Quick Summary:

SPY game plan remains the same. Focus list stocks GOOGL, WIN, BCRX, KORS, GMCR. BWLD added to watchlist. Semiconductors broke out today. Still holding KORS long and SPY short.

**IMPORTANT ADMIN ISSUE: If you have not been receiving trade alerts and the emails that update you that the new report is ready, please check your *spam* folders and mark all emails coming from Bullsonwallstreet as not spam. If you need help contact swing@bullson.ws

Key Pivot Levels: 191.52: new high resistance 187.69: 50 day moving average 181.31: recent low 181-184: plenty of buying in this range.

Under the Hood and Trading Game Plan:

Another day of chop and churn as we wait to see what the market wants to do. The plan remains the same. Strength can be shorted, a break of the old high can be shorted. I wait for pullback in focus list stocks for entry. I don’t want to have too many long positions at these overbought levels

Yesterday we talked about the Worden T2120 indicator and how 95 is the magic number to short SPY. It has moved all the way down to 78. Like yesterday, though we had a flat day slightly down, decliners lead advancers by a big margin (60%/37%). At some point soon the underlying bearishness of this move has to play out. We just have to see if there will be another leg higher before showing weakness.

The Focus List

WYNN is removed from the focus list and back on the watchlist. I was surprised to see the big move down today without earnings in play. It turns out China is regulating Macau more which will likely decrease profits of casinos. Casino stocks were hit hard with this news. I will wait to see how it handles the 50 dma over the next few days before taking it off the watchlist.

Notice that the bearish head and shoulder pattern is in play. Originally I thought the price and volume pattern on the right leg would nullify the h/s pattern, but now it looks strong.

GOOGL is similar to WYNN but has not violated the 50 dma. It is in my buy range but I did not enter due to the hard drop. If there is weakness tomorrow I might take a small stab around the 50 dma and be quick to exit if it moves further down. This is one of those trades where I take a stab , expect a small loss and take it anyway because of the potential reward. Entry at $550, with a stop at $540 and target at $575 gives a 3.5:1 risk ratio.

Ideal entry for WIN is at the bottom of the breakout bar. An issue with that is that it violates the trend line to enter from that spot. It has slightly violoated support before and resumed the uptrend. I like entry at $9.40 give or take a few cents, with a stop at $9.25. A target at the recent high of $9.75 gives a 2:1 risk ratio.

BCRX is a classic breakout-pullback play with a nice volume pattern.. Entry on slight weakness around $9.50. Stop at $8.85. Initial target is 11, but the old high at 13 is a possibility.

The KORS setup is still available and near entry levels.

The rest of the Sunday focus list stocks: (beav, kors, bid, axp, su, dlr, mcd, tol, win, ati, cxo, bcrx, wynn, fb, wlb, ibb, gmcr, amzn, googl).

The Watchlist

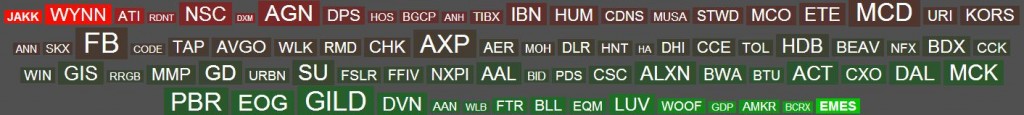

JAKK, WYNN, ATI, NSC and ANH broke down hard today and need to be watched for removal from watchlist. EMES continues to melt up in new high territory. The rest of the list is within trading range and needs pullback for entries.

Click here and scroll over ticker to see thumbnail chart

BWLD added to the watchlist. A few days of pullback and it would move to the focus list. Lots of room to reach old high at$160

Market Leaders

These are stocks that I always watch, though they might not be in my tradeable watchlist, nor are they actually always leading the market (TSLA in recent months).

GMCR continues to trade in a range above gap fill. Still waiting and stalking to get a price around $110. GS continues to build a nice bottom base.

Sector and International ETFs

Semiconductors (SMH) broke strong to new highs. Are they the new leaders. I may spend some time looking at more individual semi stocks for pullbacks.

Current Trades

Still holding KORS long and SPY short.

Here is the Trade Journal with current open and past closed positions.

New subscribers and trial members please leave me any feedback/comments in the comments, via email (singhjd1@aol.com) or twitter (twitter.com/PaulJSingh)