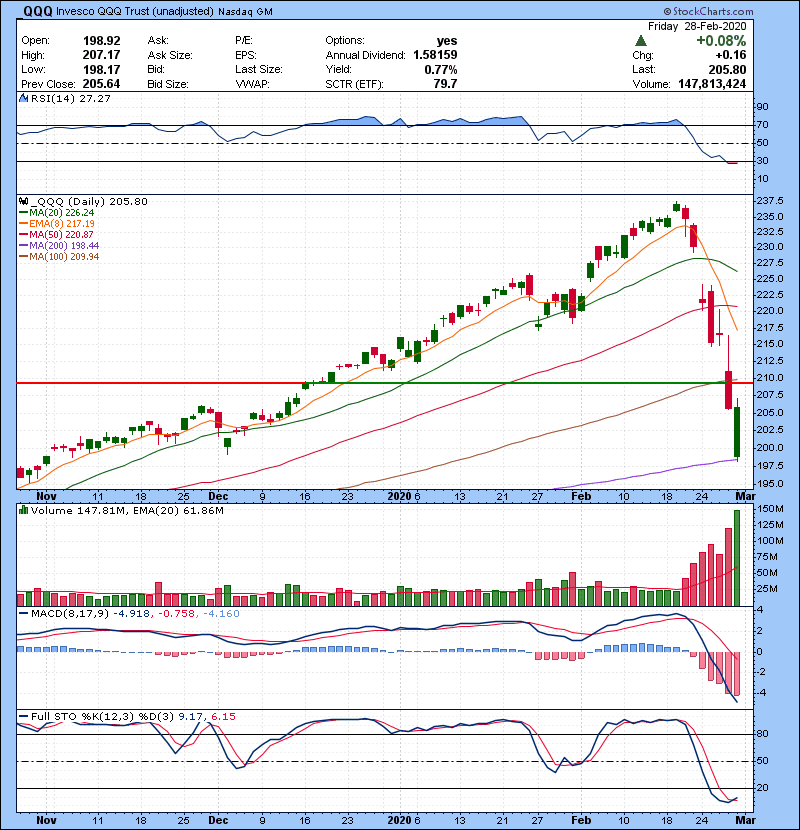

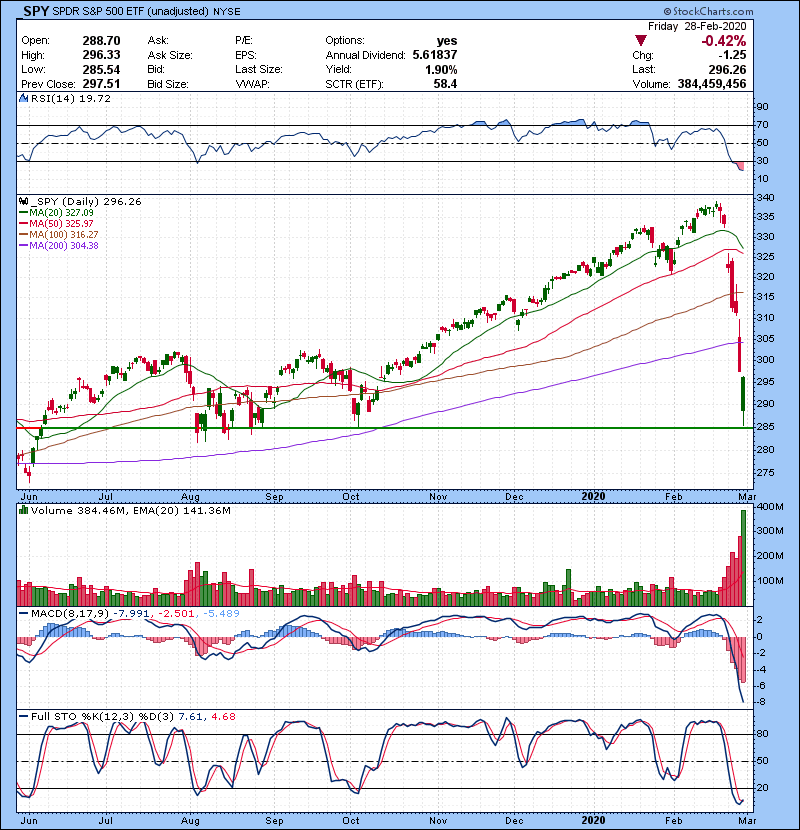

Late day bounce attempt after indices hit some extreme oversold condition in years. SPY 285 line in the sand for now and 305(200MA) as resistance.Going forward there might a bounce but given the severity of this sell off,question is how far will it bounce before seller comes back in.

