Death by a thousand paper cuts. That’s what most people unwillingly do to their retirement portfolios.

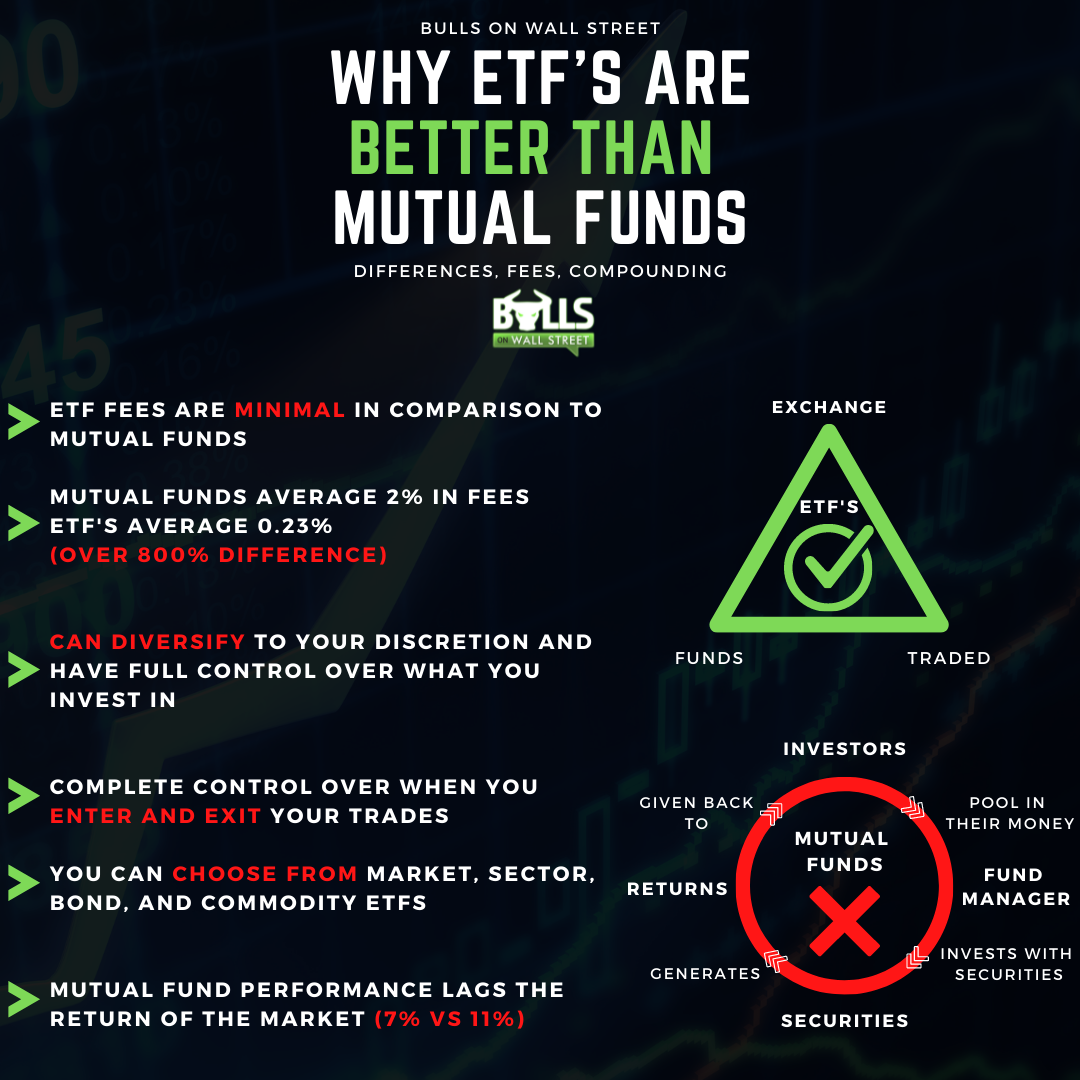

The reason is most people “diversify” their retirement portfolios by handing them over to mutual fund portfolio managers who charge seemingly innocuous fees for their expertise.

