Short squeezes. To the moon. Lambo time. Why is everyone hyped up about short squeezes this year?

2021 has been defined by this term. Gamestop, AMC the main reasons why.

As we have seen the past few weeks, this one of the most powerful trading patterns in the markets.

Fortunes can be made or lost from this setup. Here’s everything you need to know about them:

What is a Short Squeeze?

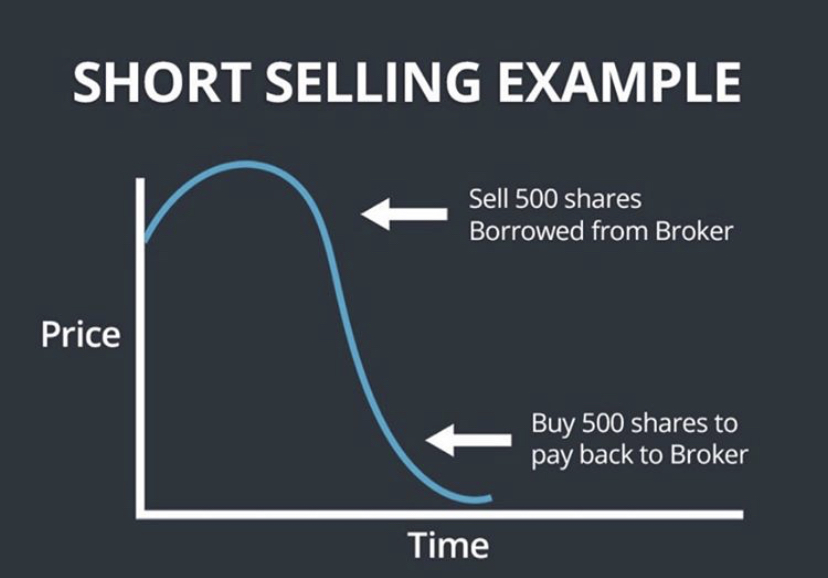

A short squeeze is simply an increase in a stock’s share price because of short covering. When you short-sell a stock, you borrow shares from your broker and then look to buy/cover them at a lower price. The difference between the two prices is the profit for the short-seller.

However, if the stock keeps going up, shorts will have to cover their position in order to avoid a big loss. As short-sellers scramble to cover their positions, they have to buy their shares back from their broker, causing the stock price to increase rapidly in value due to the increasing demand.

Pay attention to a stock’s short interest, which shows an approximation of the number shares short a stock. Stocks with high short interest are good candidates for this setup, especially when combined with a technical pattern. You can see a stock’s short interest on shortsqueeze.com.

Why do short squeezes happen? Why don’t a bunch of people just buy up every highly shorted stocks every week?

Float rotation.

Key Concept: Float Rotation

The float is number of shares of a stock that are available to trade on the open market. These shares can be owned by anyone. It is important fundamental characteristic to understand about a stock before investing into it. A stock’s float will often influence a stock’s range.

Why pay attention to a stock’s float?

A stock’s float is essentially telling you how much supply of a stock is available on the open market. Stocks with a low float, also referred to as low float stocks, tend to be the most explosive stocks. This means they are the stocks that have a high probability of making a big move in a short period of time. The move $GME made recently is a perfect example of how explosive these low float stocks can be:

So what’s float rotation have to do with this?

Supply and demand. Let’s look at the legendary $GME short squeeze that just happened:

The reason this happened is because it had a a ton of short sellers in the stock, and a low float. A stock with a low float takes less buying pressure to send upwards. There are a low supply of sellers because of the low float. Once it gets momentum and volume coming in, it doesn’t take much buying power to send it into orbit.

Look at the volume $GME was trading on those days. It’s float is only around 50 million shares. It was trading 2x-4x that amount on a daily basis. This means the float rotated. Every single share available in the public market traded that day.

How do you find a stock’s float?

There are a variety of sources you can consult to find the number of shares in a stock’s float. Finviz.com, finance.yahoo.com, and shortsqueeze.com are three great free resources to quickly find the answer. The estimates will vary, and not be exact. Approximation is enough.

Short Squeezes = Short Term Trades

Treat a short squeeze trade as a short term trade, such as a day trade or a short swing trade. In order to trade short squeezes successfully, you have to have good timing. These are not trades to marry.