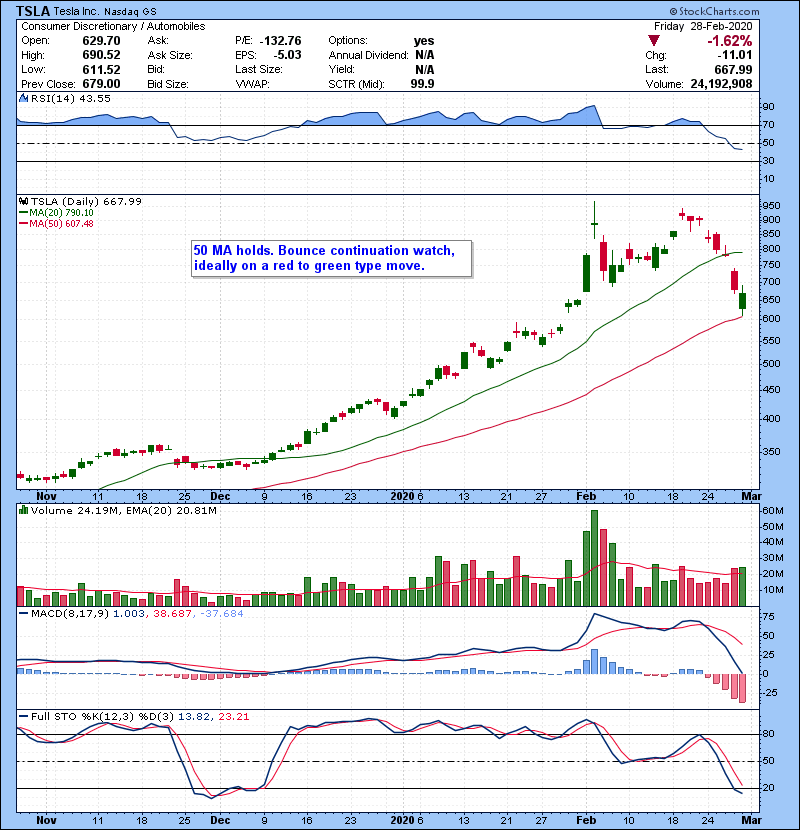

Given the uncertainty, I am expecting volatility to continue for a while. As far as trading, a red to green type move at open will be ideal for bounce continuation. Volatile market out, if you are not sure what are you doing, it’s better to stay put until market settles down. Business as usual for active day traders, buy support, red to green and sell the rips with defined risk/reward in mind.

QQQ Bouncing 200 MA with resistance at 210 area.

