How many times have you heard the phrase “you cannot go broke taking profits!”.

The truth is this is one of the biggest trading fallacies you hear peddled on social media.

After working with thousands of traders from all over the world since 2008, we can tell you from first-hand experience that early profit-taking has disastrous consequences.

Knowing when to lock in a gain is not that simple. There is a whole system for doing it properly.

It sounds counter-intuitive, but you can GO BROKE by taking profits in the wrong way, at the wrong time, and at the wrong spots.

Today, we are going to break this concept down in detail, show you how to take profits correctly, and why taking profits incorrectly can be the ultimate downfall of your trading career.

What is Taking Profits?

Taking profits is just like it sounds, selling some of your existing long position, or conversely covering your short position when you are in profit to get out of the market.

Most new traders have the expectation that the stock will just move straight to their profit target like this:

The reality is that a stock will only do that maybe 1 out of 20 times. The stock won’t ever just move straight to your profit target without any pullbacks:

New traders will often make the mistake of taking profits way too late. They hold a position because they don’t want to miss out on the next Amazon. As full-time traders, especially when day trading, we tend to focus on taking profits on the earlier side. Here’s why:

Why is Taking Profits Important?

If you don’t make money, you aren’t a professional trader. The only way to make money is to lock in profits. Many new traders make the mistake of holding their winning trades too long and getting greedy. Usually, when things look great, and you feel the rush of emotion from being in the green, THAT’S the time to start taking profits.

There are a few reasons why taking profits is important in trading. First, when you take profits, you are locking in your gains. This means that you are not risking those profits by leaving them in the market and hoping that they will go even higher.

Second, taking partial profits allows you to stay in the market longer. This is because you will have more cash available to buy more shares if the stock continues to go up.

Third, taking profits allows you to stay in the market without having to add to your position. This is important because it can help you avoid over-trading and increase your chances of success.

Fourth, taking profits allows you to adjust your position size. This is important because it can help you to manage your risk and protect your profits.

Finally, taking profits is a true sign of discipline. This is important, because it can help you to stay in the market longer and increase your chances of success.

How Does Risk Vs. Reward Ratios Come Into Play When Taking Profits?

Trading is all about risk, versus reward. As traders, we have to have a properly skewed risk-to-reward ratio in our favor, ideal 1:3. What that means is our winners should be 3x as big as our losers.

Here is where profit-taking is key in this equation. If you learn to take profits INCORRECTLY and take profits early as a trader before your target, you will skew that risk-to-reward ratio down away from a 1:3.

So, you really have to know when to take profits, where to set targets, and how to stay disciplined to your original targets. As long as the structure of the market and the stock itself stays intact, do NOT move your targets and take profits early. All that is doing is limiting your potential gains, and making your account more skewed towards a bad risk-to-reward profile.

Now, this is a very important topic, and one that regardless of your current experience level needs to explore more.

Below we have a full, free webinar posted to our YouTube channel that covers this concept in more detail. Finish this blog, and then go right over to this video.

Let’s move on to our final section, talking about the relationship between your emotions and taking profits.

Emotions & Taking profits

Why do losing traders want to take profits early?

Because they are trading SCARED! They are trading out of fear and emotion, versus logic. If you find yourself taking profits too early on a consistent basis, chances are you are just trading with a lot of anxiety and are too worried about the MONEY, rather than the PROCESS and the trade itself.

Removing your PnL box from your screen can really help with not taking profits early. If you allow yourself to only look and focus on the chart and the trade, you will stay more true to the trade and your original plan.

Win or loss, forget about your last trade as well. If you didn’t take profits and the stock reversed on you, no problem! Move on.

If you took profits at your target and the stock kept trending higher, resulting in you missing out on another thousand dollars, no problem! Move on.

Risk management is huge, and if you become emotional and just start taking profits in random places, holding onto losers, and just hoping you make money at the screens, you WILL end up in some very rough scenarios.

