The short sale rule is one of the most pointless rules in the stock market. But you have to understand what it is as an active stock trader, as it has a big effect on how a stock trades once it gets triggered. Today we will talk about what SSR is, how stocks tend to move with short sale restrictions and some tricks for successfully trading stocks with SSR on:

Shorting Stocks

Before we can get into the Short-Sale Rule, you need to understand short-selling. Short-selling is simply making money when stocks go down, instead of when they appreciate. You borrow shares from your broker, and then by them back at a lower price. If you are confused by short-selling, make sure to read this blog before continuing in this article.

What is the Short Sale Rule(SSR)

The short sale rule (SSR) is triggered when a stock goes down more than 10% from its prior close. SSR remains on a stock for the rest of the trading day when it’s triggered and remains on for the following trading day as well!

The SEC made this rule to prevent short sellers causing a stock to tank. All it really does it make it difficult to short. The people who want to short are still going to short the stock.

A stock having short sale restriction just does not always affect the probability of the stock going up and down. Do not buy a stock just because it has short-sale restrictions on.

The exception for that rule is in small-cap stocks, as these can be manipulated easier due to their lower float. It is much for a 3 million share $5 stock to drop 50 cents than it is for Netflix to drop $30-$40 a share. Strong, uptrending, low-float stocks + SSR can be the recipe for a big squeeze.

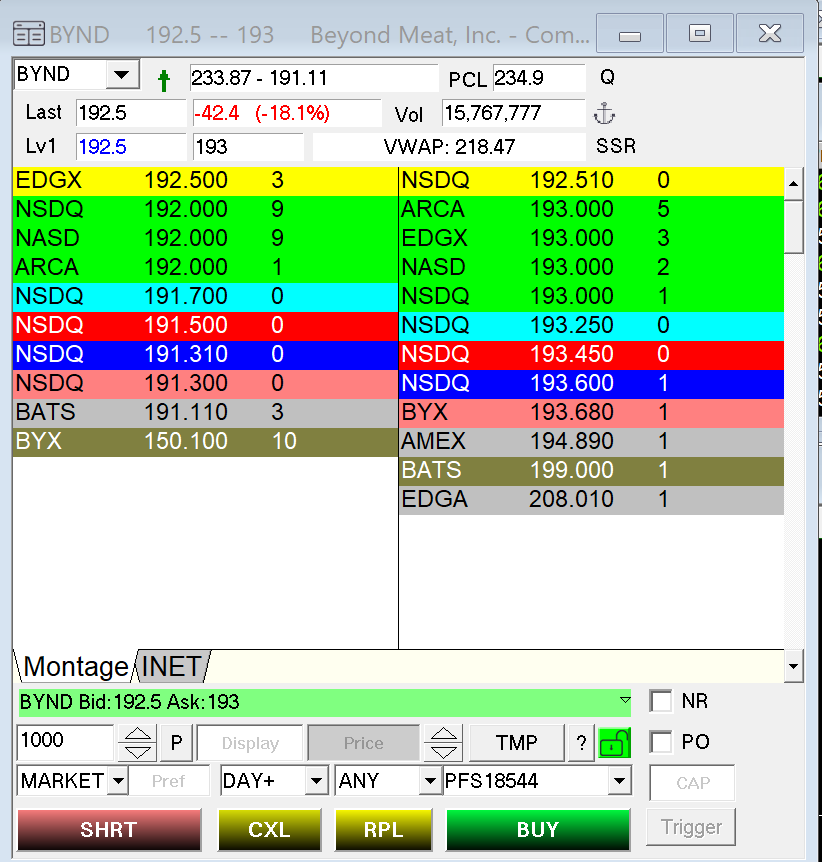

How to Tell if a Stock has SSR On

A stock will have an “SSR” on the Level 2 montage in the top right. See the example below:

Trading Stocks with Short Sale Restrictions

Stocks with short sale restrictions can be tricky to trade to the short-side. A lot of times stocks with bad news will gap down during pre-market and trigger SSR. They will often grind down slowly and then have big pops, and then continue to fade. They can provide great shorting opportunities, but you have to have good timing.

The number one rule for trading stocks with SSR: Don’t short them at lows. They will either flush and not fill you, or they will usually have a big pop, and you are stuck with a bad entry. You want to wait for a spike to get a good entry with better risk vs reward.

Getting the Right Entry

One of the biggest difficulties with SSR is that if you want to short them, it can be hard to enter, cause you need the stock to an uptick in order to fill you. As a result, you need to wait for the stock to pop a bit in order to get filled. You have to be strategic about where you place your orders to get filled, especially if there is a spread.

Use the VWAP and moving averages to get filled on these names, or try to get filled when they are consolidating in a bear flag. When a stock is trading in a range, that can give you the uptick you need to get filled. I recently traded a few stocks last week with SSR. I did a market recap recently where I breakdown how I traded them in more detail (talk about it at 10:00):

Save Your Seat for Our Next 60-Day Live Trading Bootcamp (Seats are Almost Full)

We don’t sugar coat it. Becoming a consistently profitable stock trader isn’t easy, or an overnight process. That’s why our 60-day Live Trading Boot Camp is designed specifically to help struggling traders overcome their weaknesses, and expedite their path towards profitability.

Contact us ASAP to save your seat in our next trading boot camp!