The stock market has a long and storied history, with its fair share of booms and busts. Stock market crashes, in particular, have had significant impacts on economies and investors around the world. Today, we’ll be taking a look at some of the most notable stock market crashes throughout history, exploring the causes and consequences of these events, and preparing you for potential crashes in the future.

Before we dive in, let’s start by breaking down the definition of a stock market crash is so we are all on the same page:

Technical Definition of a Stock Market Crash

A stock market crash is a sudden dramatic drop of stock prices across a major market mechanic, indicie, or industry. It results in major, widespread losses, and usually is driven by panic selling and underlying economic or political factors. Oftentimes, crashes occur after a time of large-scale speculation and economical bubbles in one or multiple industries.

The South Sea Bubble (1720)

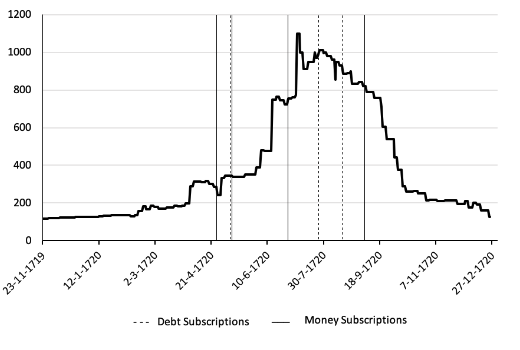

One of the earliest recorded stock market crashes occurred in the early 18th century in Great Britain. The South Sea Company, which was granted a monopoly on trade with South America, saw its stock price rise dramatically in the early 1720s. Speculators rushed to buy shares in the company, driving the price even higher. However, the company had few actual assets and was essentially a Ponzi scheme. When the bubble finally burst in 1720, the stock price collapsed and many investors were left with significant losses. The crash was a significant event in British history and is often cited as an early example of financial speculation gone awry.

The Wall Street Crash of 1929

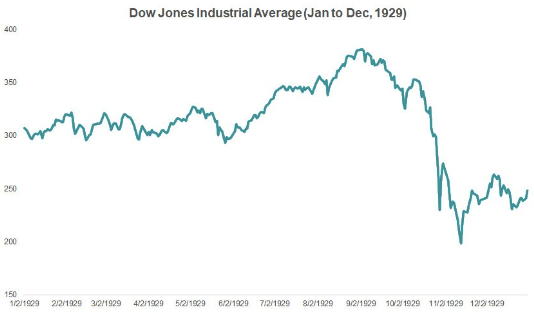

Perhaps the most famous stock market crash in history is the Wall Street Crash of 1929, also known as the Great Crash or the Stock Market Crash of 1929. The crash, which occurred on October 29, 1929, is often seen as the beginning of the Great Depression.

The crash was caused by a number of factors, including overproduction, low wages, and an oversupply of goods. As a result, consumer demand began to decline and businesses began to struggle. In addition, the stock market was fueled by speculation, with many people buying shares on margin (using borrowed money). This added to the instability of the market.

On the day of the crash, the Dow Jones Industrial Average (DJIA) fell by more than 11% and continued to decline in the weeks and months that followed. The crash led to widespread panic and a significant loss of wealth for many investors. The effects of the crash were felt around the world and contributed to the global economic downturn of the 1930s.

The Black Monday Crash of 1987

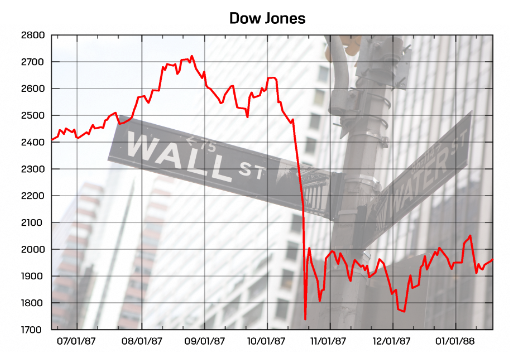

The Black Monday Crash of 1987 occurred on October 19, 1987, when the DJIA fell by more than 22%. The crash was caused by a number of factors, including a slowing economy, rising interest rates, and trade tensions between the United States and other countries.

The crash was exacerbated by the use of computerized trading systems, which allowed for rapid selling of stocks. Many investors panicked and sold their stocks, leading to a further decline in the market. The crash had a significant impact on the global economy and led to a recession in many countries.

The Dot-Com Bubble (2000)

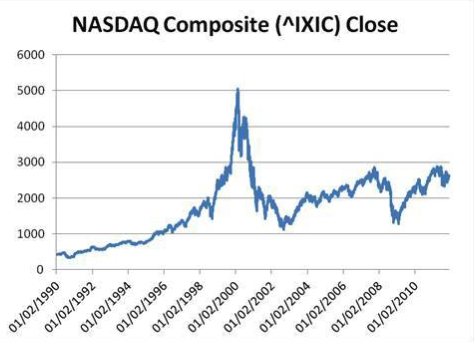

The Dot-Com Bubble, also known as the Tech Bubble or the Internet Bubble, was a period of rapid growth in the stock prices of internet-based companies in the late 1990s and early 2000s. The bubble was fueled by speculation and hype surrounding the potential of the internet and the belief that internet companies were immune to traditional business cycles.

However, many of these companies had little in the way of actual assets or revenues and were overvalued. When the bubble finally burst in 2000, the stock prices of many internet companies collapsed, leading to significant losses for investors. The Dot-Com Bubble is often cited as an example of the dangers of speculation and the importance of proper due diligence when investing.

The Global Financial Crisis (2008)

The Global Financial Crisis, also known as the Great Recession, was a significant economic downturn that began in 2007 and continued into the early 2010s. The crisis was caused by a number of factors, including the collapse of the housing market, and risky financial practices.

2020 COV-19 Crash

In March of 2020, we saw a roughly 40% decline in the S&P in just a month after worldwide lockdowns due to fear of COVID spread. Markets tumbled pricing in the potential of indefinite lockdown of economies across the world.

What’s Coming in 2023?

When you zoom out and really look at the market as a whole in 2023, we will likely see a continuation of the main themes from 2022: High-Interest Rates, Rising Unemployment, Falling Housing Prices, and Uncertainty. All of this describes what could be coming in 2023. We have already seen drastically high inflation numbers and rising rates trying to combat that inflation, which has resulted in a slowing of the economy and market instability. Now, there is no way to truly predict 100% what will happen in 2023, but by looking at the current conditions, one can reasonably believe that these negativities won’t turn around in the early part of 2023.

Will we see some easing on rate hikes by the FED towards the middle to end of the year? Maybe, or maybe not. But just looking at how things are from a high-level at the moment, one can reasonably believe that 2023 may continue to be a shaky year. As traders, we focus on REACTING to events, not predicting.

How to Prepare For The Coming Market

The most important thing you can do to make sure you are trading and investing safe in times of uncertainty and downturns is to focus on obtaining quality education, and getting involved in an experienced, transparent community. It may sound cliche, but proper education will be the number one thing separating you from dominating this type of market in 2023, or getting dominated by it.

You have to learn from others who have been through major market downturns and from those who have not just traded through bull markets. At Bulls on Wall Street, we have tons of professional traders, including Kunal of course, who have seen every market condition possible, traded through them successfully, and can teach you how to navigate them. If you don’t learn how to successfully trade these types of markets from someone else who is actually experienced, you can miss out on huge opportunities, or even worse, take some massive financial hits. Invest in education, and surround yourself with a supportive, knowledgeable, credible, and active community this year to reinforce your education and learn more in real-time.

Early-Bird Pricing Ends SOON For Our Next Live Trading Boot Camp