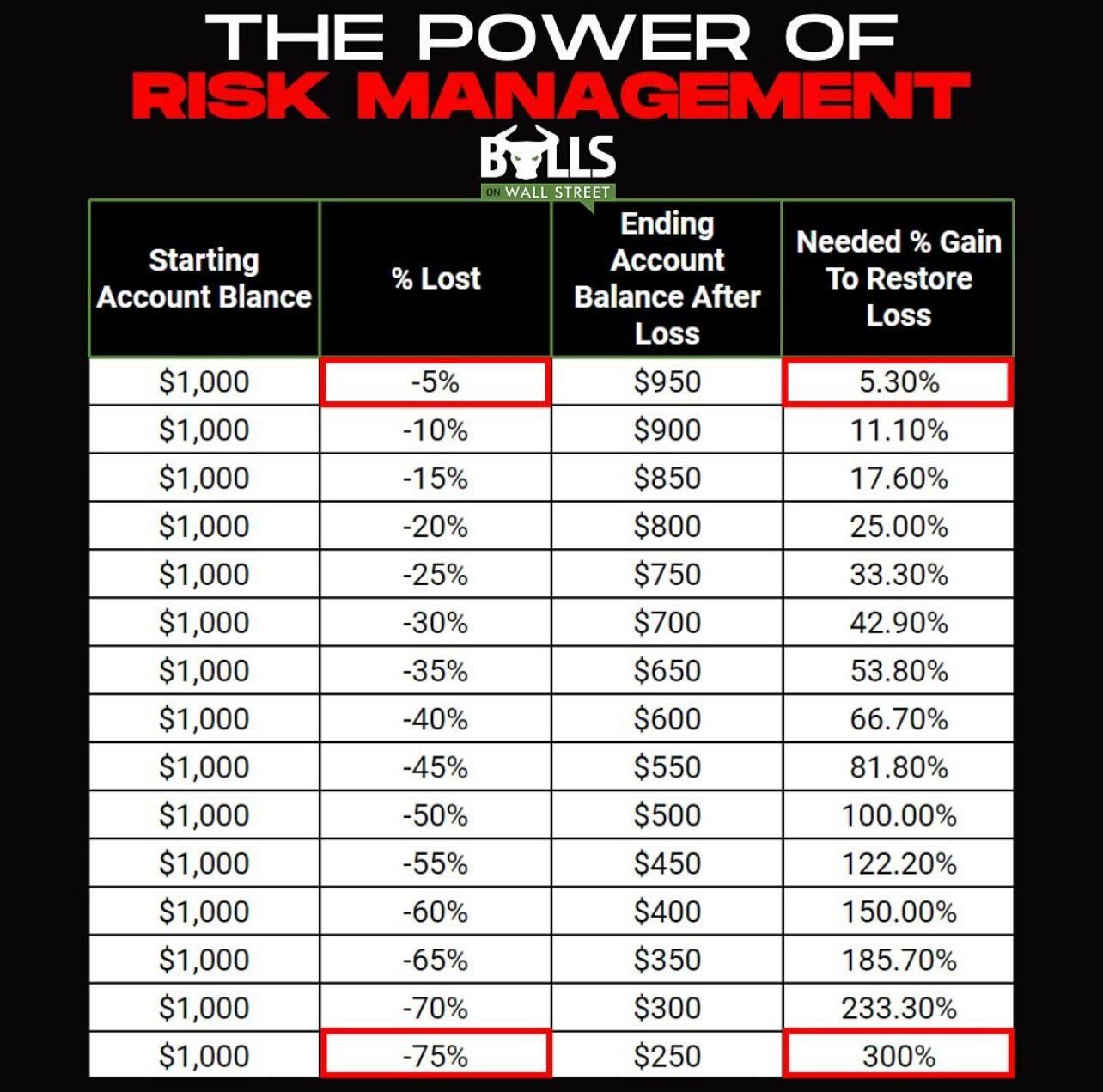

This chart below shows you just how big of a role proper risk-to-reward, profit-taking, and risk management principles are to your success as a trader.

Trade the chart, not your emotions. In doing that you will see drastic improvements in your PnL, and your ability to take profit at the right spots.

Signals To Watch

There are other signals you need to pay attention to know when it’s time to take partial or all your unrealized profits.

- The stock is approaching major support or resistance on the daily chart

- The stock has traded through its ATR (Average True Range)

- The stock has a major news catalyst like an earnings report coming soon

- A major macro event is coming up, like CPI report, that brings significant volatility into market

If you want to learn more about these signals for taking profits at the right time, make sure to apply for our next LIVE Trading Boot Camp below, where we teach you the exact strategies we have used for over two decades in the markets!

Early-Bird Pricing Ends SOON For Our Next Live Trading Boot Camp

Click here to apply for our next trading boot camp!