The holidays are one of the best periods for the stock market historically.

But will we close the year strong despite the bear market and declining economic conditions?

There are certain phenomena in the market that hold true, almost like a cyclical prophecy that holds true in the market.

There are certain times of the year where the market tends to appeciate, or go down almost on a consistent basis. Two of the most widely known phenomena or cycles are the January Effect and the Santa Clause Rally.

What are they? Will we have them this year even though we are in a bear market? How can I trade through them?

All these answers and more we will dive into so you can be ready for the markets in the upcoming weeks:

The Santa Claus Rally

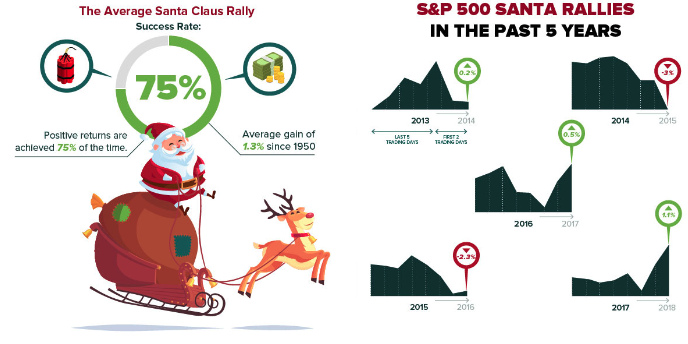

A Santa Claus rally describes a rise in the stock market that occurs the majority of the time every year in the week leading up to Dec. 25, and even sometime after. It is just a historical rally that tends to occur within the last week or so of the year. .

What Causes The Santa Claus Rally?

While there isn’t one particular thing that causes it, we have some theories that circle around.

One is tax considerations, another is maybe just a thought that people have an overall feeling of optimism and seasonal happiness on Wall Street, and the investing of holiday bonuses by traders and workers. Another theory could be that many large institutional investors take off for the holidays, leaving the market to retail investors, who tend to be more bullish, or positive, toward the market.

At the end of the day you shouldn’t buy a stock just because of the time of the year. You should have a real strategy and trade thesis behind the trade (explained in more detail in our 60-Day Live Trading Boot Camp)

The January Effect

The January Effect is very similar. It is another preferred market phenomenon where stock prices regularly tend to rise in the first month of the year, just like the Santa Clause Rally. It typically occurs after tax loss selling (explained here) in December, where investors tend to sell losing positions to get write-offs for that tax year. Often stocks will get over-sold and then bought up as January hits. This year could be different.

Will We Have Them This Year?

Currently, we are in a bear market. There is no questioning that. In recent years we have been in a bull market this time of year. So this makes things a little more unique and interesting this time around.

The January Effect and Santa Clause Rally you have to remember are NOT 100% true all of the time. They may not even be true half of the time. They haven’t been studied enough to show sufficient statistical evidence that they are a true market mechanic. Knowing these concepts can help you.

Yes, we are in a bear market but we are at the bottom of a big down then and at the bottom of a big push to the downside that has occurred. A lot of shorts have made money, and a lot of people are looking for long opportunities. These things combined may cause some upward motion in the market during this time, as more and more large traders look to cover their short positions into the end of the year, and technical patterns to the upside form and play out.

There is no way of 100% definitively predicting if these rallies will happen, so you always need to remain safe, smart, risk-conscious, and vigilant during these times, while still being observant knowing that many traders and investors are on the lookout for upside moves around the holidays and in January. Keep them in the back of your mind!

Early-Bird Pricing Ends SOON For Our Next Live Trading Boot Camp

Click here to apply for our next trading boot camp!