Tired of trading with a small account? Frustrated because it’s limiting your earning ability?

It’s true: You need money to make big money in trading and investing.

This is actually a great thing for new traders. In the long run of your trading career, starting out small is the right move. Here’s why:

Why Trade with a Small Account?

Trading has a learning curve. You will make many trading mistakes when you start out. These mistakes are inevitable. A small trading account minimizes the damage of these mistakes.

If you blow up a $50k trading account, that will be a big blow financially and emotionally. However, if you blow up a $3k account, it is not as big of a blow, and a much less expensive learning experience.

When you’re starting to trade live, it’s not about making money. It is about seeing if you can execute a strategy with an edge, and consistently make money over a period of weeks/months. There is no reason to start out trading a $50k account if there is no evidence you can actually make money trading with real capital (do not let paper trading results fool you).

Once you can consistently make just $100-$200 a day, you can scale that to $500, $1000, and beyond.

The goal of trading a small account is to grow it into a big enough account so that you can make a living off of it. Even if you have large amounts of capital available, it is still a good idea to start with a smaller account and add more equity as you start to see success.

Now that you understand the expectations and benefits of trading a small account, let’s discuss how you should approach using a small trading account:

Risk Proportionally to Your Account Size

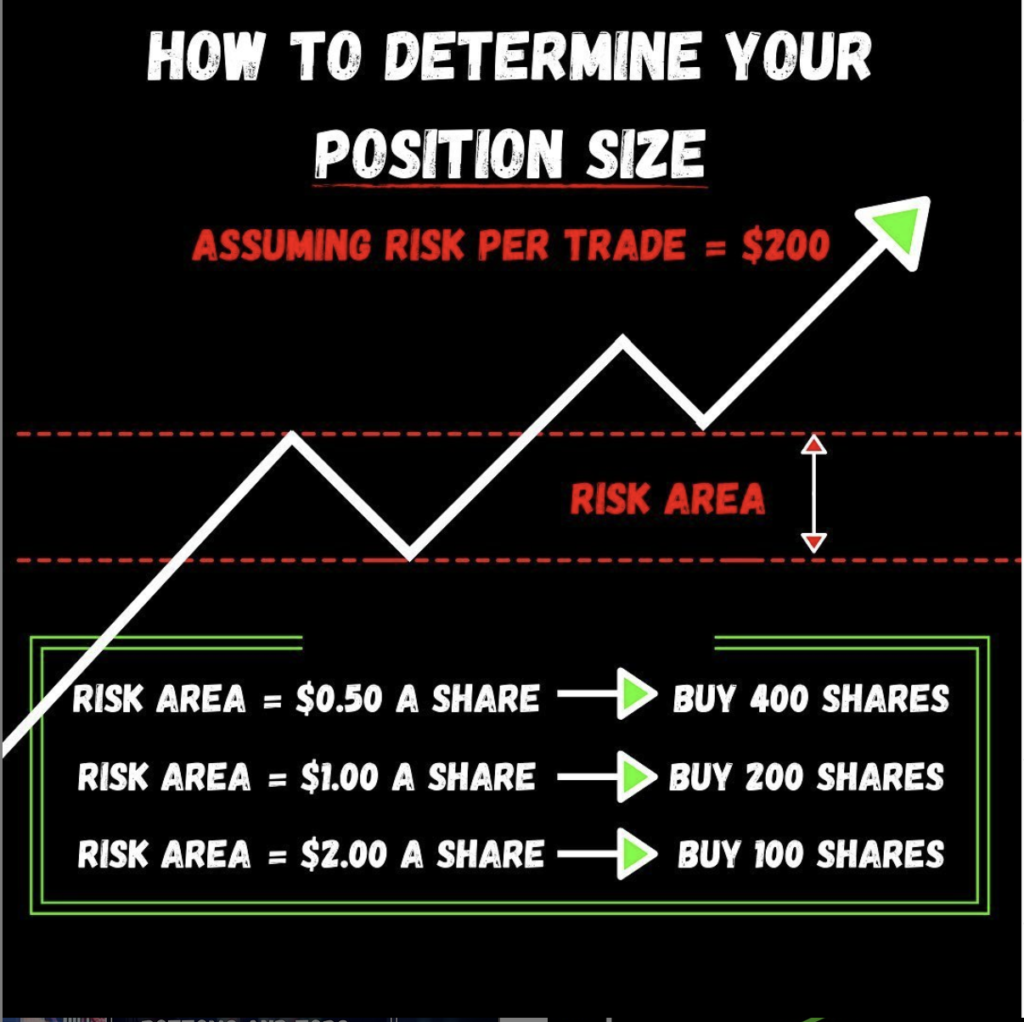

Treat your $5k trading account like you’re trading a $50k account. If you’re trading a $50k trading account, you’re likely only risking $500-$1000 per trade. So for a $5k account, you should only be risking $50-100 per trade in the beginning. Use this formula to determine how much you should risk per trade:

