This is an incredibly unique period in history. This summer’s trading conditions will be like no other we have seen in this lifetime.

The world economy is reopening. Q2 earnings reports come in July. Money is rotating into new sectors.

Summer trading is typically a period where opportunities slow down, as liquidity dries up as many traders go on vacation and take time off. With all these new changes and events going on this summer, we will likely see conditions that will challenge most traders.

Many of you reading this are new to trading, and this may be a period where you are just starting to dabbling with the markets. If you are new or struggling in the current market environment, follow these trading tips!

Focus on Micro-Goals

Expectations set the standard for your trading routines. Every new trader want’s to turn $1000 into $100,000 in a 2 months. Stop believing all the pipe dreams you’re sold on social media. Building a trading account up takes time and patience. Focus on base hits and the occasional home run, and the account growth will happen.

Base Hits Add Up

See the power of small gains. When you see graphics like this remember: This is what you average daily. No trader makes the exact amount every day. Every trader is different in their strategy and win rate. You can be a profitable trader and not make money every day. Focus on your weekly and monthly PNL.

Scale-Out of Trades

You will never sell at the top. My favorite exit strategy is scale-out. This means you sell a piece of your position once you are in the green. This allows you to lock in profit, but keep yourself in a position to capture a bigger move. Once you sell 1/2 or 1/3 of your position, you will be at ease knowing you have a realized gain, and improve your trade management.

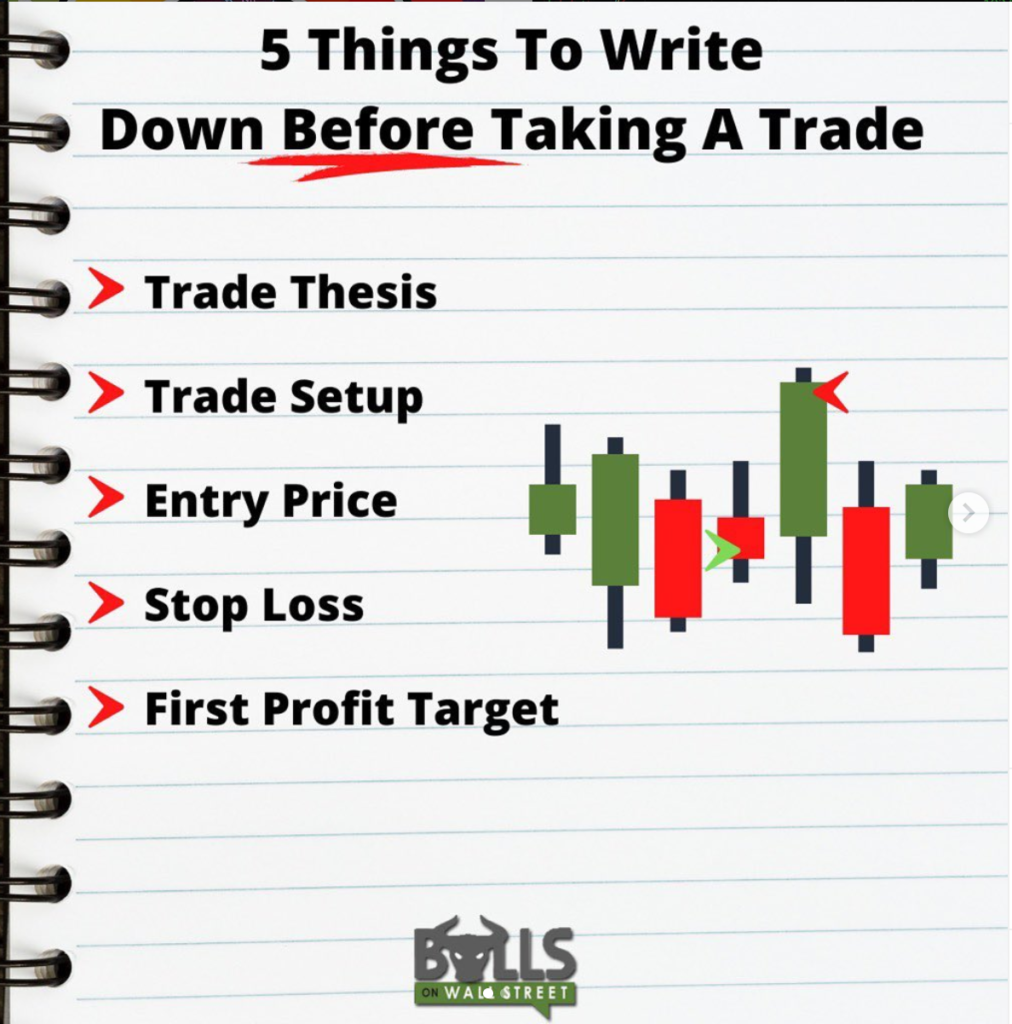

Have a Trading Plan!

Never take a trade if you haven’t defined these 5 things. Trades that have no planning never end well. The better you plan your trades, the more likely they will be profitable.

Focus on Low-Risk, High-Reward Trades

You don’t need a high win-rate if you have a strong risk vs reward ratio on your trades. You can be a profitable trader if your win rate is just 40% and you have a minimum risk vs reward ratio of 3:1. Let your winning trades run, and cut losers quickly. Cliche, but most traders do the opposite.

Join Our Summer Swing Trading Boot Camp

Join the Summer Swing Trading Boot Camp