Bear markets terrify most investors. There is nothing worse than watching your net worth plummet as your retirement account bleeds out due to relentless selling.

While there is short-term pain, these market conditions can actually provide life-changing opportunities to those who are prepared and know how to capitalize.

For new and even experienced traders who started trading in recent times, a bear market is something foreign to them. They may not know how to properly identify, trade, and invest in a bear market.

Today, we are going to make sure you have all of the tools and knowledge at your disposal you need to survive and thrive in a bear market with our complete stock trading guide for bear markets.

Let’s dive in:

What is a Bear Market?

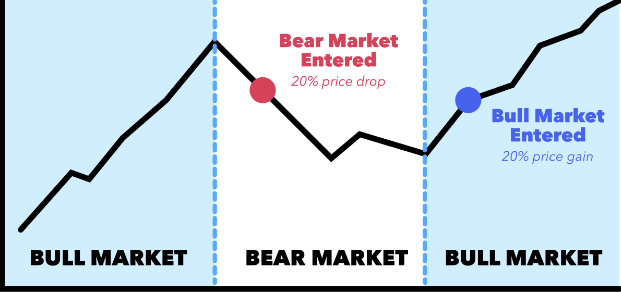

A bear market is officially defined as a time when a major market index like the S&P 500 or the Dow Jones Industrial Average has fallen 20% or more from a recent high for a sustained period of time. Right now, we are in that territory.

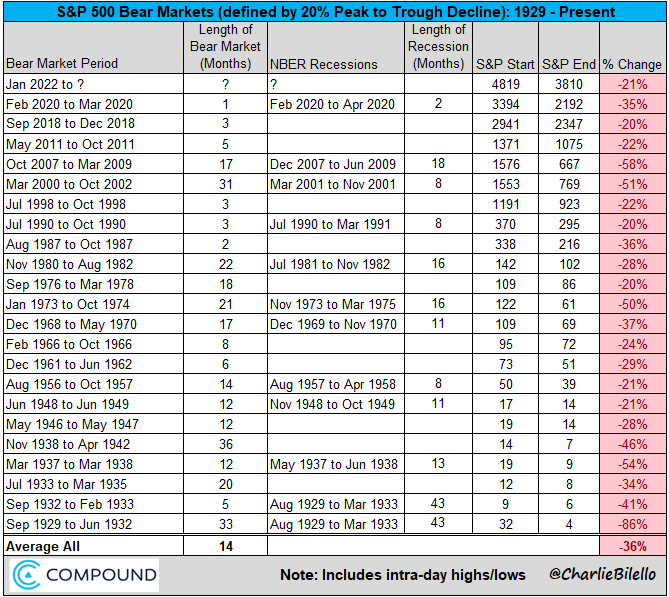

These bear markets typically occur on average once every four years:

During a bear market, buying tends to be scarce, investors and traders are scared or more short-biased, and the market can slide down for days on end.

Just think of it as a very weak time in the market where buying is much more difficult and individual stocks will tend to see a lot more selling pressure than buying pressure.

Usually, a bear market is tied to some geopolitical or macroeconomic events that are causing investors to sell rapidly. Right now for example, rates are increasing, supply chains are disrupted, inflation is increasing, and a very overbought market for the past 18 months. All of this is causing a rapid decline in the market into ‘bear market territory’:

Strategies to Use in a Bear Market

Whenever you are trading through a bear market you have to be extremely cautious at all times. Lower your size on every trade or investment, widen your stops a little bit, and be aware that there is a lot more heightened volatility you will have to deal with that could get you into some ugly situations if you don’t manage risk. But if you know what you’re doing, you can make life-changing returns.

Buying Dips

Now, buying dips can be tough during a bear market, but extremely profitable. Those people that caught the bottom of the COVID-19 drop in the market made some serious cash.

Let the bottom pick itself. Don’t try to be a hero and catch a falling knife. Take proper setups, trade smaller when the market is in a downtrend and take profits quickly. Wait to put big size on a dip buy trade when all macroeconomic events are turning more positive and the long term technical charts are looking like they are finding support. You need to have cash ready to go when the market is starting to turn back up.

We like to look at longer term time frames for support and bottoming patterns on the daily, monthly, and weekly charts whenever we are looking to enter long-term after a bear market decline. Don’t get all focused and wrapped up in shorter-term time frames, wait for the bigger time frames to form a base and buy the dip with more conviction.

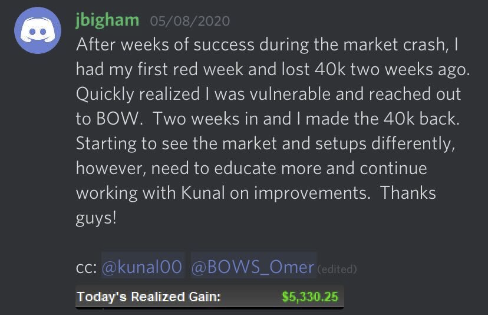

We have taught thousands of traders how to navigate bear markets in the past 14 years, and some have seen amazing results:

Switching to a Short-Term Short Bias

Whenever the market is rapidly declining in a bear market and the buying volume just isn’t there, day trading stocks to the downside is an amazing way to make money.

Look for stocks that follow the structure of the S&P 500 and are not categorized as “defense stocks” (read more about those here), and look for bearish patterns like bear flags, range breaks, and falling wedges to trade.

The selling pressure in stocks during a bear market is very strong, so shorting them into these patterns is like just flowing down a river, as opposed to trying to fight the trend and longing them in the short term.

Managing Risk During a Bear Market

One of the most important skills to have during a bear market is risk management. As volatility increases, it is imperative that you aggressively protect your trading account from unnecessary risk. Kunal Desai has been trading for over two decades, and has a variety of great strategies and tips for managing risk in bear markets that you should learn and apply this year:

Get Early-Bird Pricing Our Next Live Stock Trading Bootcamp!

Our next Live Trading Bootcamp is around the corner! There is no better course to teach you how to dominate volatile market conditions like we are seeing this year. Learn from experienced stock traders who have been trading for over 2 decades. Early-bird pricing ends soon!