Building a winning stock watch list is a critical step for any successful trader. A watch list is your backbone for the day or week. It is a list of stocks that you are interested in due to their structure, sector, or setup, and want to keep a close eye on.

By keeping an eye on these stocks, you can make informed decisions about when to buy or sell, based on market conditions, company news, and other factors during the week.

In this blog, we will cover the steps you need to take to build a winning stock watch list, and some crucial mistakes to avoid:

Mistakes To AVOID When Building A Watch List

Following Random Setups & Posts

Whenever you see a stock or setup blowing up on twitter, social media, chatrooms, or hitting a major scan, it’s already too late. The biggest mistake new traders make when building their watch list is trying to save time by adding other people’s ideas and setups to their own watchlist, and not doing the work themselves.

When you first start out, building a watchlist will take time. Don’t cut corners. You need to be watching stocks that fit YOUR game plan. It’s fine to look at what other people are watching, I’m sure many of you read our nightly watch list. Use these for ideas, NOT for blindly following.

Follow this guide, take time every night, and learn to build an effective watchlist on your own.

Adding Too Much To Your Watchlist

You want your list to be ACTIONABLE. Quality over quantity, especially when you’re new. Every ticker on your list should have some sort of highly-probable, actionable setup coming up in the near-term. Adding tons of tickers to your watchlist that just look ‘alright’ will be highly distracting, and will cause you to miss the actual A+ setups you were seeking out in the first place.

If you don’t have a list of set ups that you know you perform well on, we recommend you go back to the basics. We teach 18 different day trading and swing trading strategies in our Live Trading Boot Camp so you know what set ups you perform well on, and as a result what stocks to put on your watch list.

What Softwares To Use When Building Your Watch List?

In the video below, Kunal breaks down how he uses TC2000 to build his watch list, and incorporates several scans and lists into his process. TC2000 is a great charting platform and software to trade off of, and plan due to its easy to use interface. Kunal Desai is a veteran day trader with over 15 years of experience, and has simple routine you can learn from in the video below:

If you don’t want to use TC2000 though, you can easily use other software programs and websites like Finviz.com and TradingView.com to run scans and filter down stocks by certain setups and criteria to add to your watchlist.

Types of Stocks To Look For & Scans To Run

Stocks That Have Big Momentum

First off, when we are scanning through different stocks and lists, we want to find stocks that are starting to have big momentum along some sort of trend. Look for stocks that have broke through a massive range to the upside on volume for example, or are about to break out. Or vice-versa to the downside for short-selling. We want to be where the activity is, and this will help you. Right before the market opens, you should be running a liquid gainers scan, a simple scan that filters stocks that are gapping up or down 4% or more 1M minimum average volume:

Stocks Coming Out of a Pattern

Usually you have 3-6 days AFTER a stock breaks a pattern to trade it before it becomes too extended. Take $MARA for example below.

$MARA broke the long downtrend on extremely high relative volume. You basically had 6 days of clean upside activity after the trend broke before you had a condensing of the range, and a big reversal candle.

Look for stocks coming out of big patterns, set alerts at key levels, and add them to your watch list so you’re ready to jump in once they set up.

Flagging or Range-Bound Stocks

Looking for stocks that are coiling right now on their longer term time frames like their daily chart is great to add to your list. Look for stocks that are just getting ready to break a huge range to the upside or downside, or a flag to the upside or downside. You can actually set alerts on your charts in TC2000 for that certain level to break, which will help you a ton with not missing these moves.

$CCL is a great recent example of this type of price action:

Go-To Stocks

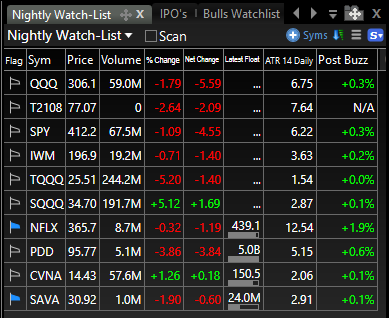

In addition to all of the new lists I am building, I also like to keep a list of my go-to stocks by my side. These are stocks that have big range, high volume, are well-known, and have a high ATR (learn more about ATR here). These stocks usually give rise to solid opportunities a few times per week, and are great to keep on a revolving list to analyze.

How To Analyze Indices

Whenever we are building a watchlist, it is important to look at the major indices like the Russel 2000, $SPY/@ES, and $QQQ/@NQ to get a solid gauge on what the overall market conditions are.

If we are trending downwards, it is a good idea to look for shorts or over-extended bounce plays to the upside. If the market and indices are trending upwards, it is a good idea to do the opposite: look for longs or over-extended short setups. Use the indices as market color to aid in your bias going into the week.

If you want to learn more strategies and tactics to use to dominate the 2023 market conditions, make sure to apply for our LIVE Trading Boot Camp below!

Early-Bird Pricing Ends SOON For Our Next Live Trading Boot Camp