Every loves making money in a short period of time. But scalping strategies are not the way to do it for new traders.

Scalping is a trading style that involves buying and selling shares in a very short period of time, usually minutes or seconds, and taking very small gains over and over again. I know there are successful traders who scalp, but it shouldn’t be the core of anyone’s trading strategy, especially if new. Here’s why you shouldn’t be a scalper:

The Scalping Mentality

Scalpers use large size to capitalize on small market movements. Stocks usually trade back and forth, so it makes sense to them since you don’t want to be in a stock that might go against you.

The actual justification for this style of trading is that these traders are scared of being in a losing trade. They are afraid that they could be wrong on a trade and having the trade going against them. To avoid having the pain of trade go against them, they take a small gain to avoid dealing with that possibility.

The thought process behind their decision-making is that having a trade go against you is less painful than leaving money on the table. But the bigger issue is creating and executing a profitable system in the LONG run.

The Problem

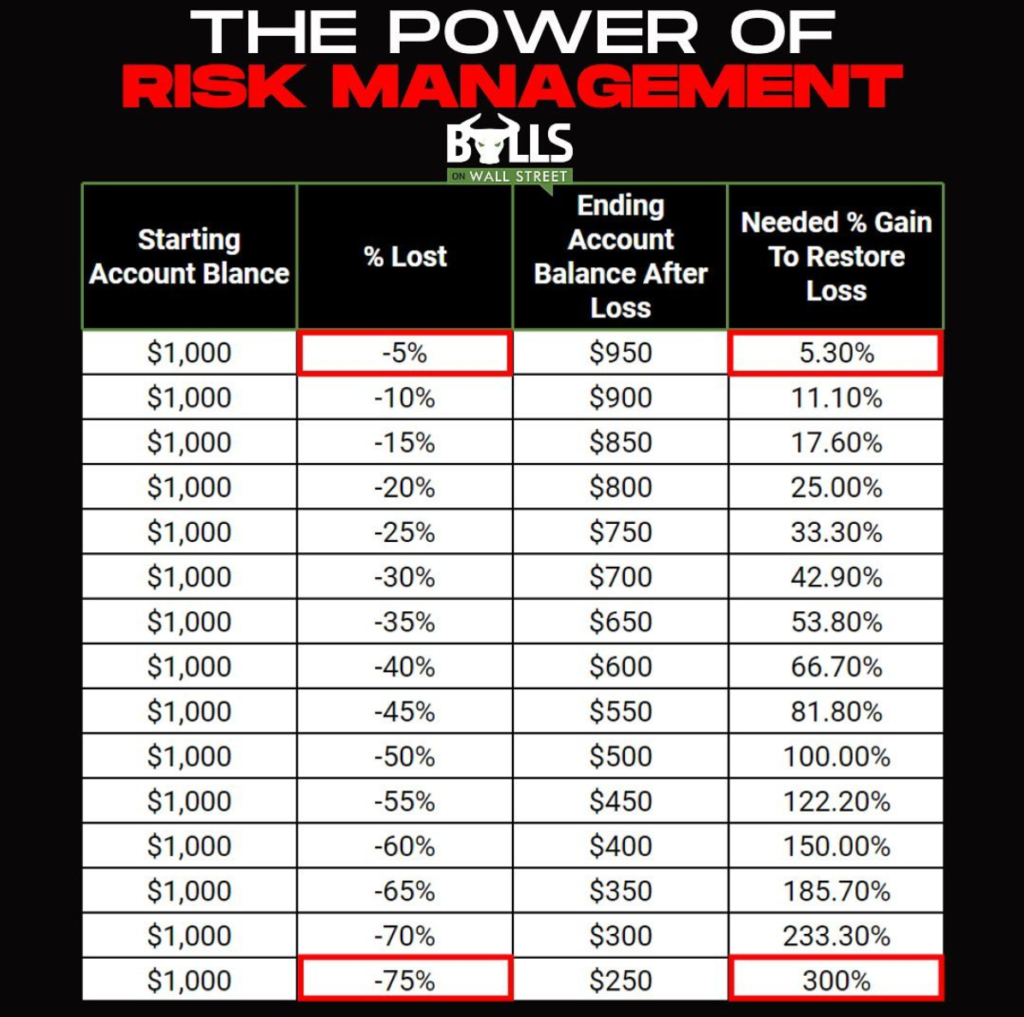

The issue with scalping isn’t just that it has a low probability of making money in the long run. The issue is that after commissions, taxes, and other trading fees, it makes profitability very difficult. Not only that, it is a very stressful trading style, and it can really punish you if your risk management is bad. One big loss sets you back weeks to months:

It is so easy to get into the “add, add, add” mentality when you are a scalper. “It will come back”, are most scalpers last words. 9/10 the stock comes back when you average down and you get away with it. The one time it doesn’t, weeks and months worth of gains are wiped out. Most successful scalping strategies are executed by computers these days and speed-wise you don’t stand a chance competing with them.

Commissions Eat You Alive

This is especially true if you have a smaller account, and you’re day trading an offshore broker. This is what it looks like when scalping goes wrong:

Who knows what that random person on Twitter made on that trade. But we do know that he paid thousands of dollars worth of commissions. Even if he somehow came out green just from his buys and sells, his commissions ate up most, if not all of his profits.

There are way easier and less stressful trading strategies.

Make More Money By Doing Less

When you know how to ride stock trends, you can make more money with way less stress. You might find a scalping strategy that works for you. But know that there are strategies out there that can allow you to capture bigger moves in the market, with much less stress and micromanaging.

I have a quick style of trading where I often scale out of the ⅓ of my positions very quickly. That is similar to a scalp. But I still keep ⅔ of my shares for the bigger move! Scaling allows you to get some profit and green in your account but still stay in the position for a bigger move. That is the best solution I’ve found for scalpers who have trouble maintaining a sound risk vs reward ratio.

Summary

You can make more money by trading A LOT less. You can scalp occasionally if you want to. But it shouldn’t the core of your trading strategy. Even with day trading, holding a trending stock for an hour or two can give you much larger gains, without a lot less stress, commissions, and gray hairs.

It’s okay to sell part of your positions quickly when you get a move in your favor, but be sure to let the rest of your position ride for the bigger move. This will allow your winning trades to be much larger than your losing trades, and make it much easier to become profitable in the long run!

Live Trading Classes From Experienced Traders: Join Our Live Trading Boot Camp

Space fills up fast in our boot camps. Apply for your seat to see if you qualify!

Click Here to Save Your Seat