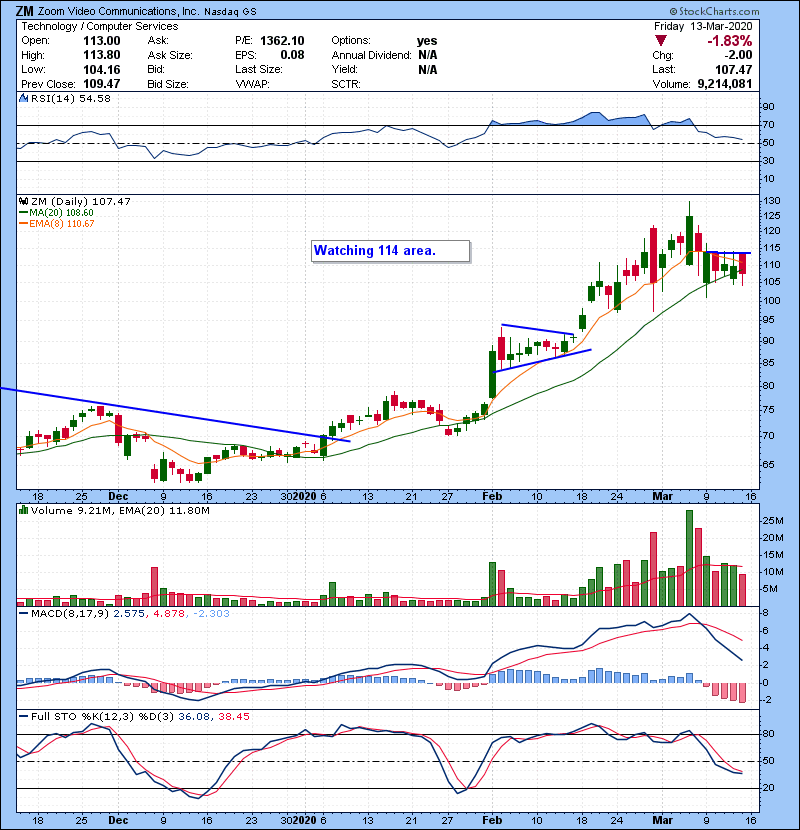

Here is the watch list and game plan:

