I got a couple requests for me to go over my MNST play on friday and how I knew the play was going to bounce.

The honest answer to this is.. that I didn’t know. Sometimes trading is about feeling the stock. Thats why seasoned traders often can make trades that us newbies will never understand. (kunal does this all the time and it blows my mind). He just knows the game and has been around the game for so long that he can tell when a stock is ready to pop and when its not. I am starting to hear the stocks speak to me, but I still have a long way to go… Having said that.. below is my thought process on the trade,technically, for what its worth!

Catching knives can be one of the toughest things to do in daytrading. Often times its best to avoid this especially if your new to trading.

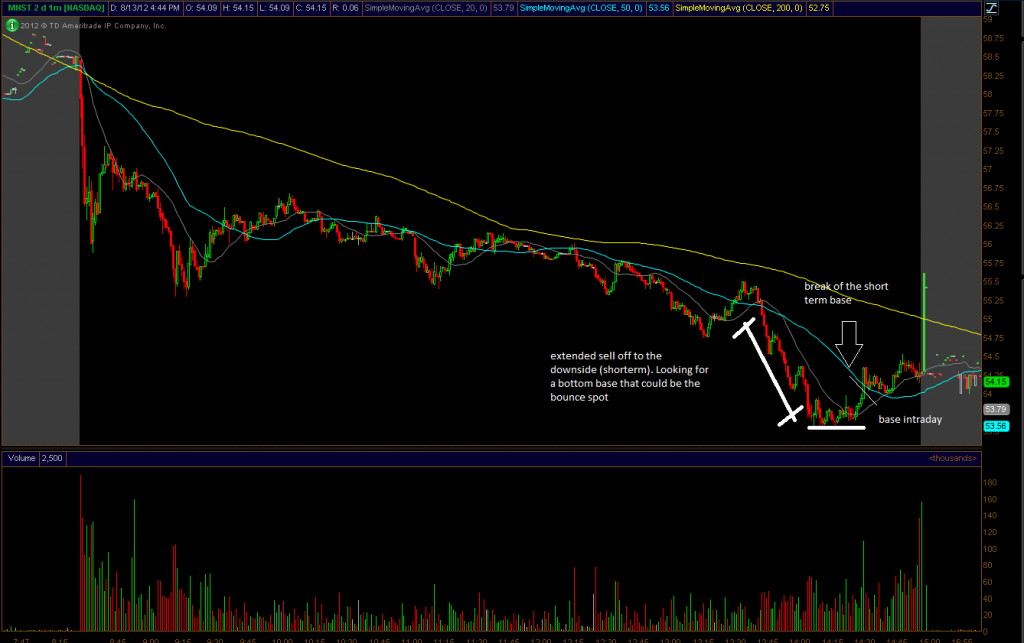

MNST had dropped from 55.4 to 53.5 in less than an hour. I knew that sell off was probably getting extended to the downside so I started eyeballing the stock for a potential, short term, intraday bottom. When I saw it tap the 53.5 level multiple times and not break thru.. I thought bingo this is the bounce spot. The intraday chart then started to base right at 53.5. So I dipped into the stock around 53.7 in the base with small size.. placed my stop at the low of the day and let it do its thing. Got lucky and actually did catch the short term bottom in the stock and sold it for a nice $200 gain minutes later.

1. The risk to reward intraday was good.. .20 cent risk vs .50cent reward..

2. my position size was small.. if I was wrong and the knife continued to cut.. i wouldn’t get hurt to bad.

3. bought a break of the top of the base for a quick day trade