Never risk more than 1-2% of your total account size on any one trade when you’re new. Remember the goal with a small account is to develop your edge and refine your strategy as a new trader. The size will come eventually.

Use Leverage Wisely

Leverage is a double-edged sword. This is the first thing you see everyone talking about when using a small account. If you don’t know what leverage (or margin) is, it’s when you borrow funds from your broker to buy or short more shares of stock. If a broker gives 2:1 margin for example, if you have a $5000 account, you will have up to $10,000 in buying power.

When using leverage focus on how much you are risking per-trade. You can use leverage on a trade, and still have controlled risk. The key is knowing how much of your trading account you will risk-per-trade BEFORE you enter, and place your stop loss accordingly.

It has the ability to exponentially grow your account if used correctly, To learn more about how to use leverage correctly, check out this blog here.

Stop Comparing

I’m sure you see people on Twitter posting huge PNL’s every single trading day. How they do it, and whether they’re actually trading real money or not doesn’t matter. They’re likely much more experienced traders with a lot bigger trading accounts.

Following anyone who is posting their PNL on their Twitter doesn’t help you at all in the beginning. Focus on your own journey and building up your skillset and equity.

Have Other Sources of Income

Since you’re trading a small account, you will have to have other sources of income so you don’t feel a need to force trades to make the money you need to survive. As mentioned above, you shouldn’t open a small account with the expectation that you will make a living from it, especially as a new inexperienced trader.

