Whether you are reading this right before tax season, or actually during tax season, there are a ton of valuable tax strategies us traders can apply to reduce our bill to Uncle Sam at the end of the year.

Today, we are going to dive into Tax Loss Harvesting, one of the top strategies investors use to cut down on their bill at the end of the year by essentially trimming losing positions, and locking in gains from winning positions at the same time.

Please consult with a CPA before using any of these strategies to get insight to how to use them for your unique situation!

What is “Tax Loss Harvesting”?

If you are reading this, chances are you have actively invested or traded before, and know that losses are a part of the game. You can’t escape them. Fortunately, a loss on your account does have a silver lining to it. You may be able to use your losses to lower your tax liability at the end of the year. This strategy as a whole is called tax-loss harvesting, and it’s one of the many tax saving strategies that you need to be aware of as a trader or investor.

Tax Loss Harvesting is an overarching term for the bundle of strategies that allows traders to offset capital gains with capital losses during the year The term capital gain refers to the increase in the value of a capital asset when it is sold. A capital gain occurs when you sell an asset for more than what you originally paid for it, and thus have to pay capital gains tax. All the money you make on a trade is never yours. At the end of the year if you have a lot more gains than losses, you’ll need to look into some Tax Loss Harvesting strategies like the ones we are about to dive into.

How Does Tax Loss Harvesting Work?

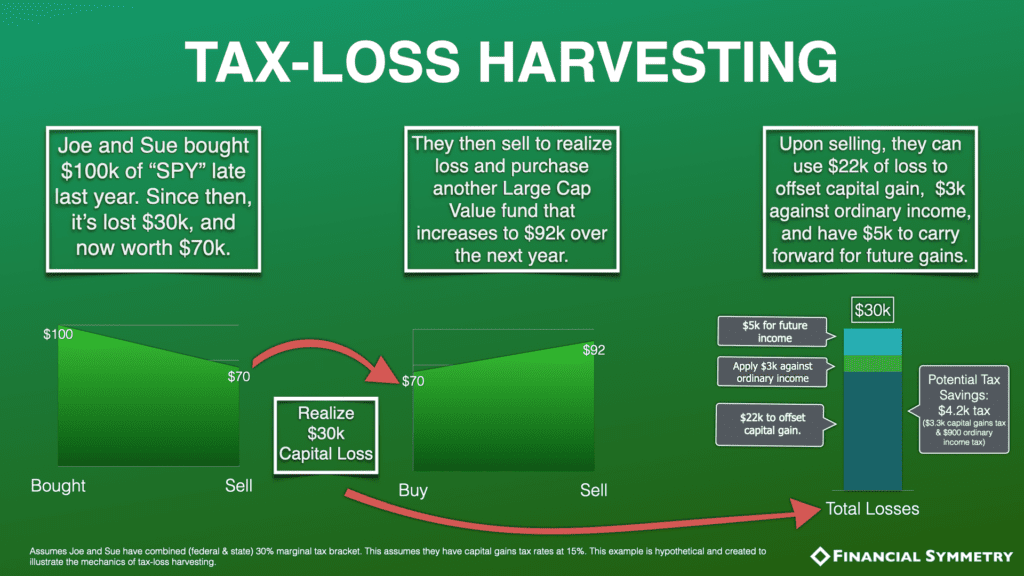

To break it down in a simple structure, tax loss harvesting works in three stages or steps.

- First you take a loss on investment or trade

- Second, you use that loss to reduce your taxable capital gains at the end of the year. This allows you to potentially offset up to $3,000 of your ordinary income come tax time.

- Third, you reinvest the money from the sale of the losing trade or investment into a different investment or trade

Overview of Tax Loss Harvesting At Work

Let’s say for example you are holding a portfolio you have built up over some time, and see that the healthcare stocks you are holding have risen, while your tech stocks have dropped. Due to this, you now have a considerably higher amount of your portfolio exposed to the healthcare sector. In seeing this, you know that stocks don’t go up forever, so you want to sell some of your increased healthcare holdings to lock in some gains. By selling those healthcare stocks, you are locking in a profit and thus incurring a significant capital gain in the process that you will have to pay at the end of the year on your tax bill.

Now, this is where tax loss harvesting comes into play! If you sell those underperforming tech stocks in your portfolio that have dropped in value, you can use those losses to offset the capital gains you got from selling, locking in the profits by selling your healthcare stocks, thus reducing your tax liability.

Also, if your losses are LARGER than your gains, you can use the remaining losses to offset up to $3,000 of your ordinary taxable income. Any amount over $3,000 can also be carried forward into future tax years to offset income in the coming years keep in mind.

Example of Tax Loss Harvesting

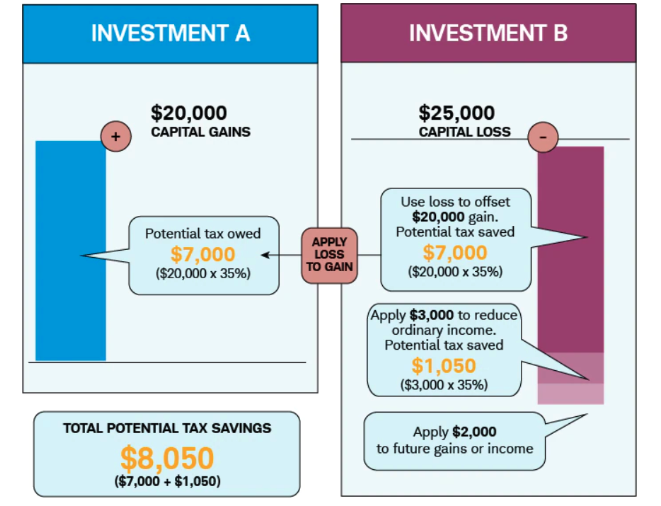

Now, let’s break down a specific example using some numbers. Below is a visual graphic as well from Charles Schwab that will help you get a better understanding of this concept.

Let’s say this past year you realized a gain of $20,000 on a healthcare stock you bought less than a year ago. In this example, we will call this Investment A.

At the same point in time, you incur a loss of $25,000 by selling off some underperforming tech stocks in your portfolio you did not like. We will call this Investment B in this example.

Your $25,000 loss would offset the FULL $20,000 profit from Investment A, which means you do not owe any taxes on that gain and could thus use the remaining $5,000 loss to offset $3,000 worth of your ordinary income. The remaining $2,000 leftover could be used in the coming years filings.

In this example as well, we will assume you are subject to a 35% marginal tax rate, which brings your overall tax benefit of harvesting the loss on the tech stock to $8,050. Below, let’s break this down some more.

By offsetting the capital gains of Investment A with your capital loss Investment B, you could potentially save $7,000 on your taxes (assuming a marginal tax rate of 35%… $20,000 X 35%), and since you lost an additional $5,000 more than you gained in this example as stated above, you can reduce your ordinary income by $3,000, potentially lowering your tax liability by an additional $1,050 ($3,000 X 35%), bringing us to that $8,050 figure.

Early-Bird Pricing Ends SOON For Our Next Live Trading Boot Camp