Stop losses are a crucial part of profitable momentum trading. Whether you are using a hard stop loss or a mental one, you need to have a strategy for placing it at the correct price level.

If your stop loss is too close to your entry price, you will get stopped out prematurely and miss out on the move you were anticipating in the market. If you keep it too loose, you will be risking more money than is needed to find out if the trade will work or not.

The best stop loss strategy is not too tight and not too loose. Most day traders have the tendency to keep it too tight because they don’t want to risk a lot of money, but get stopped out and then get frustrated cause they missed the big move.

In order to place it correctly, you need to consider 4 simple factors:

Stop losses are a crucial part of profitable momentum trading. Whether you are using a hard stop loss or a mental one, you need to have a strategy for placing it at the correct price level.

If your stop loss is too close to your entry price, you will get stopped out prematurely and miss out on the move you were anticipating in the market. If you keep it too loose, you will be risking more money than is needed to find out if the trade will work or not.

The best stop loss strategy is not too tight and not too loose. Most day traders have the tendency to keep it too tight because they don’t want to risk a lot of money, but get stopped out and then get frustrated cause they missed the big move.

In order to place it correctly, you need to consider 4 simple factors:

Key Support and Resistance Levels

Both intraday and daily support and resistance by levels should be considered before placing a stop loss. But more weight should be given to daily price levels, regardless of whether you are day trading or swing trading. Ideally, your entries are near strong support levels on the daily chart for longs, and near strong resistance levels for shorts. This will allow you to keep your stop losses tighter and lower risk on the trade. Day trades will, in general, have tighter stops than swing trades. Swing trades are going for big picture moves, while day trades are capitalizing on short term volatility. Before you place your stop loss, you know whether you are taking the position as a day trade or a swing trade. Many new traders make the mistake of not defining what time frame they are investing on before entering a position.The Stock’s Range

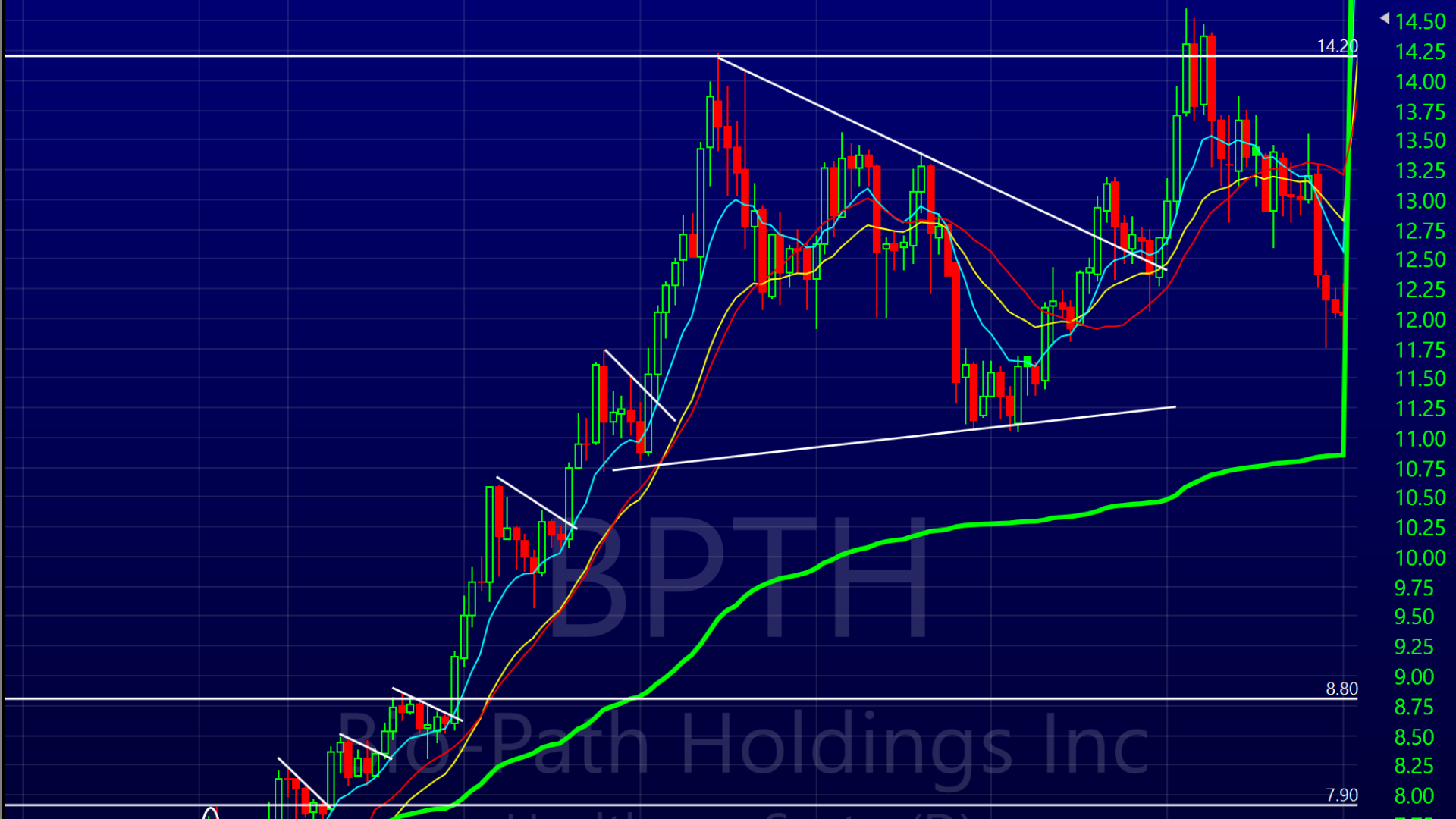

You have to take into account a stock’s intraday range when placing your stop orders to avoid getting stopped out prematurely. So many traders make the mistake of trading a stock like BPTH and use a 10 cent stop. Your risk vs reward is good, but your trade as a 5% of not hitting your stop loss. Look its intraday chart: The stock moves about 50 cents or more on each candle. You would miss all of the moves if you kept a 10 cent stop when trading this. Don’t think about a trade in terms of risk vs reward without considering probability.

You want to typically give a 5-minute candle’s worth of room under the support area you are risking off for your stop area for day trades. A lot of traders don’t like doing this because it requires you to increase your risk on the trade and buy fewer shares. But, it also increases the probability of your trade being correct.

The stock moves about 50 cents or more on each candle. You would miss all of the moves if you kept a 10 cent stop when trading this. Don’t think about a trade in terms of risk vs reward without considering probability.

You want to typically give a 5-minute candle’s worth of room under the support area you are risking off for your stop area for day trades. A lot of traders don’t like doing this because it requires you to increase your risk on the trade and buy fewer shares. But, it also increases the probability of your trade being correct.