@szaman here, today in the chat we traded SWHC. Stock has been sold hard last few day’s on news. So i was eyeing it yesterday for a bounce trade. Late yesterday we initiated a swing position at 7.77 as daily chart was showing oversold condition and 60 minute chart was printing some indicators that sellers might be becoming exhausted.

On the 60 minute chart as of yesterday price was making lower lows but the short term indicators like Stochastics/CCI were painting higher high or became flat. Stock was also painting a Bullish “Falling Wedge” which usually proceeds a bounce .

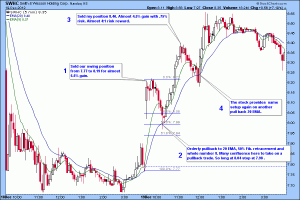

Stock gapped up this morning and we sold our swing position at 8.19 for a nice overnight gain. When a stock gaps up there will always be a first pullback. This is where day traders will initiate a position for a trade. Click on the intraday chart to see notes.

1 . Sold our over night swing position from 7.77 to 8.19 for almost 5.5% gain.

2. Orderly first pullback to 20 EMA/5 min. , 50% Fib. retracement and whole number 8. Many confluence here to take on a pullback trade. The more things line up the better the outcome. So long at 8.04 stop at 7.98 .

3. Sold my position 8.40. Almost 4.5% gain with .75% risk. Almost 1:4 risk reward.

4. The stock provides same setup again on another pull back 20 EMA.

We came out with almost 10% gains with round trip trade.

Hope this helps.