Today we’re going to talk about the scariest phase of them all: The run-down phase. Also known as a bear market. We haven’t seen a bear market for around a decade. But there is likely one coming over the next couple years. Now is the time to study and prepare. The best traders actually make the most money during this period. You will see them in all financial markets so it pays to understand what they are, why they occur, and how you can trade them.

The Run-Down Phase

The run-down phase is a period of complete fear in the markets. Sellers are firmly in control. Once the supply of shares exceeds the demand in the distribution phase, the rundown phase. It is characterized by a series of lower highs and lower lows, and high volume sell offs. The news cycle is very negative, as longs become trapped, and there are bag holders everywhere. Novice traders blow up as they try to catch a falling knife and average down.

Bear markets occur every 6-10 years in the stock market. They do not mean the end of the world is coming like the media portrays it. Everyone who doesn’t understand investing is scared. Logic does not rule this period, and everything goes much lower than everyone imagines. Often climatic selling and the bulls giving up total hope coincide with the end of the run-down.

If we start to see higher lows for an extended period of time the market may be entering the accumulation phase. If the market starts to see higher highs and higher lows, there may be a full on reversal into the run-up phase. Here is how you should trade during this phase so you don’t lose money like everyone else.

How To Trade This Phase

This phase is a short-sellers dream. Gap ups in the market are sold into hard. Gap downs always follow through with more selling. Even good news and earnings reports cannot get stocks out of their downtrend in a bear market. Everything will fall further than you expect. The last thing you want to try to do if you’re an inexperienced trader is to try to a catch the falling knife.

A bear market is actually great for momentum traders as a ton of volatility enters the market. Even in a bear market there is still opportunity for good long trades if you know the right setups. There is a lot of opportunity to both the short and long side. You can short breakdowns and strong rallies. You can also play oversold bounces as well if your timing is good. Understand that all long trades in the run-down phase have to be quick (we’ll give you the exact setups we use in the webinar).

Remember bear markets don’t last forever. Do not do what everyone does during a bear market and panic sell. The whole point of understanding market cycles is so you understand that every phase doesn’t last forever. If you do what everyone else does let your emotions take control, you will lose a lot of money.

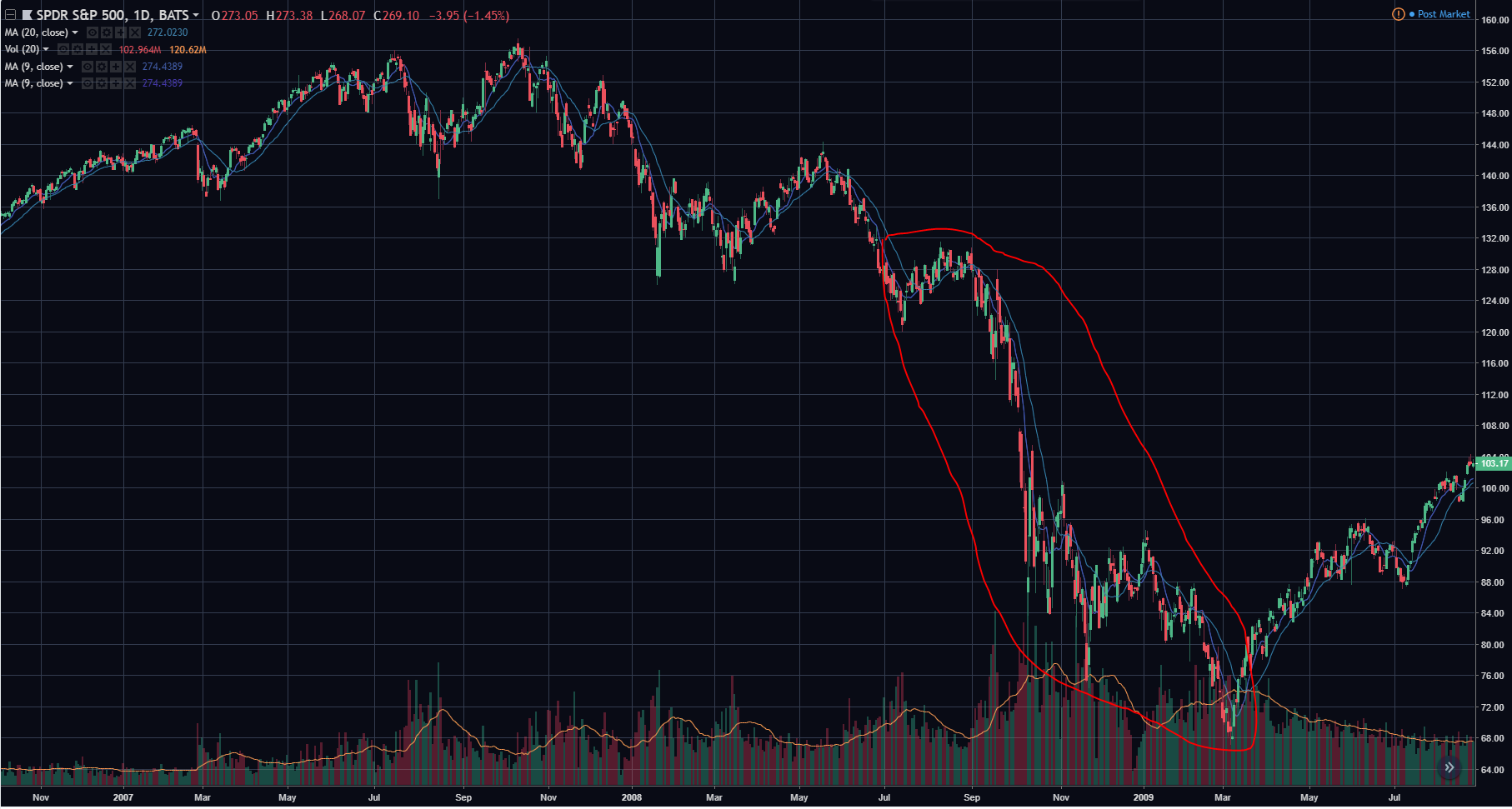

This is a SPY chart from 2008 and early 2009, the last bear market we had. It was a short bear market compared to past ones, but it still resulted in around a 50% pullback in just 8 months. You can see how much volatility came into the markets once the $128 support level broke. Also notice how much volume came in as the market more or less went into free fall mode for a period in October 2008. Once we bottomed, we transitioned straight from the run-down to the run-up phase.

If you missed yesterdays article talking about the distribution phase click here to read it.

Free Live Trading Webinar TONIGHT and Tomorrow

We will be going into much more detail about the run-down phase in tonights webinar. With the current state of the market, this could be the most important webinar you attend.