RSOL is one of the stock that went from low of 1.85 on Friday to a high of 4.17 today. That’s almost 285% gain in two days. It still doesn’t mean that can be shorted just because it has been up so so fast. In this post i will show you how to anticipate and prepare for a short by using moving average and price divergence.

Divergence simply is , price making new high however indicators are not making new highs causing a divergence. That still doesn’t mean the stock will change direction since most of this indicators are time lagging. But its a good signal to anticipate change in direction of trend along with other confirmation such as break of price support , trend line and moving averages.

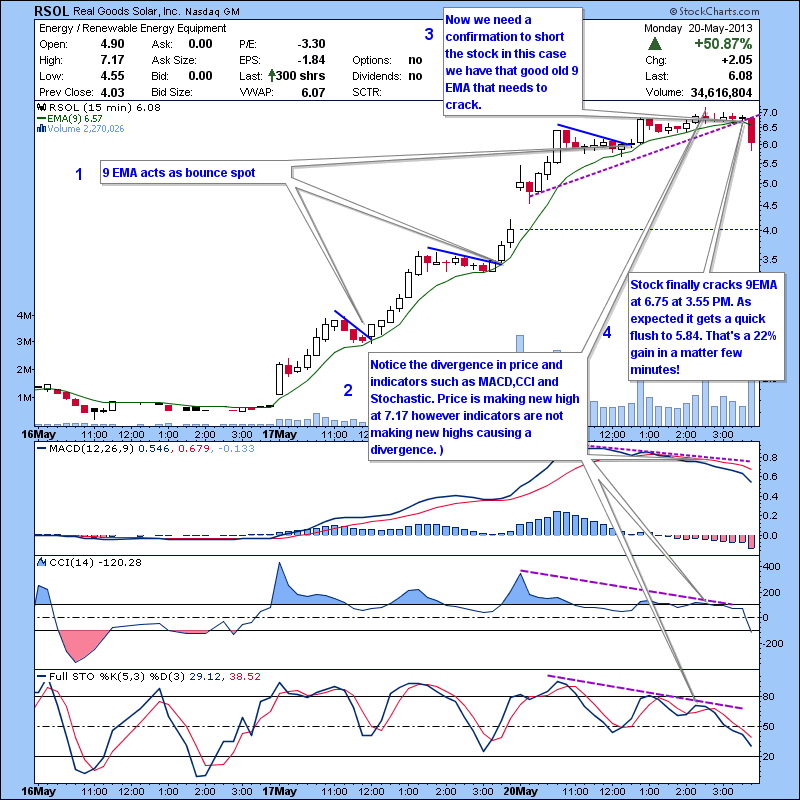

Lets us check out an intraday chart to see how RSOL played out today. In this case i am using a two day 15 minute chart. I have 9 EMA on the chart and indicator MACD,CCI,Stochastic.

1. Last 2 days 9 EMA acts as bounce spot 3 times. Now we can assume if it cracks that 9 EMA is a strong support and any crack of it get a quick flush after such a fast run.

2. Notice the divergence in price and indicators such as MACD.CCI and Stochastic. Price is making new high at 7.17 however indicators are not making new highs and here actually at the lows, causing a divergence.

3.Now we still need a confirmation to short the stock in this case we have that good old 9 EMA that acted as resistance needs to crack. If it does we have alignment in multiple factors such price divergence and a breach of EMA that has been a strong support and the 15 minute uptrend line. Remember the more things line up the better is the outcome. In this case I am expecting a quick flush.

4. Twitted and posted in chat this at 3.48PM. Stock finally cracks 9EMA at 6.75 at 3.55 PM.

As expected it gets a quick flush to 5.84. That’s a 22% gain in a matter few minutes!

Hope this helps.