Volatility continues and expected to continue for a while with news cycle. For active day traders,some nice opportunities to day trade intraday swings both long and short. We continue to focus on day trading ETF’s like TQQQ, TVIX, SPXS,SPX JNUG.

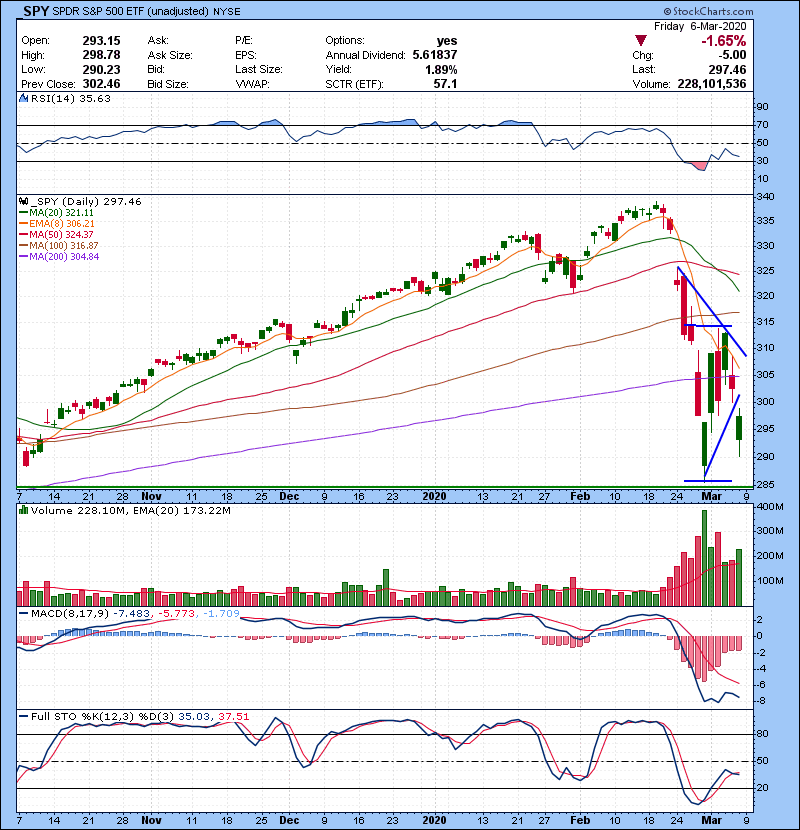

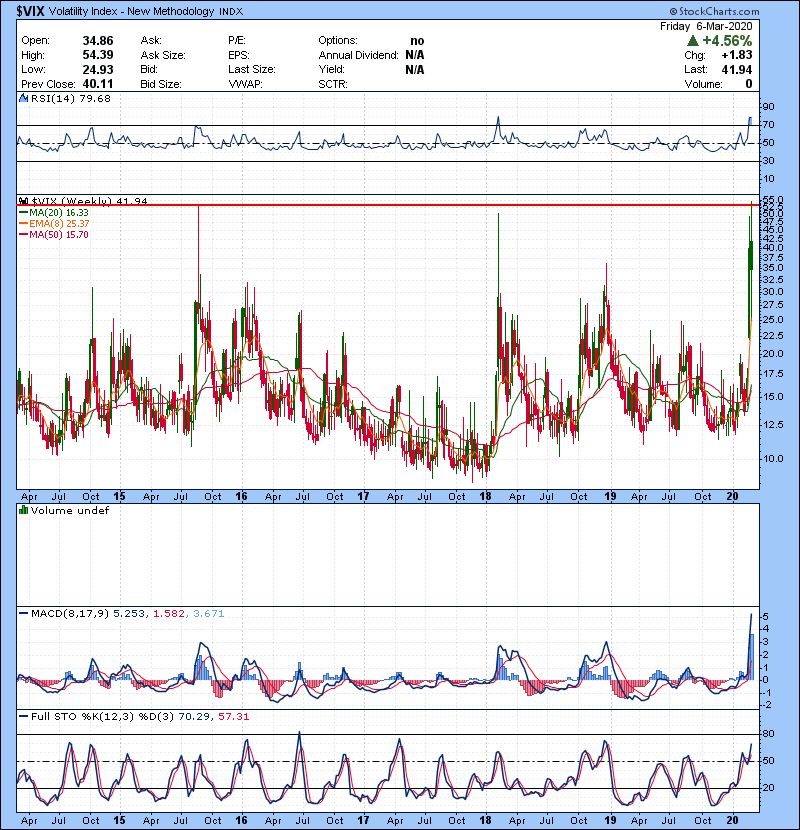

SPY broke down short term flag pattern but manged to close off the lows. Only positive thing for bulls is volatility index $VIX,backed off from big resistance. Does not it mean it it won’t try again but market has an excuse to catch a bounce.There is also possibility of testing recent lows. Active traders, keep an open mind and trade the price action.

Early-Bird Pricing Ends Soon!