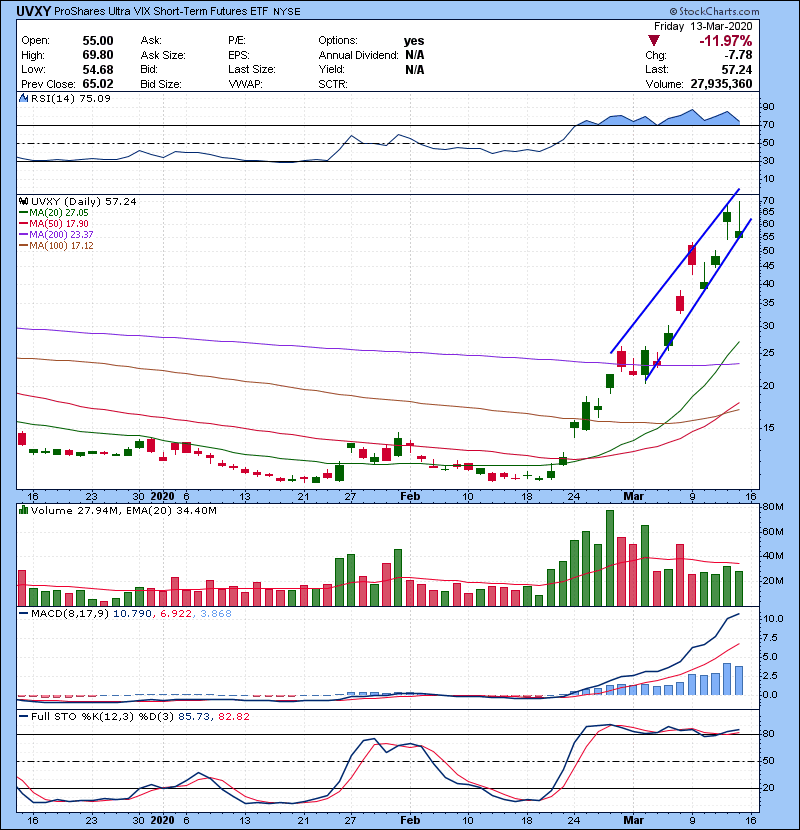

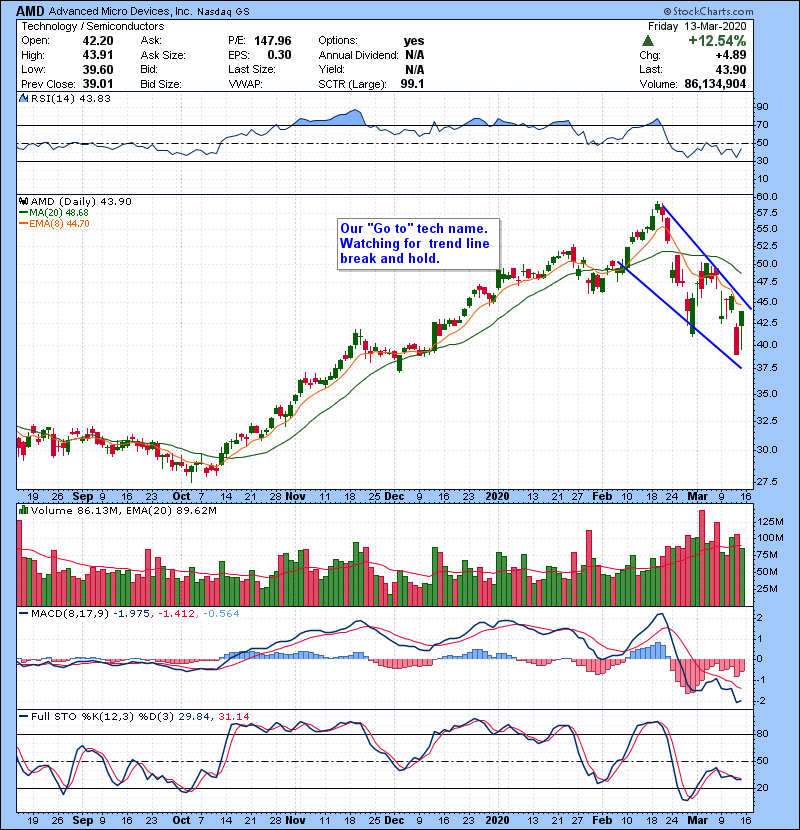

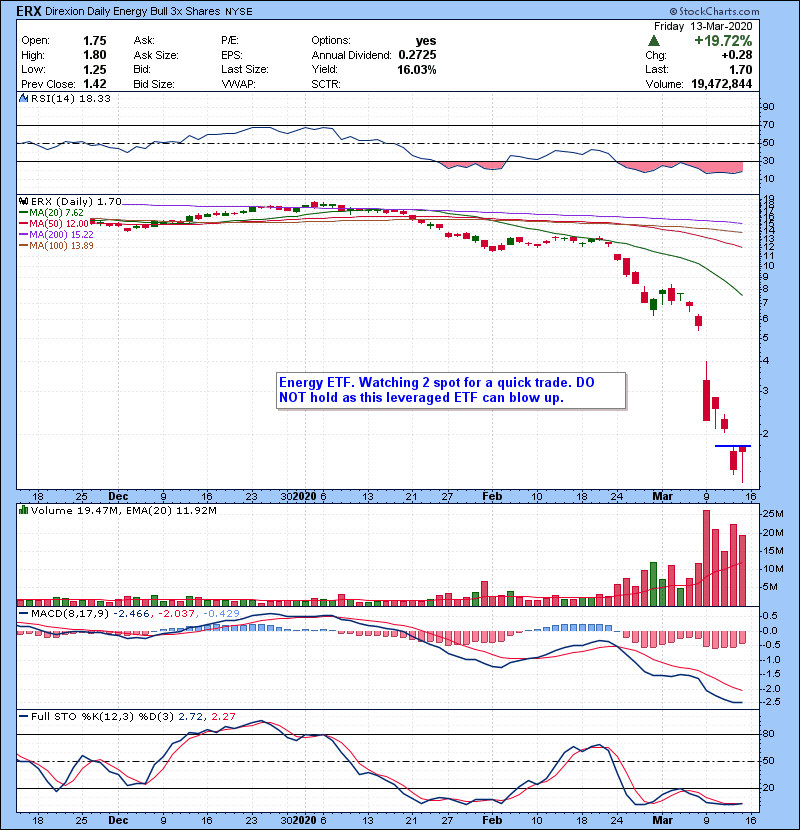

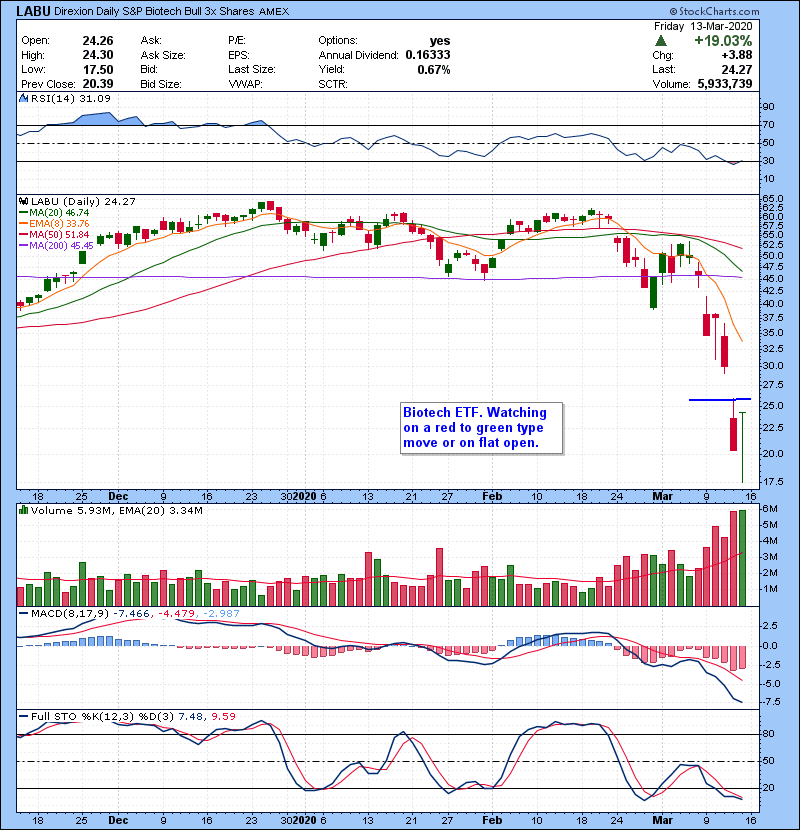

Again, given the volatility,I will be mostly watching ETF’s like TQQQ LABU, SPXL,LABU,TVIX and some highly liquid tech names for both long and short trades. Volatile market out, if you are not sure what are you doing, it’s better to stay put until market settles down. DO NOT chase stocks up.

