Quick Summary:

SPY closes at low of day for first time since August 7. Momo stocks poor closes. Z entry.

Video Analysis (4 minutes):

In the morning analysis we talked about watching for a close near the lows of the day and inverted hammers holding in momentum stocks like TSLA, BIDU, BITA and NFLX. That is exactly how we ended up closing.

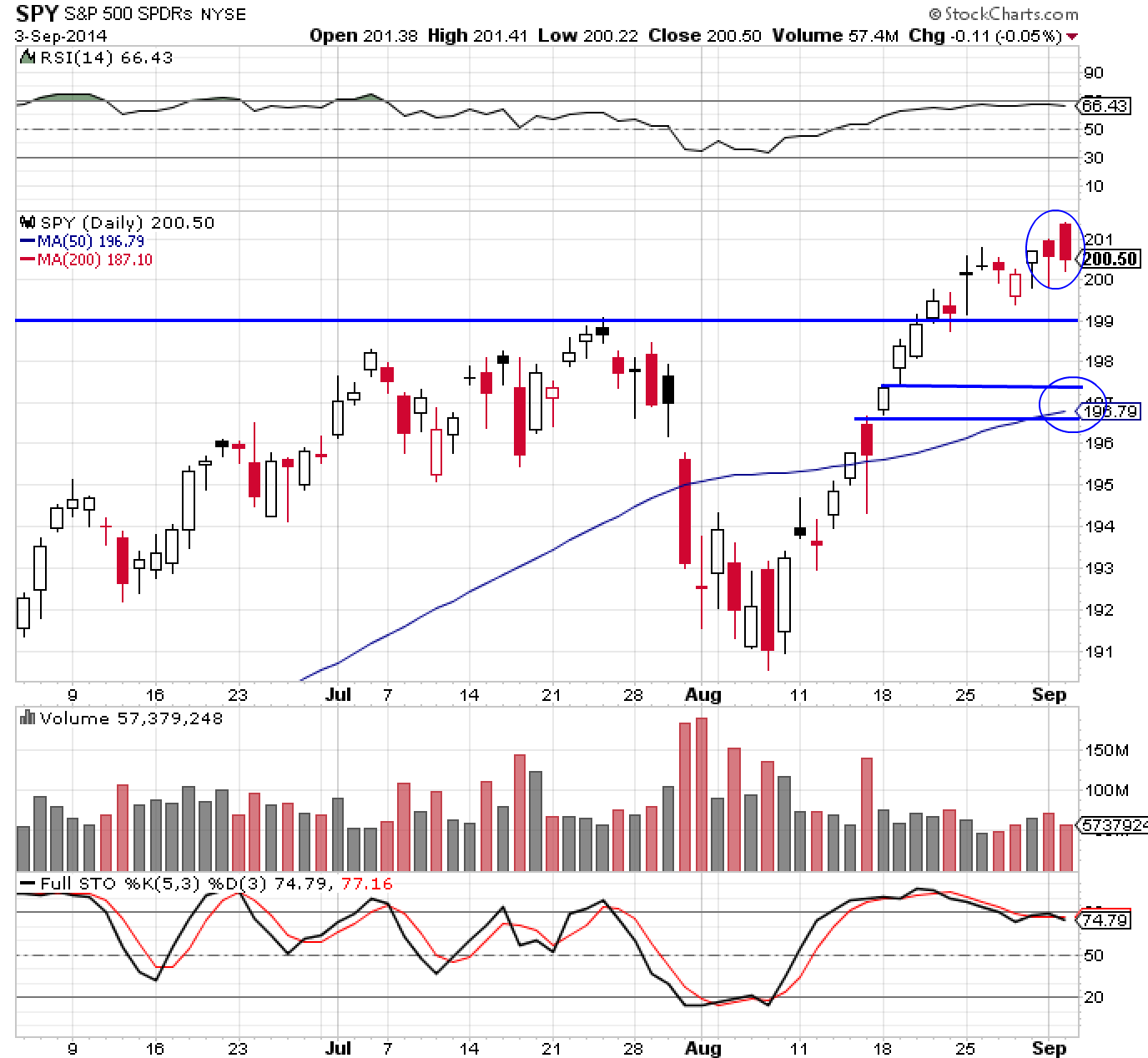

Key SPY Pivot Levels: Round number $200, Old high 199, 50 dam 196.79, 197.50 gap fill and support level

Under the Hood and Trading Game Plan:

Today was the first day since August 7 that SPY closed near the lows of the day. That by itself is not of huge significance, but the fact that many momentum stocks closed near lows or with inverted hammers raised the probability of a pullback.

The current game plan is to manage the SPY short position. I continue to look for long setups on momo stocks, but will not chase. Biotech continues to be the sector of interest. Oil/gas is also picking up.

Current Trades

I am still holding SPY short via SPXU. I entered Z today on a pullback toward the moving average and am holding GWPH.

Note: I have taken *half size positions* in most positions lately because I find them speculative, but with good reward to risk, and have noted that in alerts. I am not concerned with win rate and work at keeping losses small. If you want high probability positions *do not* enter when I take a half position or label something speculative.

This is how I trade, looking for limited account risk, high reward to risk ratios, small losses and big gains. If you keep losses small during slumps, you will be successful in the long run. Think big picture.

The Trade Results Journal/Spreadsheet is up to date.

The Focus List

Finviz link to easily follow the entire focus list.

Let’s take a look at the failed breakout in BIDU to illustrate what happened to many momo stocks today. The stock gapped up while already at overbought levels and closed back within the trading range. While it was up for the day, it is no longer a breakout.

This type of move should start a pullback to a good entry level.

NFLX is another good example. Remember the fact that they closed up slightly is not what is important–it is that they closed off the highs and back within trading ranges.

INSY has pulled back to support and offers good reward to risk. Entry around $33.50 with stop at $32 and target at $37 gives 2.5:1 reward to risk.

PNRA is a breakout-pullback setup. Entry in the $148.75-149.50 range, with stop around $147 and target at $154 offers 2+:1 reward to risk.

BITA requires pullback to the $84-85 range, but is volatile enough to do that in a day or two and still be a good setup.

Short Setups:

My focus now is shorting SPY via SPXU

Market Leaders

Every market leader closed off highs and most were near lows of the day. A few were flat out ugly failed breakouts–NFLX, FB, TSLA. Let’s see if we get some good pullback entries.

Please read the post 23 Laws of the Part Time Swing Trading the Market Speculator Way and How to Anayze Your Swing Trade Results It is important to know these rules if you trade off the Report.

New subscribers and trial members please leave me any feedback/comments in the comments, via email (singhjd1@aol.com) or twitter (twitter.com/PaulJSingh).