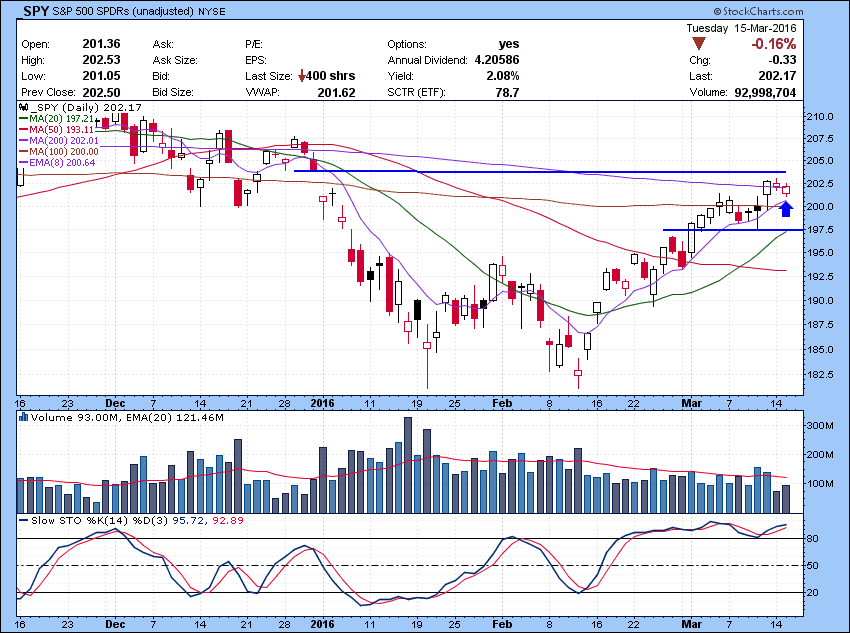

Low volume churning action in the market.

Benign trading action in the market. Type of market where indices might churn while individual stocks make some nice move. We are seeing that type move today with CPXX and Monday, with ZYNE and GWPH. Off course it all could change after FOMC rate decision on Wednesday. SPY holding short term momentum indicator 8 EMA. A break below 200.60 area could change the momentum a bit as 20 MA test then comes into play.Only worrisome sign from Tuesday was the action in small cap and biotech stocks. Some decent day trading action on from previous watch list. AMZN , BIDU, CLF, YY, JUNO gave some actionable trades.If you are struggling with your trading or learn how to trade you need to join our 60 day Bootcamp course. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders. You can also check out the testimonials from our students.

Also if you are interested in our day trade alert services and chat room , take a free trial! Check them out here.

Follow me on Twitter @szaman and on StockTwits @szaman

Check out our newest Offering “Bulls Vision” ! A brand new screen share product! See through the eyes of @kunal00 while he trades live everyday.