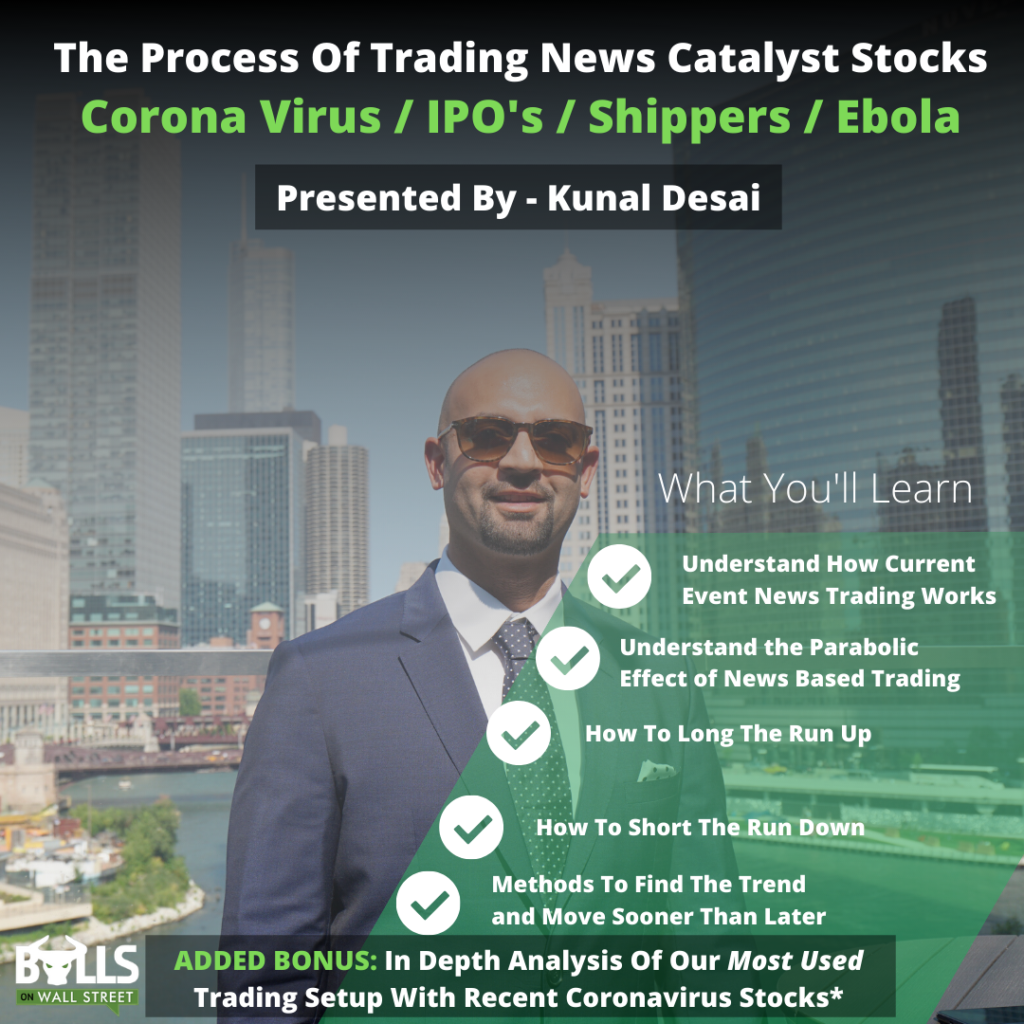

Important Live Webinar This Week

We are seeing a MAJOR shift in trend in the overall market in the past week. We want you to be prepared for these unique market conditions. Join us for our live webinar this week and learn how to trade in market conditions with major news catalysts like the Coronavirus. Don’t miss this.

Click Here to Sign Up For the Webinar

Follow me on Twitter for real time trading setups@szaman and on StockTwits @szaman

Get started on the right path to trading success. Get access to our accelerated day or swing trading course with over 20 hours of content, access to our trading chatroom, live market commentary, and much more. Learn what it takes to succeed in the best profession in the world.

