Over the past few weeks, we have seen some crazy moves in the market. Every trader, regardless of their experience level, knows that volatility equals opportunity. For momentum traders, volatility is extremely beneficial for a number of reasons. On the other hand, traditional investors panic whenever they see the market get shaken up!

The main cause of that is just due to differing perspectives and goals for the market. As momentum traders, we have the ability to take advantage of expanded ranges and increased volume/liquidity.

There are a number of key things you have to be aware of as a trader when the market starts to increase in volatility. All of these things can be huge advantages if you know how to leverage them.

Let’s dive right in, starting with how you can truly gauge an increase in overall market volatility:

How To Gauge Volatility?

Sure, it can be easy to look at a chart of $SPY and see the sharp expanded moves and conclude that overall volatility has increased, but there are a few other things you should be keeping a close eye on.

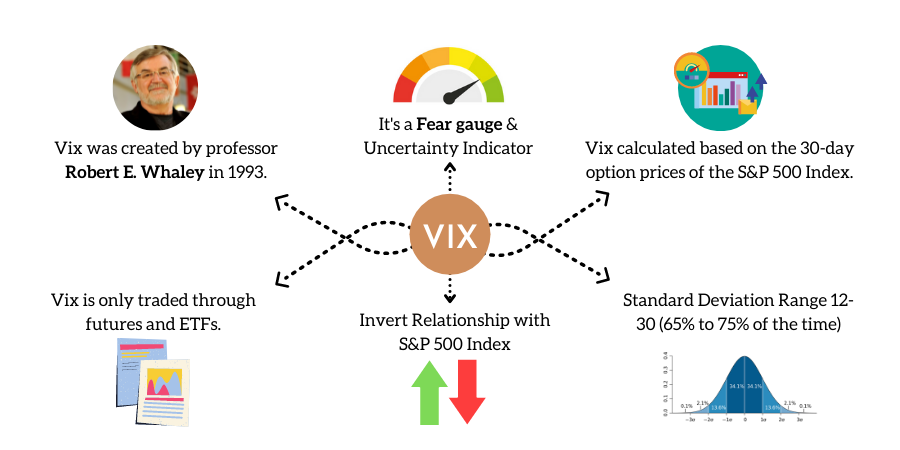

The $VXX index is the volatility index, which gauges fear in the market. Whenever that index begins to increase in price and volume, that is a strong indicator that true volatility is increasing overall.

Benefits Of Increased Volatility

Expanded Ranges

An increase in volatility gives momentum traders a swarm of benefits and solid trading opportunities to take advantage of due to a few things. The main reason is thanks to the expanded ranges the market gives on individual names. Average True Ranges (ATR) of individual stocks increases significantly, meaning you can play with less size and reap strong rewards.

Increased Liquidity

Whenever the market starts to get shaken up as well, the volume and liquidity overall increases. You will find that you can easily be filled on the buy or sell side of moves. Your basket of ‘tradable’ stocks based on volume criteria increases significantly as market participants look to take more and more trades, causing usually illiquid names to trade smooth.

Cleaner Trends

Another thing you will notice when trading during volatile market conditions is the fact that stocks trend much cleaner. As momentum traders, this is huge for us. The combination of increased volume and expanded ranges causes stocks to trend upwards or downwards for much longer periods with little opposing action. You will be able to actually read and ride trends much easier when volatility shoots through the roof.

How To Safely Trade In Volatile Markets?

So, you now may be looking forward to the next round of volatility, but how do you actually trade it in a safe manner?

It all comes back to the expanded ranges and higher Average True Ranges stocks will have in times of volatility. During wild market conditions, you have to size down. The wider trading ranges you will see will allow you to make more with less size, since the moves the stocks make will be much larger than usual.

Expanded ranges are a double-ended sword if you play things the wrong way and are careless with your position sizing. If you play too large when volatility increases, not only will your wins increase but your losses can be catastrophic in certain scenarios.

It doesn’t take much size to make a considerable amount of money when stocks are moving well outside of their normal ranges, so sizing down will allow you to still reach strong profit goals yet remain safe and avoid devastating losses due to abnormal violent moves against you.

Recognize that there is more room for stocks to move in either direction when volatility increases, and make sure you size down to compensate.

Learn How to Trade Market Volatility (Live Webinar)

Don’t miss this week’s free webinar with Kunal Desai. Learn the best strategies and tactics for navigating market volaitlity profitably!

Click Here to Save Your Seat