Well, these fees are not so harmless. In fact, they are a danger to your retirement.

The small “fee” in exchange for market beating performance is a mirage. Over time, the fees have an enormous impact on your retirement portfolio. To make matters worse, you usually end up paying through the roof for lagging performance.

So what’s the alternative?

Actively or passively trading ETFs.

After reading this article you will know exactly why ETFs are a better choice than mutual funds for growing your retirement portfolio.

What Are Mutual Funds

Mutual funds pool together money from many investors to invest in different investment vehicles like stocks, bonds and other assets. They are operated by portfolio managers who use an investment strategy to attempt to achieve an investment objective.

For our purposes today, we won’t get into the nitty gritty of how they work. What we are going to focus on is how they lose you money from fees and inadequate performance.

Mutual Fund Fees Kill

The average mutual fund ends up costing you around 2% in fees.

This doesn’t sound like a lot, but it ends up costing you tens or even hundreds of thousands of dollars in fees over the lifetime of your retirement portfolio.

Mutual fund fees get you in three primary ways: load, expense ratio and “marketing” fees knows as the 12b-1 fee.

Load is an upfront fee that is usually around 5%. This means if you invest $10,000, right off the bat you are down to $9,500. Not every fund charges this type of load. Some might “back load” or charge a yearly load. Always make sure to check what the “load” charge is.

The expense ratio is the charge for operating the fund, and also often includes the 12b-1 fees. This is where they pay the fund managers salary, office equipment and other expenses for running the fund.

Ideally, you are willing to pay these expenses for market beating performance. However, here’s the rub: the average fund does not beat the market.

Mutual fund Performance Lags

Most of us are willing to pay for performance. The problem with mutual funds is you are paying Cadillac prices for a beaten up used car.

Over the past 10 years, the average mutual fund has returned 7%. That sounds pretty good, right?

Well, it’s not.

Over that same time period, passively investing in “the market” would have returned 11%.

Now that we know how much mutual funds cost and how they under-perform, let’s take a look at ETFs and the impact the fees and performance have on our portfolios after 25 years.

ETFs

We’ll talk more about ETFs in future articles and classes, but for now know that an ETF is an exchange traded fund is a basket of securities that trades like a stock. ETFs come in all shapes and sizes including market, sector, bond and commodity ETFs.

Why are ETFs better?

ETFs are a better choice than mutual funds because the fees are minuscule and you can easily perform with the market. An added bonus is it’s easier to “control” what’s in your portfolio.

Whereas you pay around 2% in fees for the average mutual fund, the average fee for an ETF is a .23% expense ratio.

You are paying over 800% more for the lagging performance of a mutual fund.

Now let’s crunch the number and see how that impacts your retirement.

Compounding and Performance

We all know there is magic in compounding. Over time, seemingly little numbers make a humongous difference.

Let’s crunch the numbers assuming you start with a $10,000 account at age 30 and add $10,000 per year over the life of your account. Essentially, you are investing $310,000 over the life of your portfolio.

Here is how the fees will kill you.

Assuming the average market return of 11% over the last 10 years, your $310,00 investment will turn into $2.4 million in 30 years without fees.

The fees of the average mutual fund wipe out over $800,000. You are left with $1.6 million. That little 2% fee costs you 33% of your nest egg.

Compare that with the minuscule .23 fee of the ETF. Your nest egg is sitting at 2.3 million.

Now let’s not forget about performance.

In the above example we assumed both hit the 11% average performance. But we know the average mutual fund is at 7%. Sure you could get lucky and find an outperforming fund, but that’s not likely.

At the average mutual fund performance rate, your 2.4 million is now $1 million.

Mutual funds kill your retirement nest egg.

Conclusion

While ETFs are not risk free, they are the better choice compared with mutual funds. In fact, I would go to the extreme and say nuke mutual funds from your investment strategy.

We’ll talk more about ETF strategy in our next article. And don’t forget the retirement class that starts next week.

Join me LIVE this Sunday at 12PM EST as I dive deeper into this topic, along with how you can start to think about taking advantage of your retirement trading accounts from your 401k's to IRA's.