Quick Summary

Short SPY on strength. T2120 is at 97. Long setups IWM, AMZN, GMCR, TLT, KORS. Make sure to read trader education.

The Market

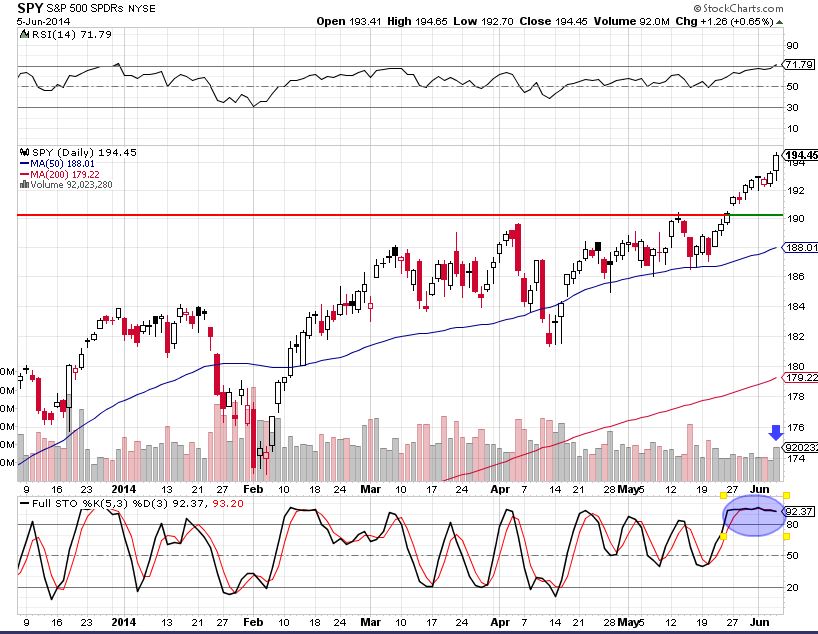

Key Pivot Levels: 194.45: new high, 190 old high, 188.01: 50 day moving average, 181.31: recent low 181-184: plenty of buying in this range.

Under the Hood:

After days of little bumps up on low volume, today we got a nice move on stronger than usual volume. I mentioned before that when the T2120 indicator hits 95, it has been a great short opportunity. We hit 97 today. I almost went long at the end of the day, but the strong uptick in volume made me think twice. I don’t want to get stopped out if we see strength tomorrow. Tomorrow I will short on strength.

*Trader Education Note:

1. Taking Stabs:

With these types of counter-trend trades, I am taking small stabs at the trend before the big move. The win rate is not going to be big. I don’t care. I don’t mind a few small losses. The big gains will make up for it. A trader needs to have the mentality that small losses are okay. You just have to make sure your wins are bigger than the losses. My trading journal is a good example of this. The small sample win rate is 55%, with 5 wins and 4 losses. However, the average win is more than double the losses, which has lead to $6351 in gains and 6 percent in only 3 weeks of trading.

We are TRADERS, not stock-pickers. We are about making money, not having a pretty looking win rate. I laugh when people talk about never going against the trend, not trading volatile stocks, only waiting for confirmation, or talk about never “catching falling knives.” Some of the biggest gains come from doing these four things. A trader knows how to *manage* those types of trades and risks, and profit when the big moves come. There are a lot of broke stock pickers. WE are traders

(Keep in mind there are a lot of broke people who do those things, you have to know how to manage those trades).

