Bounce plays can offer some of the best risk versus reward trades. When stocks get extended to the up or downside, they will often have a bounce, a quick retracement in the opposite direction. This is not a setup suited for newer traders. It is easy to mistime these, and if you do not have solid risk management, you can take big losses.

However, counter-trend trades in extreme scenarios can offer amazing risk-reward trades in a very short period of time. This is a great setup to have in your repertoire this year for all the blockchain plays, a catalyst that will often result in an extreme move in one direction. Here are 3 rules you must follow in order to capitalize on these plays.

Only Trade Plays With Real Extension

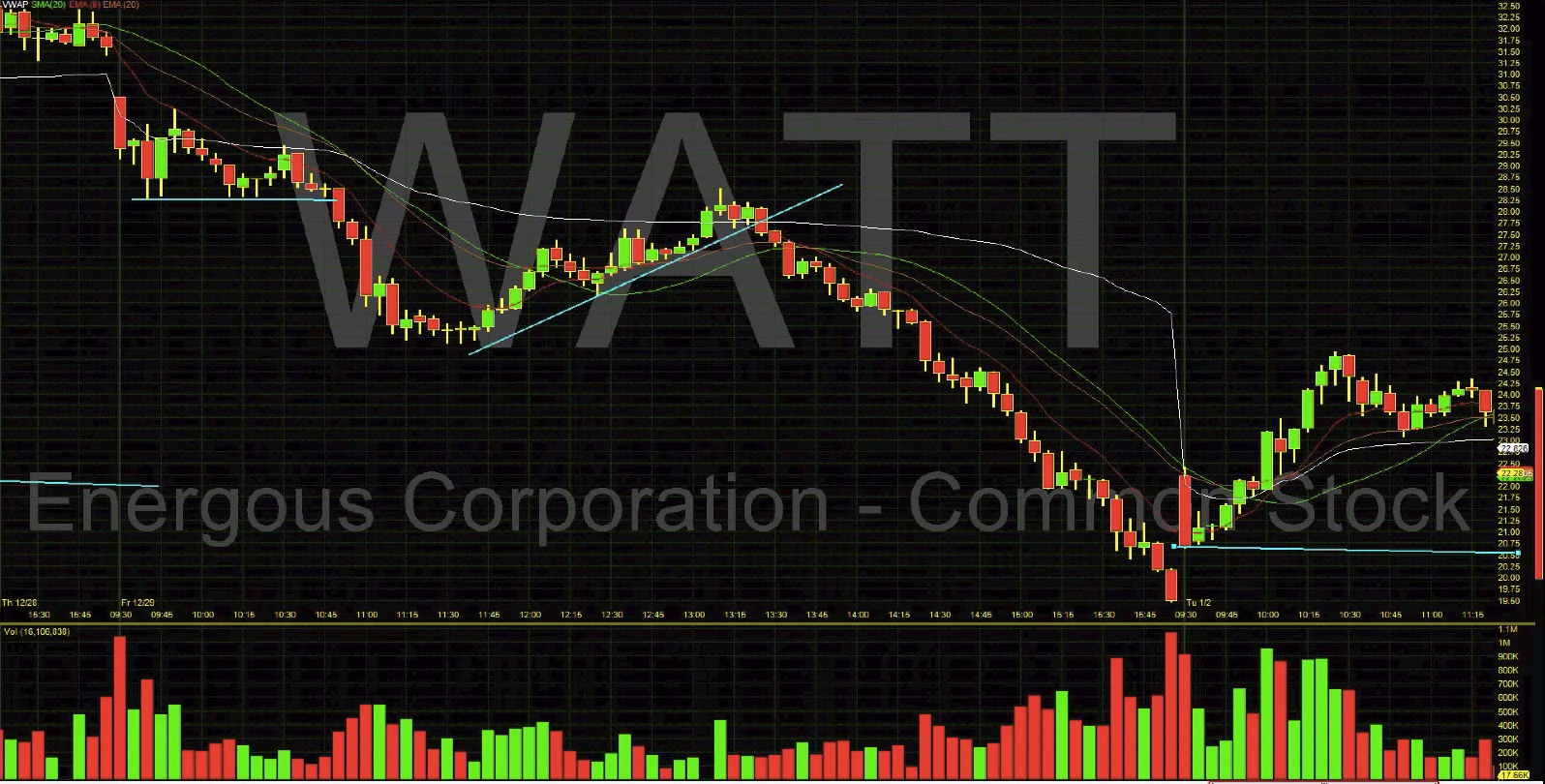

Bounce plays are setups you need real meat on the bone to play. You don’t want to be taking a bounce play where a stock only dropped 4 points. You need some meat on the bone to make it a high probability setup with good risk vs reward. We can see that WATT recently had some significant extension to the downside:

We can see that WATT dropped from 30 to 19.5 in one trading day. That is significant extension, and enough to expect some sort of dead cat bounce. However, you have to understand how stocks trend in these scenarios. Stocks almost never completely retrace all the way back to where the move started.

You need to have the understanding that bounce plays are not trades to marry. In order to play these, you need to have an understanding of what appropriate targets are to set in these contexts. Check out this video to learn more about how we play bounce plays like WATT.

Set Appropriate Targets

Think of a stock like a rubberband. Once it gets extended, it snaps back hard. This is basically the principle behind bounce plays. In order to capitalize on these plays, you need to know what the realistic targets are in these kind of plays. As mentioned earlier, when you take this setup you are not looking for a complete retracement. You’re looking for a bounce. Usually a safe target for a bounce play is a 33% retracement.

Use WATT as an example: It drops $10 straight down in a single trading day, from $30 to $20. Once you get an entry signal, a good first target is around 23-24 range. That would be a good spot to take out half your shares, move your stop to breakeven, and see if it will continue. Don’t get too patient with these plays. Here is another example of a bounce play we had last year in JDST.

Don’t Be Afraid To Take A Small Loss

Bounce plays are hard to time correctly. Just because a stock drops 30% in a trading day does not mean that it can not drop 50%. You cannot be afraid to take a small a loss on these kind of plays, because it can always go lower. Luckily on these kind of plays they offer great risk versus reward. When you do time the bounce, you will almost always make up for the small losses you took on your earlier entries.

You need to have an entry signal to increase the probability of your trade working out. You don’t want to just be buying a stock when its down 50% just because you think it’s down too much. Otherwise you will take more losses then is necessary. Patience is needed to time these plays correctly.

Get Started With Our Free Trading Kit

Our trading kit is the best free resource out there for new and struggling traders. It includes

- Intro to Trading Course

- Comprehensive Trading Handbook

- Trading Consultation