This is like dating versus marriage. We are traders. Not investors. BIG difference in how you approach every stock.

Look at where $GME is trading at today versus a few days ago. 70%+ off highs, double digits. Probably be at $10 in a few months.

Scaling Out

We all know these are junk companies. That means the trades you take should either be day trades or, short-term swing trades.

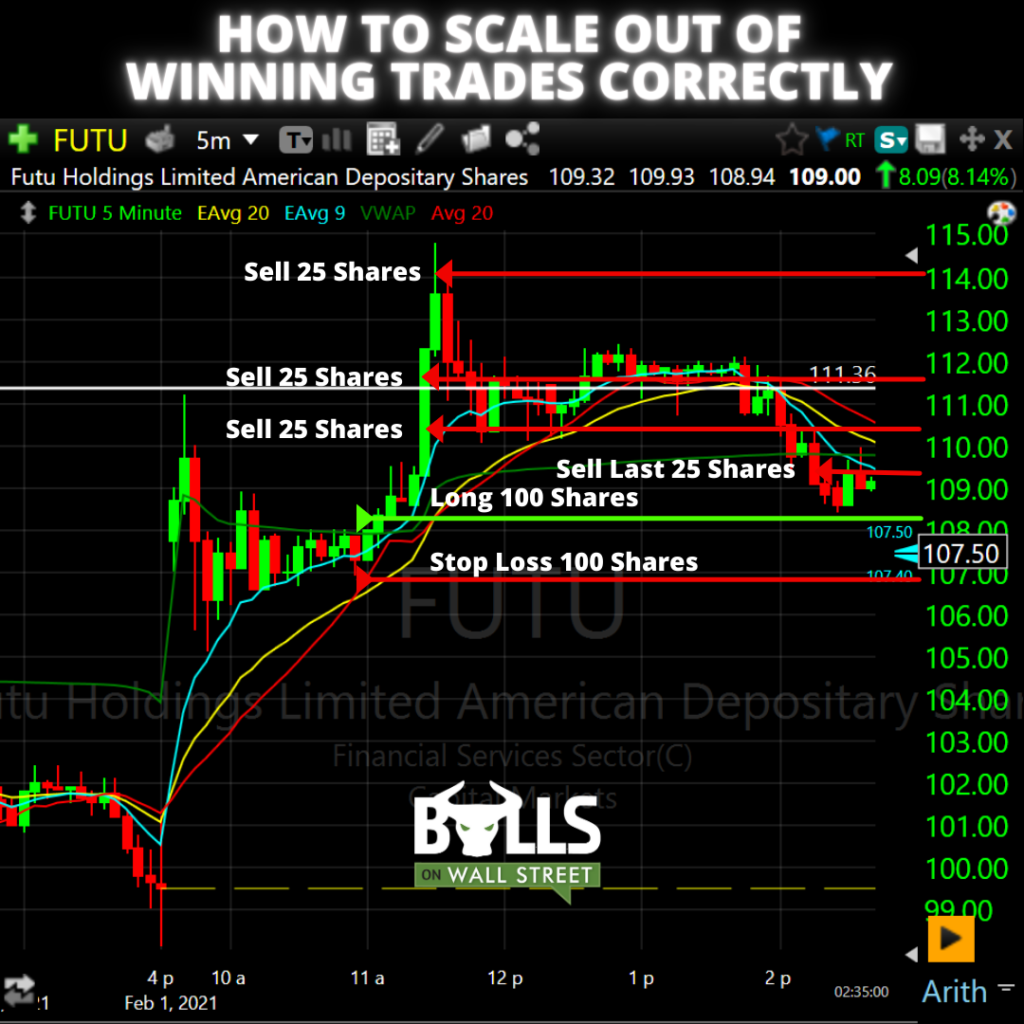

This graphic shows you an example of how you should trade scale out:

The best way to exit a position. Nailing tops or bottoms is tough. This is why us momentum traders at Bulls on Wall Street, especially when day trading, scale out of our positions. Also referred to as taking partial profits. This allows you to lock in profits while you have them in the trade, but keeps you in a position to capture a bigger move!

Join Our Next Live Trading Boot Camp!

Learn all the day trading strategies we’ve been using for 2 decades in our Live Stock Trading Bootcamp. Early-bird pricing ends soon!