You’ve probably heard the saying “no man is an island.” Well, the same is true for stocks. The movement of a stock will often influence other stocks in the same sector. For example, if one of the big gold miners is running, other gold mining stocks will often run along with it. This is where some simple sector analysis comes in handy. If you miss the entry on the first stock, or if you want to simply find additional stocks that are running, look at the rest of the sector.

$SHIP is a great example of this. It ran from $4 to $7 in a short period of time, telling us there was momentum in the sector – and as you know, we like momentum trading. So, we started looking at other stocks in the shipping sector (which, by the way, is a sector that’s particularly good for sympathy plays) and found $TOPS. $TOPS had recently had a huge breakout, but then had pulled back for three days, so we thought it was due for a bounce play. But, it’s important to note that even though there was sector strength and we had a stock that seemed ready for a pullback, we still needed a technical setup to enter $TOPS.

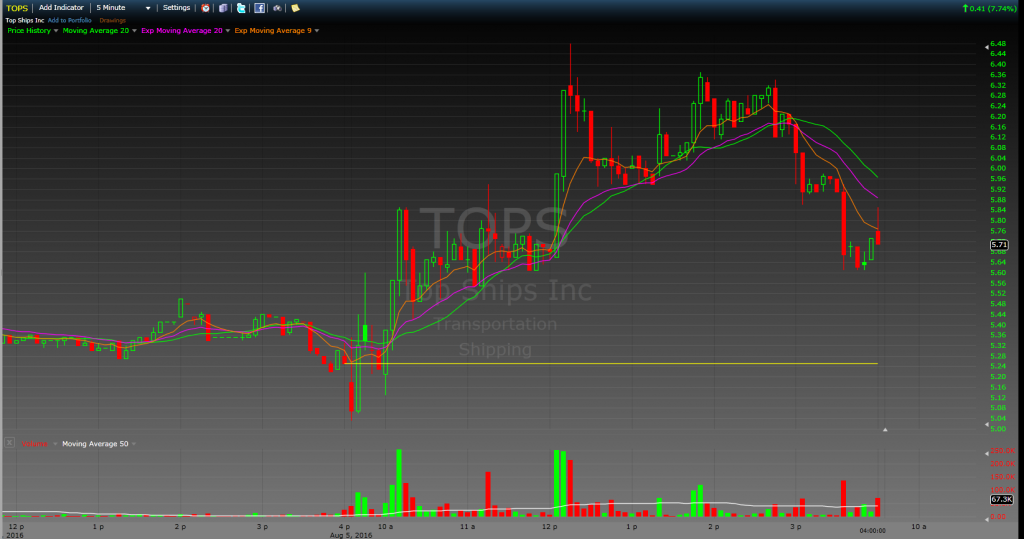

We got our first setup in the morning when the stock provided a nice Opening Range Breakout trade. We got our second in the afternoon; $TOPS held its moving averages all day, forming a nice flag. It broke out of the flag and ran from the $5.60s to the $6.40s – a nice run for momentum traders like us.

In our stock trading Bootcamp, we teach in-depth sector analysis and show you how to find sympathy trades, but here’s a quick video to give you an idea of how it worked with this trade!