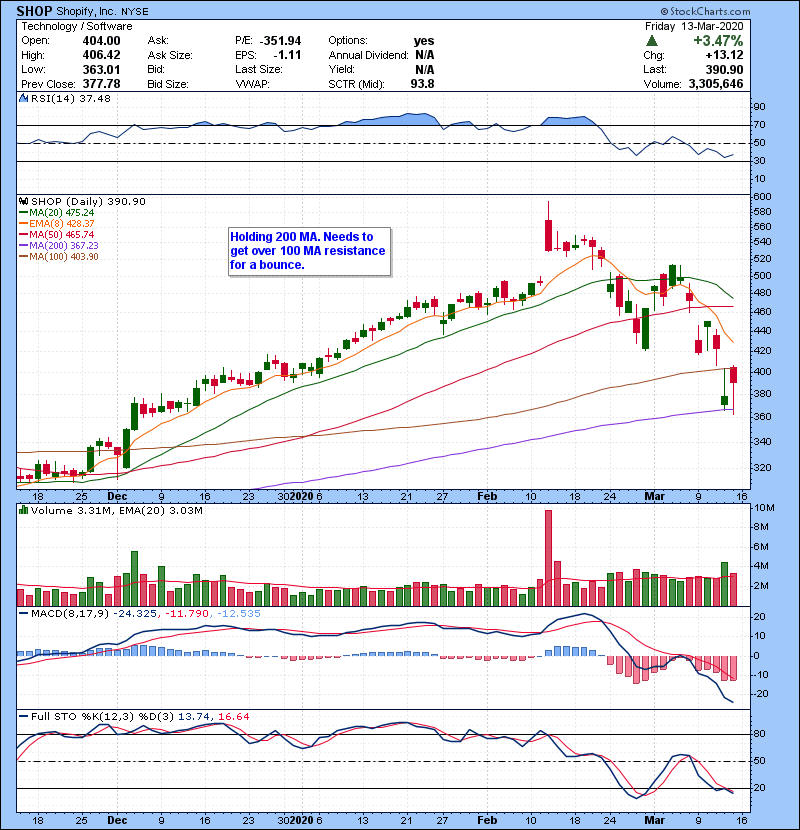

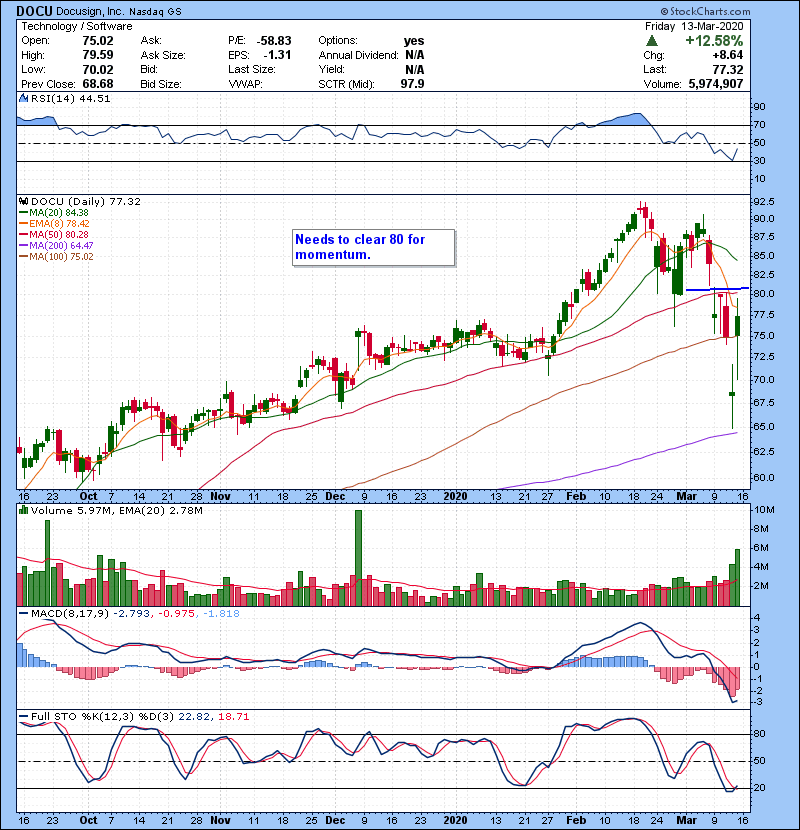

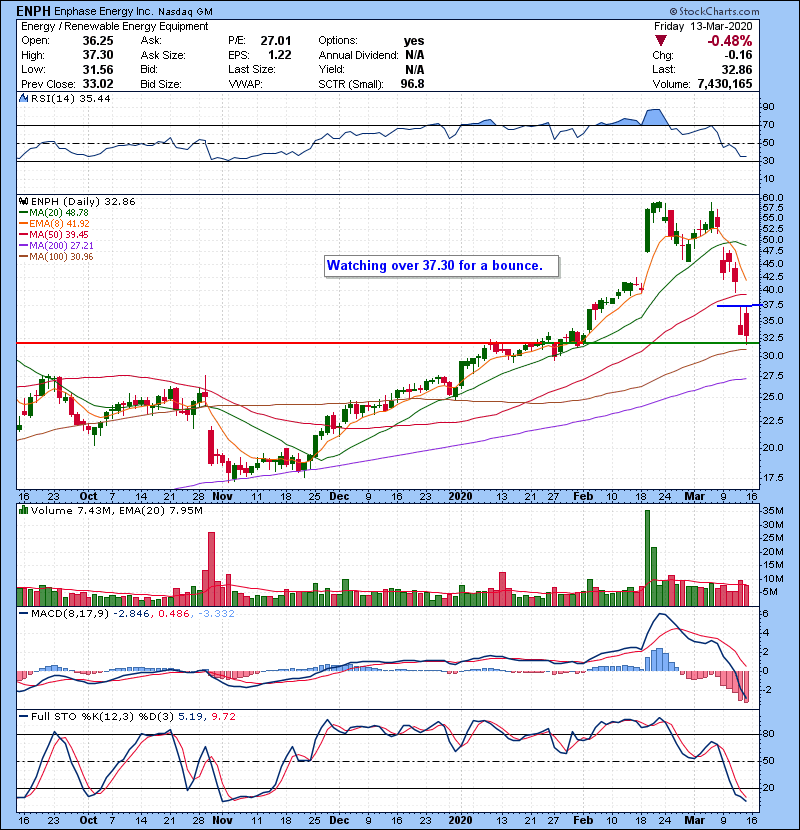

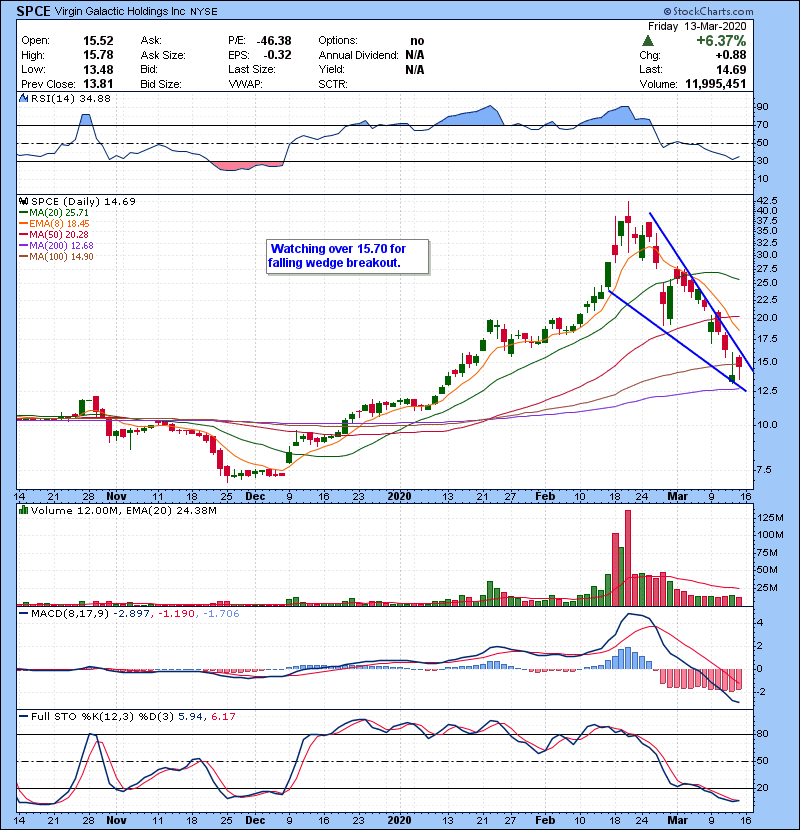

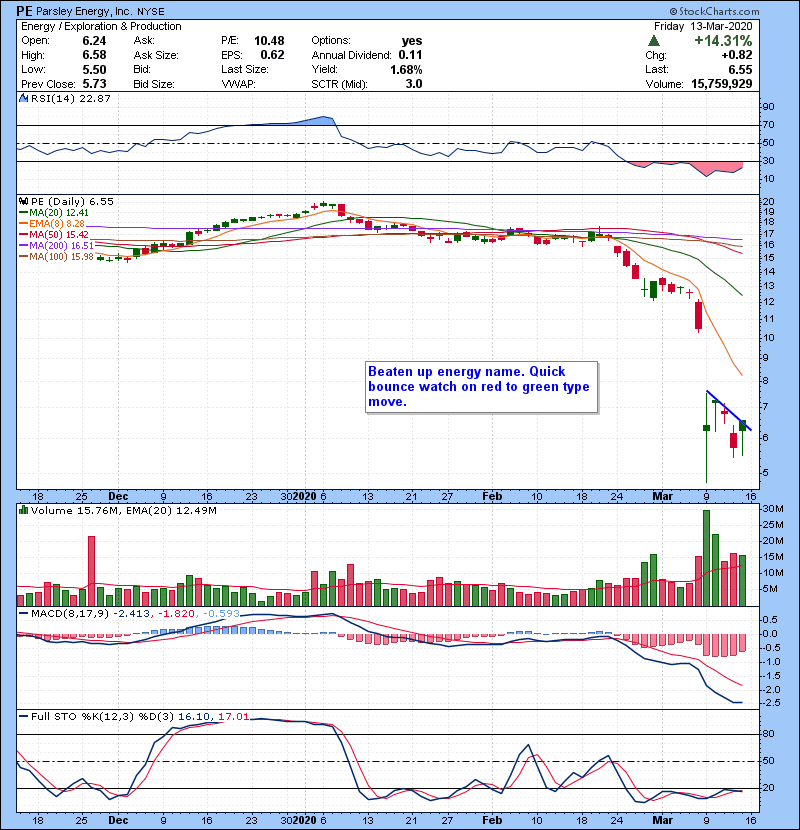

If market continues to bounce , every stock will bounce. Here is a few select ones that grabbed my eyes.

Follow me on Twitter for real time trading setups@szaman and on StockTwits @szaman

Limited Time: Get 66% Off All Our Packages

We are seeing unprecedented volatility in the stock market right now.

We are getting hundreds of messages a day asking “What should I do?” “How do you trade these market conditions?” “How do I survive this?”

Prepare and educate yourself. Learn proven strategies from traders who have seen multiple bear markets.

Click Here to 66% Off Our Total Trader Package