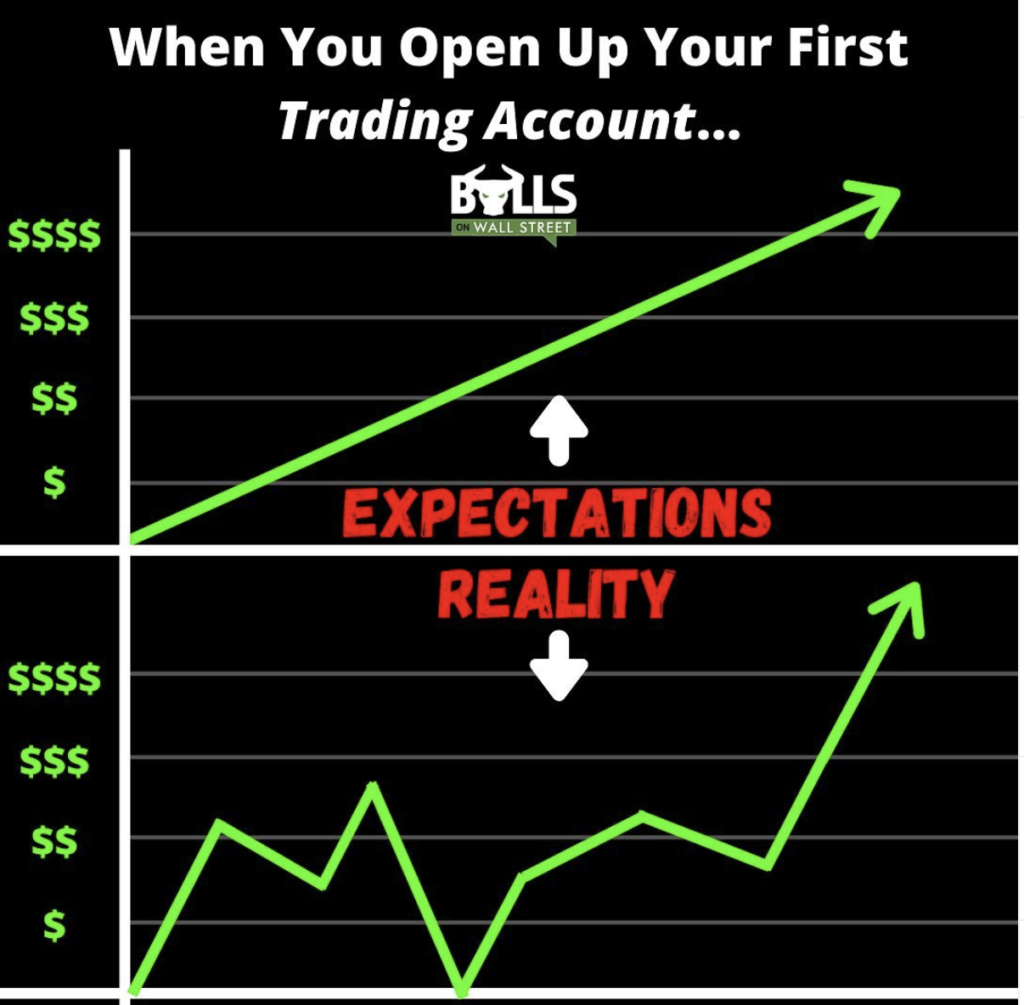

Set Realistic Expectations

Growing a small account is not an overnight process. Do not expect to go from a $5k trading account to a $30k trading account (not to say it can’t be done) in 6 months. Do not rush the process and set unrealistic expectations. Your equity curve in your account will not go straight up:

This will cause you to force trades and actually slow down your account growth. If you have seen several months of green, you can wire in more money into your account so you can increase your position sizes to speed up the growth process. Remember trading is a marathon, not a sprint.

Don’t Pull Out!

This is one of the few times in life where you will hear this advice. The goal of having a small trading account is to grow it into a bigger account. You cannot grow it into a big account if you’re wiring out profits.

You’re trying to grow your account so you can increase the amount you can risk per trade, and therefore increase the amount you can make per trade. If you are trying to get over the pattern day trading rule, it is especially important to leave your profits in there. Going back to the sources of income point: Don’t be reliant on your trading income when you’re new and unproven.

Focus on One Strategy

Less is more in trading. When you have a small account, you cannot afford to touch setups you have no edge in.

Stick to one strategy. And sit all day and wait for it, ignore everything else. Once you master 1 setup and extract profits consistently with it, then you start adding more to your repertoire.

Slowly Increase Your Position Size

After you start to see some green weeks/months and find some consistency, you can start to increase your position sizes. However, you’re not going to go from $100 risk per trade to $500 risk per trade. You slowly increase your size.

Go from $100 to $150 or $200. Rushing size can lead to emotional trading, and will likely lead to a big loss, and undo weeks of hard work and disciplined trading. Once you prove you can manage risk and trade with an edge, you can increase your portfolio risk. You can go up to 5% if you want to get really aggressive. Once you’re ready, step on the gas, expedite the growth of your account.

Small Account Trading Summary

- Risk Proportionally to your Account size

- Use leverage wisely

- Don’t compare yourself to others

- Have other sources of income

- Set Realistic Expectations

- Focus on 1 Strategy

- Don’t pull out profits

- Slowly increase your position size

Live Trading Classes From Experienced Traders: Join Our Live Trading Boot Camp

Space fills up fast in our boot camps. Apply for your seat to see if you qualify!

Click Here to Save Your Seat