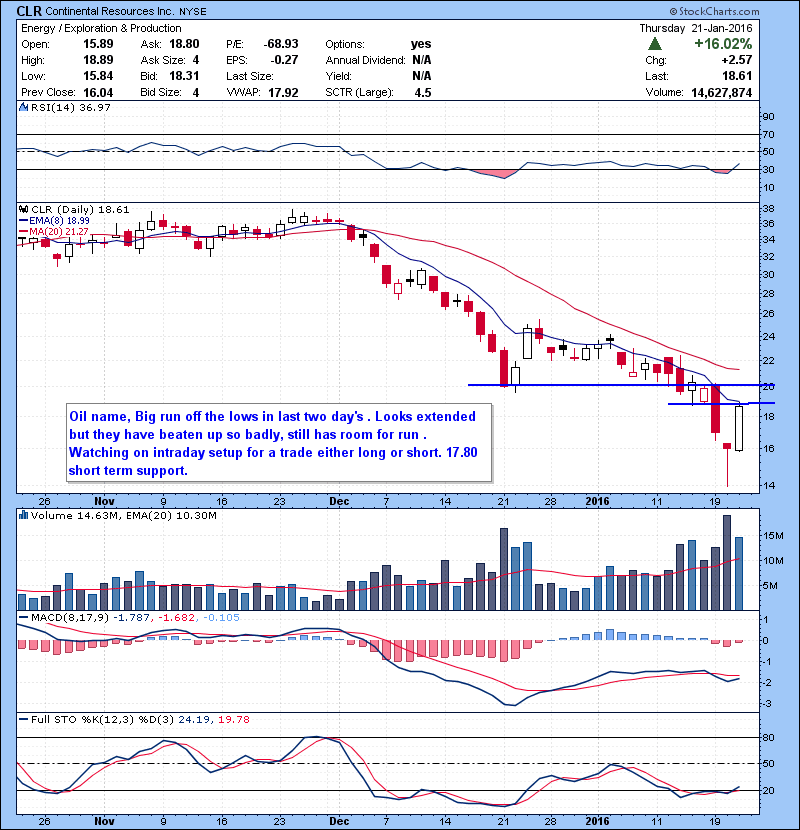

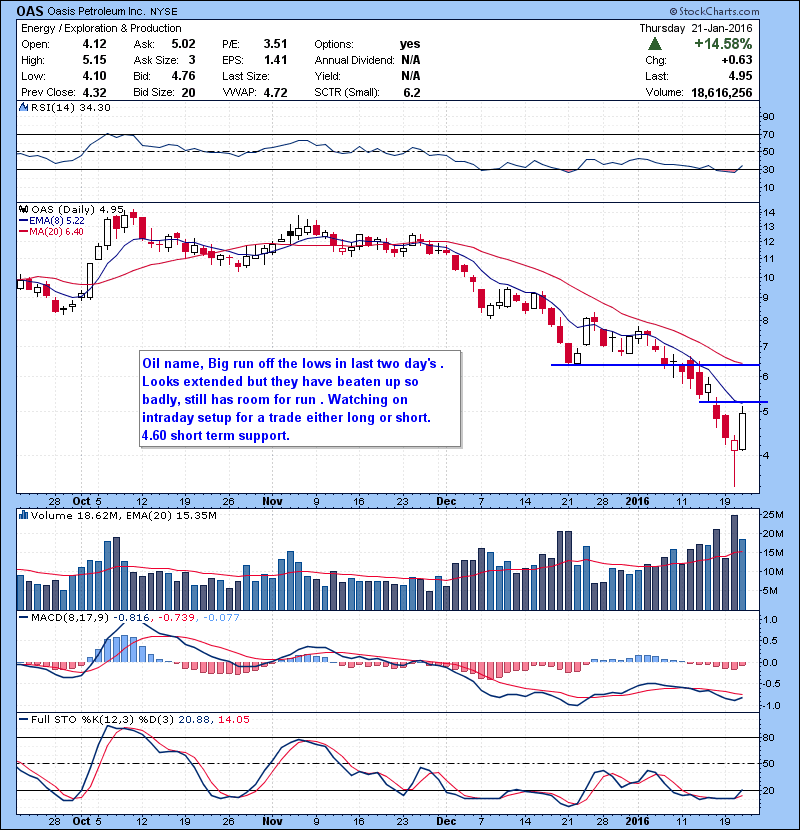

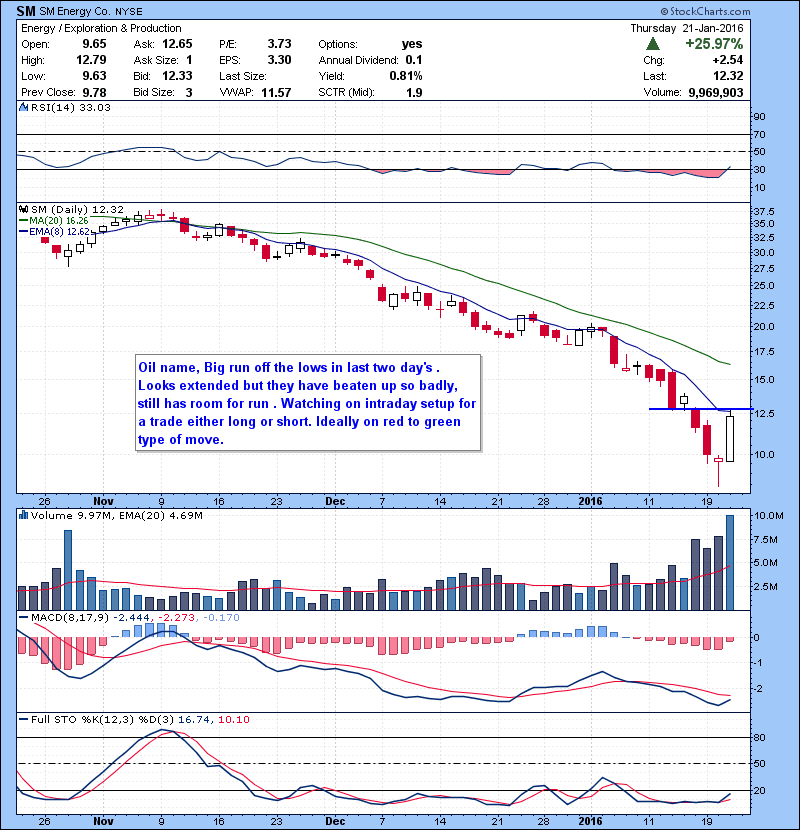

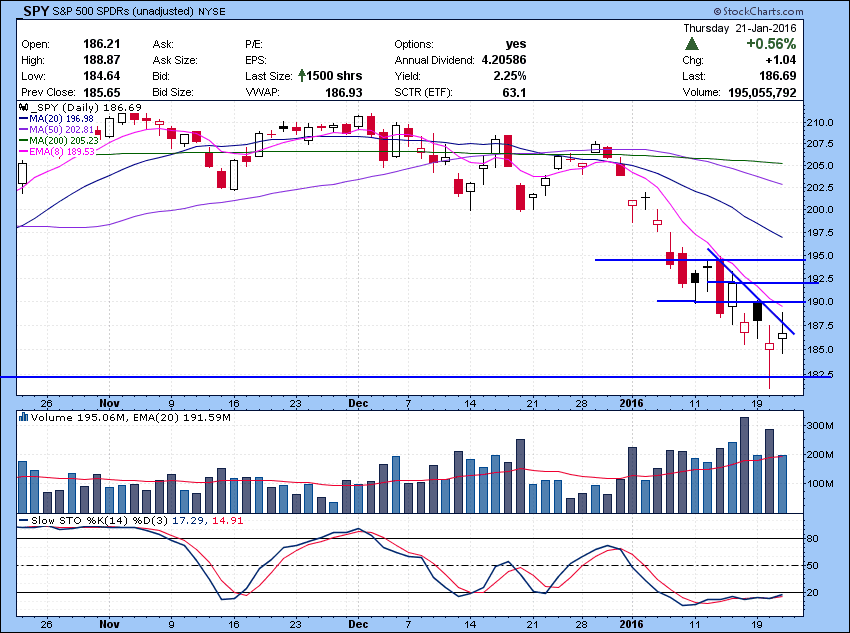

Decent two day rally after SPY manged to make a low below August low , shaken out some hands and rally on Wednesday. Thursday’s run was mostly about oil/energy names. It was nice to see Market opening down and lead higher via strength on energy/oil names instead of a gap up and fade that has been happening lately.

SPY tried it’s best but could not manage to stay over the down trend line without any help from tech, small cap and financials . We are in the middle of the range again with resistance at 190 and minor support at 184.64. A crack below 184.65 should bring some bears again, trend is still on their side. Bulls wants to see some consolidation via small range days and attack that 190 area for next push higher Great week if you are a short term traders. This volatility is bringing some incredible ranges, you see a ETF like DWTI which has $100 intraday range! As far as trading , our chat room trade alerts broke another record in terms of profits!! If you follow me on Twitter or Stock Twits , i provided some decent live trading calls. Now more than ever , you need to learn how to be profitable trader in any Market by joining our 60 day Bootcamp course. Our program is designed in such a way that you come out of it ready to trade live in just 3 months. We teach you everything from risk management to scanning to trading strategies. I also share my profitable intraday trading strategy which will make you money short term regardless of Market condition. The class is one of a kind, see why you should sign up for the course here . You will also have access to a private community where you can ask questions, share charts and talk with the instructors or other traders. You can also check out the testimonials from our students.

Also if you are interested in our day trade alert services and chat room , take a free trial! Check them out here.

Follow me on Twitter @szaman and on StockTwits @szaman

Check out our newest Offering “Bulls Vision” ! A brand new screen share product! See through the eyes of @kunal00 while he trades live everyday.