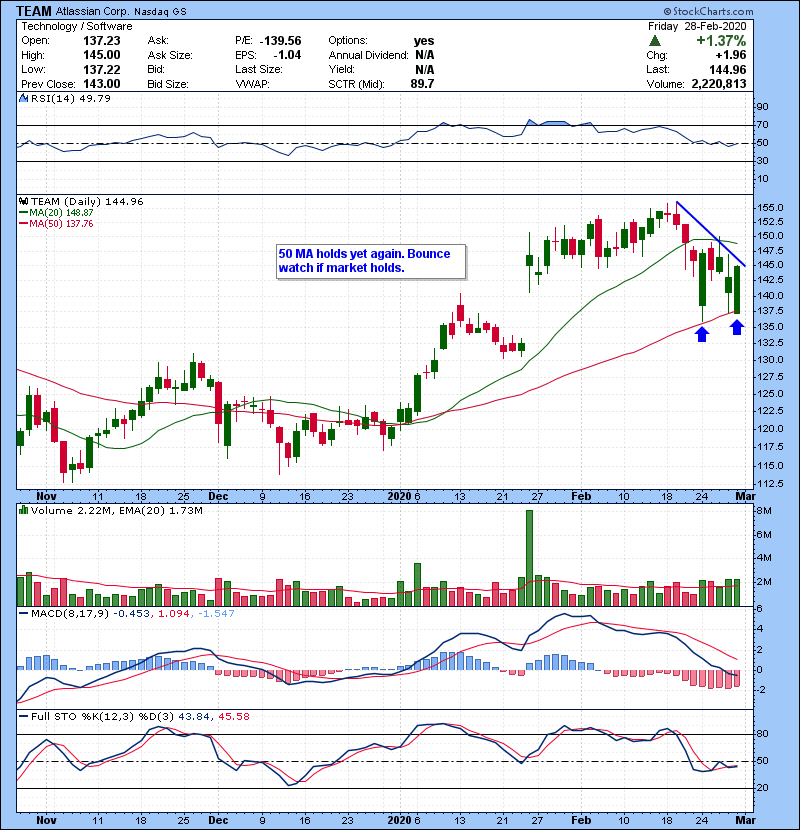

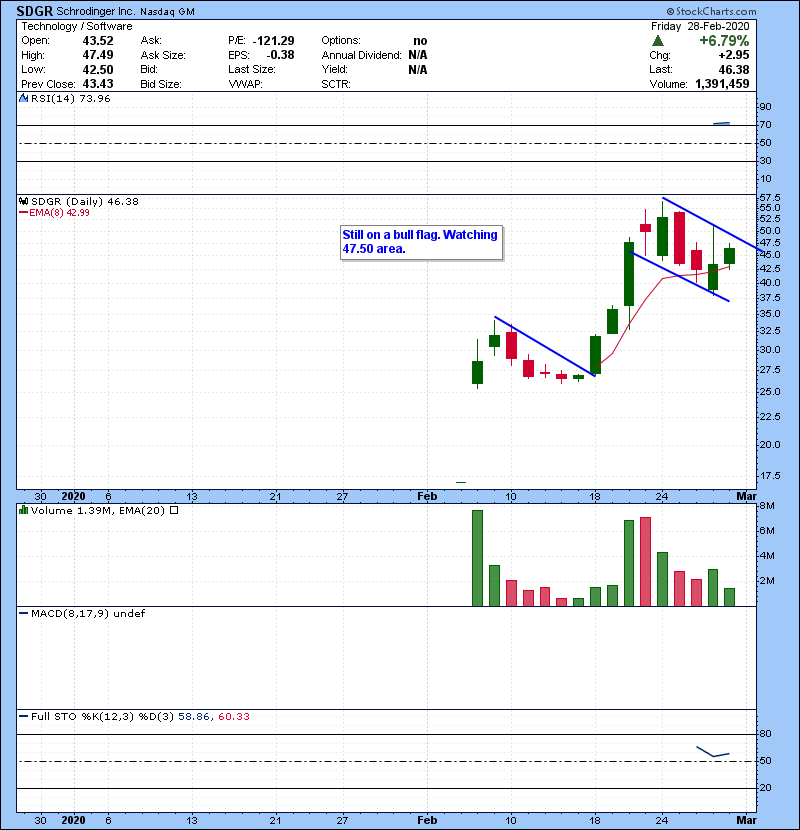

Here is the watch list and game plan:

I will be mostly watching ETF’s like TQQQ LABU, SSO,JNUG and some highly liquid tech names for bounce play. They tend to bounce cleaner than individual stocks on a weak market.

Follow me on Twitter for real time trading setups@szaman and on StockTwits @szaman

Important Live Webinar This Week

We are seeing a MAJOR shift in trend in the overall market in the past week. We want you to be prepared for these unique market conditions. Join us for our live webinar this week and learn how to trade in market conditions with major news catalysts like the Coronavirus. Don’t miss this.

Click Here to Sign Up For the Webinar