Early-bird pricing for our next Live Trading Bootcamp ends March 7th. We are only offering the discount to the first 10 accepted applicants!

Click here to Get the Early-Bird Discount For Our Next Trading Bootcamp!

Follow me on Twitter for real time trading setups@szaman and on StockTwits @szaman

Get started on the right path to trading success. Get access to our accelerated day or swing trading course with over 20 hours of content, access to our trading chatroom, live market commentary, and much more. Learn what it takes to succeed in the best profession in the world.

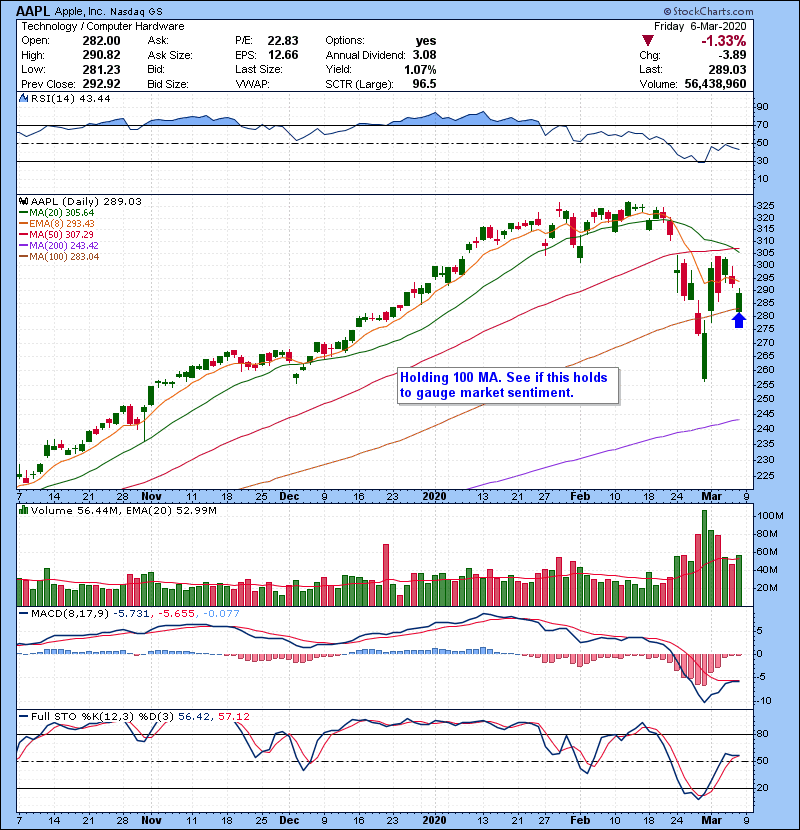

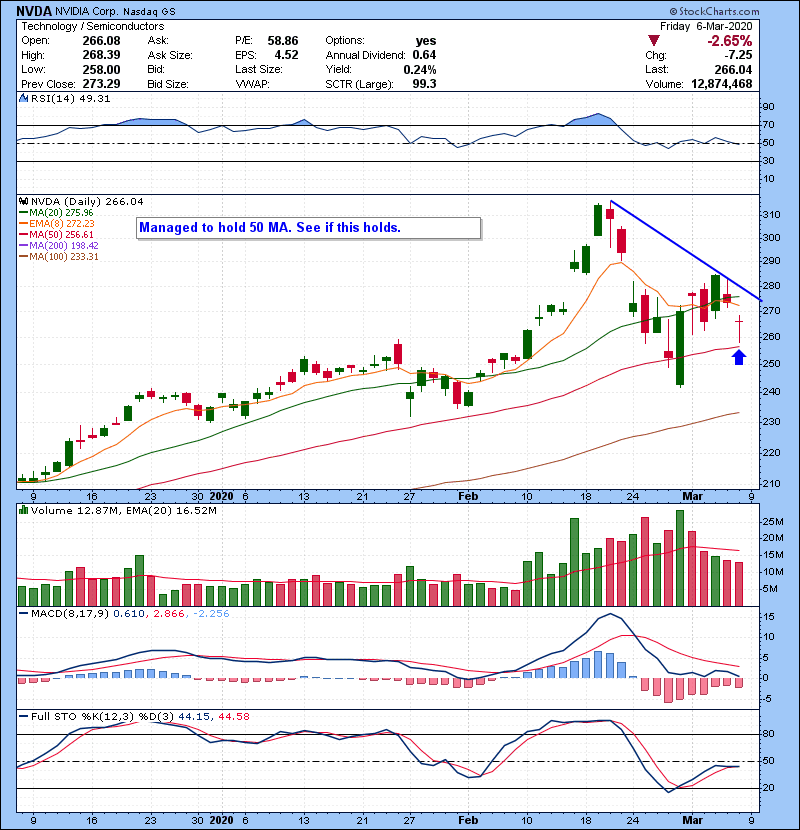

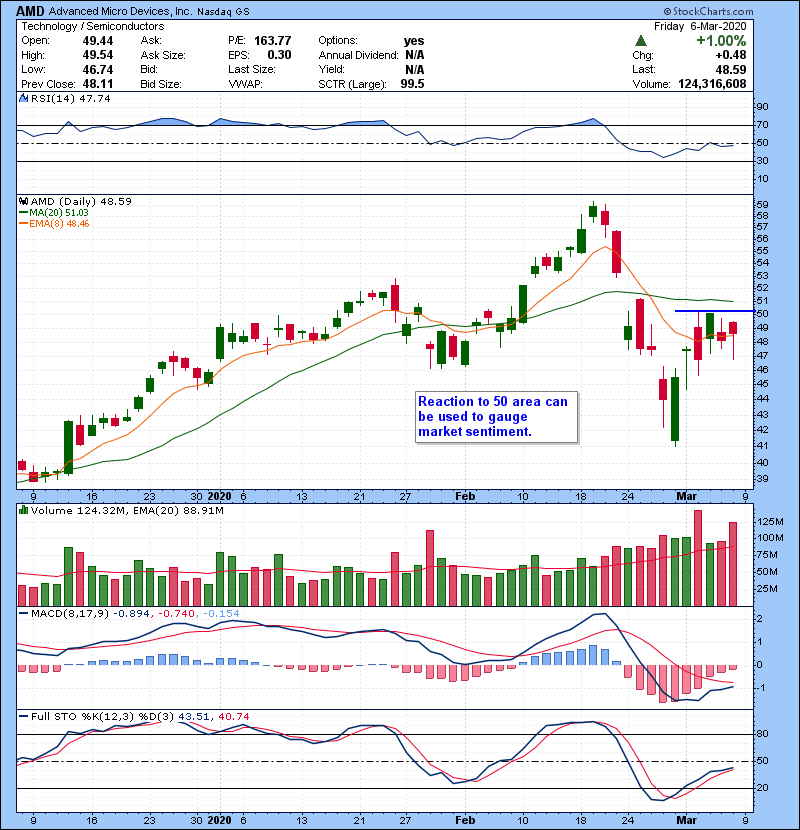

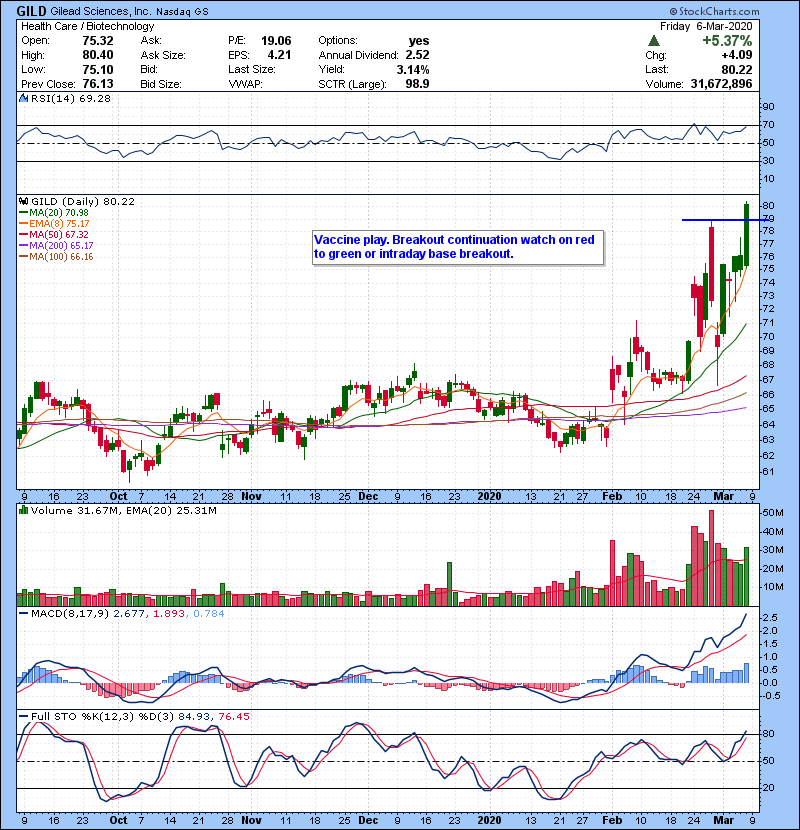

Here is the watch list and game plan:

Again, given the volatility,I will be mostly watching ETF’s like TQQQ LABU, SPXL,JNUG,TVIX and some highly liquid tech names for both long and short trades. Volatile market out, if you are not sure what are you doing, it’s better to stay put until market settles down. Business as usual for active day traders, buy support, red to green and sell/short the rips with defined risk/reward in mind.

Follow me on Twitter for real time trading setups@szaman and on StockTwits @szaman

Early-Bird Pricing Ends Soon!

Early-bird pricing for our next Live Trading Bootcamp ends March 7th. We are only offering the discount to the first 10 accepted applicants!

Click here to Get the Early-Bird Discount For Our Next Trading Bootcamp!