Quick Summary

SPY at extreme overbought levels on all indicators. Shorting strength. AMZN, FB, DHI, WLB, ALNY and HALO are on focus list. Z, GS, BIDU and GS are possibilities as well. New watchlist additions from biotech and other strong sectors. Still holding GOOGL and KORS long.

The Market

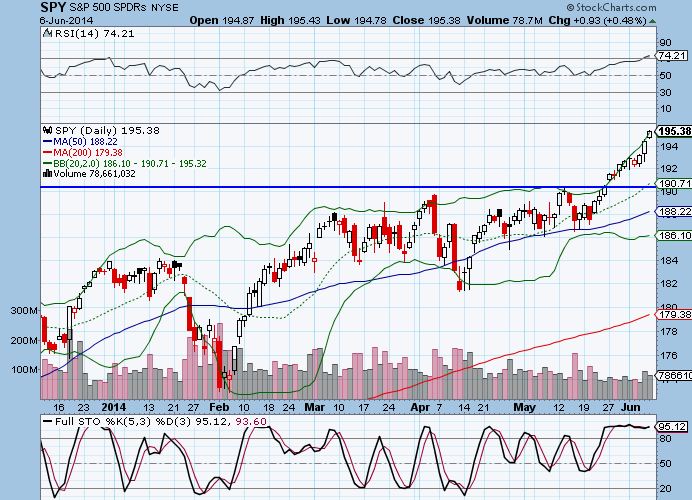

Key Pivot Levels: 195.38: new high resistance, 190: old high support 188.22: 50 day moving average 181.31: recent low

Under the Hood:

SPY continues to float into chartered territory making new highs on almost a daily basis. We are at extreme overbought levels with stochastic at 95, the T2120 indicator at 97 and price riding the top of the bollinger band.

This is the first time i have discussed bollinger bands. I only use them when price starts to hit extremes. They give you a feel for just how “for from the mean” price has gone. The bollinger bands measure when price is trading 2 standard deviations above and below the average. The mid-point is the 20 dma. Tagging the top of the bollinger band is not a sell signal on it’s own, however it gives you a feel for how extended the stock is. Often, a stock will “ride the top” of the bollinger band for a while, but when it falls, it will fall hard. That’s what we are waiting for now. Taking small stabs, get stopped out a few times for small losses, but hit the big one.

Trading Game Plan:

I decided against shorting on Friday. I wanted to see at least a 1 point move up in SPY and we never got it. On Monday I will be quicker to short strength. If price hits $196, i will take a short position.

For individual stocks, I am looking for stocks that are no extended to go long.

Focus List:

Here we find actionable setups culled from “the watchlist” for the coming trading day.

Note: I have been asked what happens to stocks when they are off the focus list. It does not mean they are no longer good setups. They are just no longer near buy points. They go back to the watchlist unless I say they are removed from the watchlist.

Seven focus list stocks to start the week: AMZN, DHI, WLB, CXO, FB, ALGT, ALNY and HALO.

AMZN broke downtrend, breakout out over the 50 dma on strong volume. Entry on pullback to $315-321 range. Initial target is the 200 dma at $342. Stop is under breakout bar at $305.

DHI is from the strong, bottoming homebuilders section. Recently broke out from tight consolidation. Entry on pullback to $23.50-24. Target $25. Stop $22.90.

ALNY has put in a nice bottom formation with a very strong volume pattern. Price has remounted the 50 dma. If the 200 dma gets cleared, there is a lot of room to move higher. Entry $57.50-59.50. Stop 56.50. Initial target $70.

HALO broke out strong over the 50 dma and looks to fill teh huge breakdown gap around $11. Entry $8.25-8.50. Stop at $7.80. Target between $10-11.

Watchlist:

I am working on weeding and adding to the watchlist. Here are this week’s additions: CSTM, WOR, XOM, SLB, ALGT, BIDU, XON, SRPT, QCOR, ALNY, HALO. XON-HALO are biotech stocks. As noted in the sector section last week, the biotech sector looks good.

Market Leaders:

GMCR broke out big. It’s a tough one because it broke out just before hitting my buy zone. AMZN and FB are on the focus list, and GS, CAT and Z just missed the list, I still may make a trade on those on pullback. CAT and TSLA are not longer being watched as shorts.

Current Trades:

Still holding GOOGL and KORS long.

Here is the trade journal