It is easy to see price action in the stock market as random. Some days stocks go up, and some days stocks go down. Some days they go up a lot, and some days they go down a lot. To the average person, the financial markets seem just like a casino.

But the reality is that all markets move the same way, and actually go through all of the same phases. All markets are either in a period of consolidation or they are trending. There are four phases in all financial markets:

- Accumulation

- Run-Up

- Distribution

- Run-Down

You will see these in stocks, ETFs, crypto, Forex, and all other financial markets. Once you study and master these four phases, the markets will not seem so random anymore. By learning to recognize these different phases, you will become a more profitable trader because you will know when to apply a particular style of trading. We will give you the exact setups we use to trade each phase during our free webinar on November 20th. Today we are going to talk about the accumulation phase, and how you should trade during this phase.

The Accumulation Phase

The accumulation phase is a stage of consolidation. There is no clear trend, and the stock is usually trading in a range. It’s a span of time in which traders and institutions are slowly accumulating shares, but the market has not broke out yet. It’s also referred to as a “basing” period. It begins after the completion of a downtrend where the sellers have started to let up and short sellers have started to take their profits.

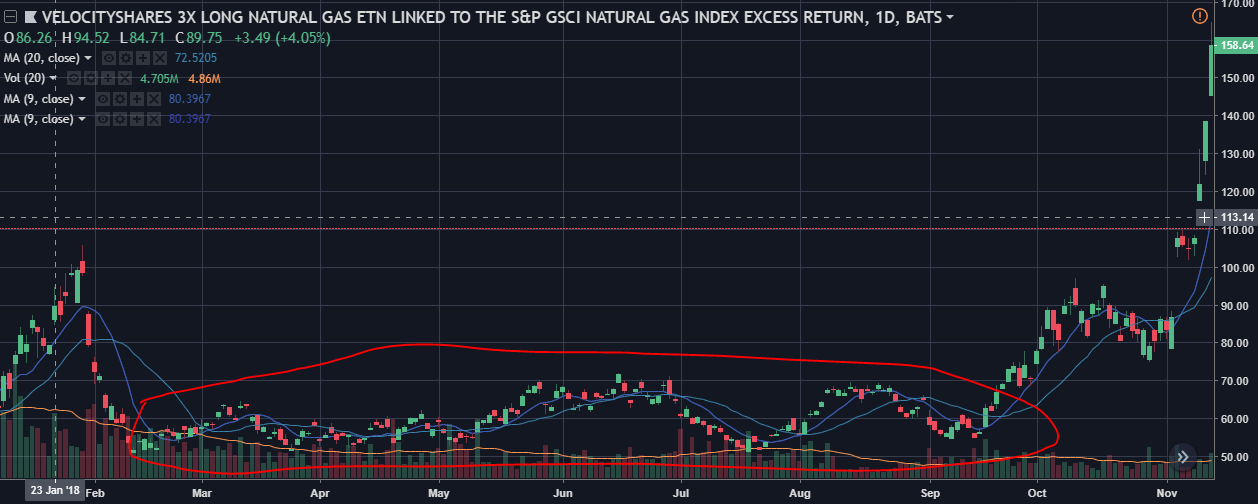

The moving averages will give conflicting signals during this period, a tell-tale sign that the market is not trending. Usually, the longer the accumulation period, the more explosive the run-up if it starts to break out. UGAZ is a great recent example of a stock with a long accumulation phase preceding an explosive runup.

How To Trade This Phase

The accumulation phase is a period of consolidation following a downtrend but precedes an uptrend. It will take some time to work out all of the sellers in the market. This phase can take weeks and months to complete, so have the patience for the right entry. During this period there is a contraction of price range, and no real edge for day traders. You can still take trades during this period, but be sure to take them with smaller size until a trend is confirmed.

The longer the period of consolidation and basing, the more likely that the market bottom is in, and you can know for certain the accumulation phase is about to end. Negative news will often no longer affect the market. Once you have seen a long period of consolidation all it can take is one decent press release or piece of news to take a stock out of this range and start an uptrend in the market. Once a key level of resistance is broken and you start to see higher lows and high relative volume pouring in, the accumulation phase is over and we are into the run-up phase.

UGAZ Example

UGAZ, a natural gas ETF, is a great recent example of an ETF coming out of a long accumulation phase and exploding. You can see how it consolidated between $51 and $70 a share for almost 9 months. Going to reemphasize a point we made above: this phase takes time to form and complete. Once it broke out of the range, we saw an over 100% move in less than two months.

Come back tomorrow as we will talk about the runup phase.

Free Live Trading Webinar on Nov 20th and 21st

Wondering how to profit when the market crashes? We are doing a free workshop analyzing all the market cycles of the stock market in even more depth, which sectors you should be trading, and the best setups to use in a bear market like the one we are in now. On the 2nd day you can watch me day trade live and see exactly how I trade and profit in the current market conditions.