On March 15, $DUST had a nasty break. In fact it was the sort of massive drop we were looking for since last week. But when Yellen came out with news of interest rate hikes, $DUST took a massive nosedive. When a stock makes a powerful move like this it immediately gets put on our radar. So we watched it to see how it would react the following day.

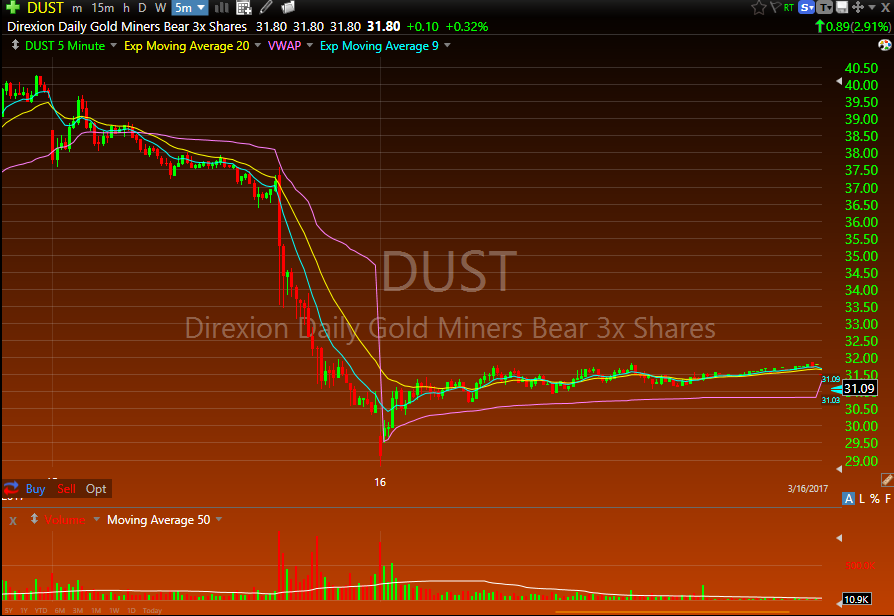

Daily Chart – $DUST

With that much pressure, the selling continued aftermarket and premarket causing $DUST to gap down. But once the market opened $DUST was exhausted; it was too extended. See, the harder the push in one direction, the stronger it has the potential to snap back. Because $DUST also gapped down at the open, it had potential to fill in that morning gap to yesterday’s low at $30.30.

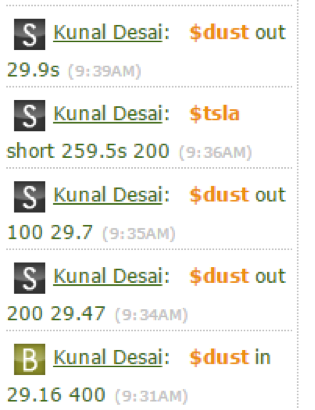

Intraday Chart – $DUST

Right out of the gate $DUST started showing strength. The first 1 min. candle was a hammer and the second one cleared its highs. I entered $DUST long at $29.16 anticipating the breakout with a stop below the bottom of the first tail, $28.81. Immediately the stock pushed higher and I scaled out of my position at $29.47, $29.70, and $29.90.

After resting at the whole number $30.00 level it pushed even higher, blowing past $30.30. Later it began to setup for another push, triple tapping at $31.00. Once it broke out here we got another push higher.

$DUST is an ETF that moves off of the gold miners ETF, $GDX. $GDX gapped up into resistance on the daily chart, signifying that $DUST was also ready for a big move. All we had to do was be patient, be ready, and ride that wave higher.

If you really want to learn every aspect of my trading system, the Bulls Bootcamp is the way to go. It’s an intensive 60 day course to teach you exactly how I trade and why. To learn more or signup, email me at kunal@bullsonwallstreet.com today!