2. Sticking with Stops and Targets:

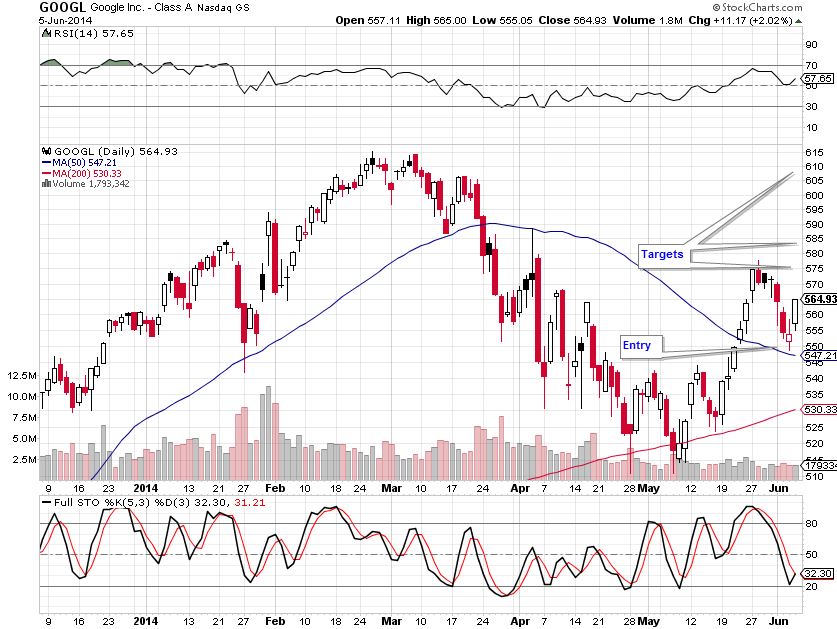

Four members emailed me today having a hard time not taking profits in our GOOGL trade. I know it’s tough not to take that profit when it’s there. GOOGL was up 12 points today and it’s hard not to take the money and run. Again we have to remember we are traders, not stock pickers. We manage our trades and risk. Yeah, taking that profit and running is going to give you a good win rate and put a little money in the bank. However, over time this type of trading will likely lead you to ruin. Taking the profit today would only give you a 1:1 risk ratio. This type of risk management leads to the slow death of a trader who takes lots of small gains and bigger losses. It is very hard to win this way. You will always cut off your big gains, and will have to rely on a big win rate to be profitable. That’s a losing game. Most traders trade like this, which is why there are so many bad traders.

Trading Game Plan:

I am looking to short strength in SPY. Take focus list setups as they come. No directional bias.

I will also look to go long IWM on a pullback. IWM had a strong breakout over resistance today. It also tripled SPY’s gains. A pullback entry would take a few days of pullback, so this is likely not a trade for tomorrow.

The Focus List

Here we find actionable setups culled from “the watchlist” for the coming trading day.

AMZN broke out similar to IWM. The 50 dma was mounted on strong volume. I will look to enter on pullback to $315-318. Stop is under the breakout bar at $305. Initial target is $340. Depending on entry, this gives approximately 2 to 2.5:1 reward to risk ratio.

GMCR continues to trade in that tight post breakout trading range. I have been waiting for a gapfill at $110, but might enter in this $112 range. If we place the stop at $109, we stil get almost 3:1 if the target is $120

The KORS setup is still there, though I am a bit concerned that KORS didn’t participate with the market today.

The Watchlist

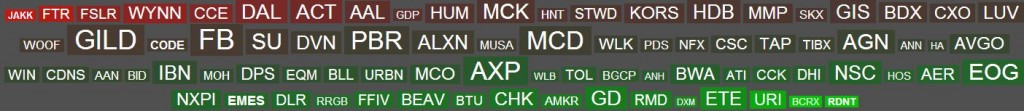

JAKK is falling hard, but not where we can play a rubber band reversal yet. Lots of breakouts GD-RDNT on the chart below all broke out strong. There were also a lot of breakouts in my scans that I will consider adding this weekend in anticipation of pullback entries.

To view thumbnails of watchlist stocks, click here and toggle over the ticker.

Market Leaders

These are stocks that I always watch, though they might not be in my tradeable watchlist, nor are they actually always leading the market (TSLA certainly hasn’t in recent months).

CAT is officially off the “short setup” watchlist, after remounting the earnings day breakdown bar. It might even be good for a pullback entry in the coming days. PCLN, Z and FB are close to getting on the focus list. Just need a little more consolidation.

Sector and International ETFs

Can it be any clearer what the trend play is for TLT? Buy pullbacks to bottom of range and short when it hits the top. Here you go long.

Current Trades

I was stopped out of SDS (inverse short SPY) at $26.25. I am still holding KORS, which did nothing today. The GOOGL position broke out strong.

View trade journal for past and current trades

New subscribers and trial members please leave me any feedback/comments in the comments, via email (singhjd1@aol.com) or twitter (twitter.com/PaulJSingh)