Every new trader is chasing the holy grail indicator. Nowadays, platforms have hundreds of indicators you can slap on your charts, not including the ones you can create yourself.

One magic indicator won’t all of a sudden make you a profitable trader. But they can be used to help improve your probabilities of putting on a winning trade and gauging trends.

Moving averages though have been around for decades and arguably are the most well-known and widely used indicator for traders and investors in the stock market. Almost every chart you see from an active trader will have some sort of moving average guiding them and aiding in their decision-making process.

Today, we are going to make sure you know exactly what moving averages are, which ones to focus on and try out from the start of your career, and the differences between some of the major moving average types:

The Basics of Moving Averages

The moving average is a simple indicator tool that smooths out recent price data by creating a constantly updated average price and plotting it on a chart. The average is taken over whatever period of time the trader or investor chooses (X days, X minutes, X weeks, etc.). These can be tailored to different strategies and types of traders making them key tools for long and short-term investors/traders alike.

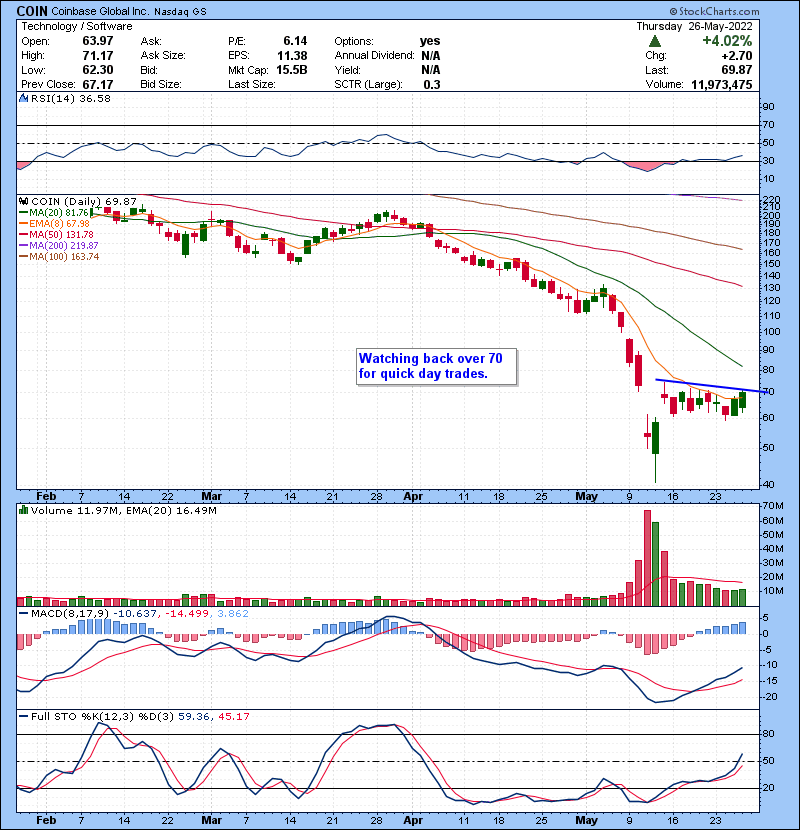

Below you can see green 20 moving average on the $COIN chart below (from our day trading moderator Szaman’s stock watch list), and compare it to the other location of other moving averages on the chart:

Why Use A Moving Average

There are a couple of key benefits of using moving averages all traders widely accept. One of the big ones is that it acts to help identify trends on charts easily. Moving averages visually plot uptrends and downtrends on charts making it easy for traders to quickly establish the strength of a stock.

In some strategies, traders have accepted as well that moving averages can act as support and resistance zones on charts. When the stock price reaches a particular moving average on a particular time frame, there is a higher chance of a reversal around that zone. Now, if you do view moving averages as areas of support and resistance, keep in mind the keyword ‘areas’ here. They won’t pinpoint perfectly the support or resistance level to the cent, but they will act as a rough area where buyers or sellers may come in at. Moving averages can be combined with technical patterns to create explosive moves:

Simple Moving Average (SMA) vs. Exponential Moving Average (EMA)

Most platforms when you choose to add a moving average onto your charts will give you two options… an SMA or an EMA.

Both do have their pros and cons and work better in different scenarios, but the main thing you need to be aware of with them are their differences in their calculations.

Simple moving averages are very straightforward. SMAs take recent closing price data of ‘x’ number of prior closes and averages them together. For example, a 10-day SMA is the past rolling 10 days closing prices averages together and plotted on a chart.

Exponential Moving Averages as well tend to ‘hug’ the price action of a stock more and update quicker than Simple Moving Averages which tend to lag.

What Moving Averages To Use

Here at Bulls on Wall Street we use different moving averages depending on whether or not we are looking at an intraday chart or a daily chart.

Intraday Charts

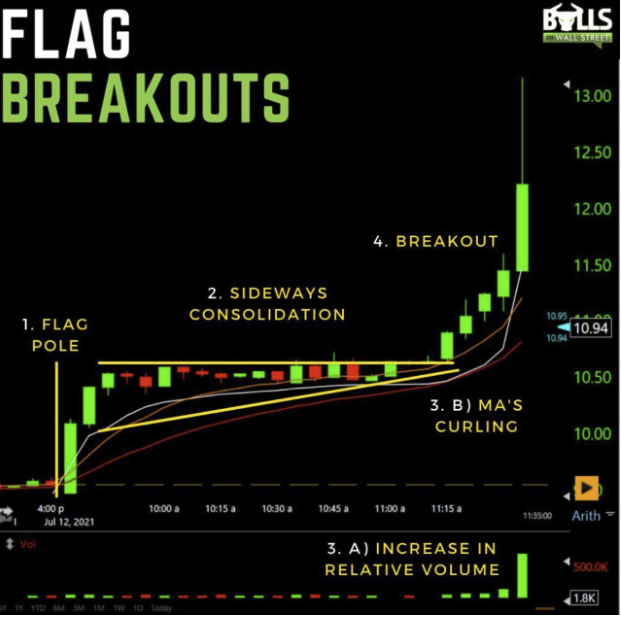

We use moving averages on intraday charts to gauge intraday trends, and also spot when momentum is shifting in one way or another. Just like this image above, when we see moving averages ‘curling’ or ‘turning’ to the upside like this into a technical pattern like a flag or range break, that is a great leading indication that a breakout is coming.

On intraday charts, we like to use the 9EMA and 20EMA on whatever time frame we are watching from a 1 minute to an hourly chart.

Daily/Long Term Charts

On daily charts, weekly charts, and monthly charts even we want to spot more long term trends and key support and resistance zones. We also like to use slower moving averages, thus being the SMAs, as opposed to quicker data generating EMAs. That is why we typically use the 200SMA (an indicator that thousands of funds and traders have used for decades) and the 50SMA.

Knowing how to use moving averages properly though is just the tip of the iceberg with trading. You can’t expect to slap a moving average on your chart and instantly become profitable. You have to have a sound understanding of technical analysis to be able to successfully trade. This is what we teach in our 60-Day Live Trading Boot Camp:

Get Early-Bird Pricing Our Next Live Stock Trading Bootcamp!

Our next Live Trading Bootcamp is around the corner! There is no better course to teach you how to dominate volatile market conditions like we are seeing this year. Learn from experienced stock traders who have been trading for over 2 decades. Early-bird pricing ends soon!