Quick Summary:

The Market

Key SPY Pivot Levels: 198.20 : new high resistance, 196.58 20 dma, 193.23: 50 dma

Under the Hood and Trading Game Plan:

I was not expecting the move on Friday. Sure, I thought we could get a remount of the 20 dma, but I didn’t think we would also retest the highs. Keep in mind this does not negative any patterns. We still need to see a break of the highs. What it has done is change my market bias from negative back to neutral.

Many of the regular high momentum focus list stocks we regularly watch have pulled back to good entry levels near supports. I have had mixed feelings on how to play these. On the one hand there are a high number of good pullback setups on low volume. However, we still don’t know the direction of the market until we get a breakout or breakdown, and the market will greatly influence these stocks. I have decided to take some shots, again with low aggression. Position sizes will be smaller. I am also going to continue to closely watch a few more short setups.

Current Trades

I am still holding AAPL short, and EZCH and TSLA long. Note that while not on the focus list since they are current trades, they are all still worthy of being on the focus list.

The Trade Journal (I will fully update tomorrow post market)

The Focus List

Last week we talked about having a few stocks in five different categories to key on, but no real entry level focus list stocks. With the pullback and many stocks pulling back to key support, or breakouts that have pulled back, I am going to include the regular focus list this week.

Notice on all of my picks, they are momentum stocks that have pulled back quite a bit, but are still technically sound. Volume on the pullback has not been damaging, and price is either above or remounted major support levels. Stochastics are usually very oversold. I won’t comment on it for each setup, just look at the chart annotations.

Most of these are trend pullbacks. BKS, BLUE and BWLD are differentiated as breakout-pullbacks.

BKS is at the bottom of the breakout bar and holding well. Entry $21.50-22.15. Initial Target $23.50. Stop under breakout bar or gap level.

BLUE is a breakout that broke down below the breakout bar, but there is a huge gap so that’s not a concern. It bounced strong off the 50 dma. Enter on pullback with stop below Friday bar. Target at $40-42.

I’ve already been burned by BWLD twince, but still love the pattern. Remounted 50 dma. Enter on slight weakness. Stop under Friday bar, target as high as $167.

CTRN bounced strong off 5o dma. Enter on weakness. Target around $23.

FB is above the breakout level, but it’s not a breakout due to the low volume and levels of the bar. Watch for a clean break. Another entry would be on pullback to the 20 dma.

Another 50 dma bounce play. Entry on slight weakness. Target $127. Stop $115-117.50.

Strong remount of 50 dma. Enter on slight weakness. Target $30-31. Stop under breakout bar.

Z is not the best setup due to concerns about pullback volume. However, there is so much room to move you can get a really good reward to risk–this makes it worthwhile for me. Entry at $123, with a sto at $120 and target at $134 gives 3:1. If target is the old high you’ve got 7:1.

I am not ready to set buypoints here, but these are a few of the short setups I am watching.

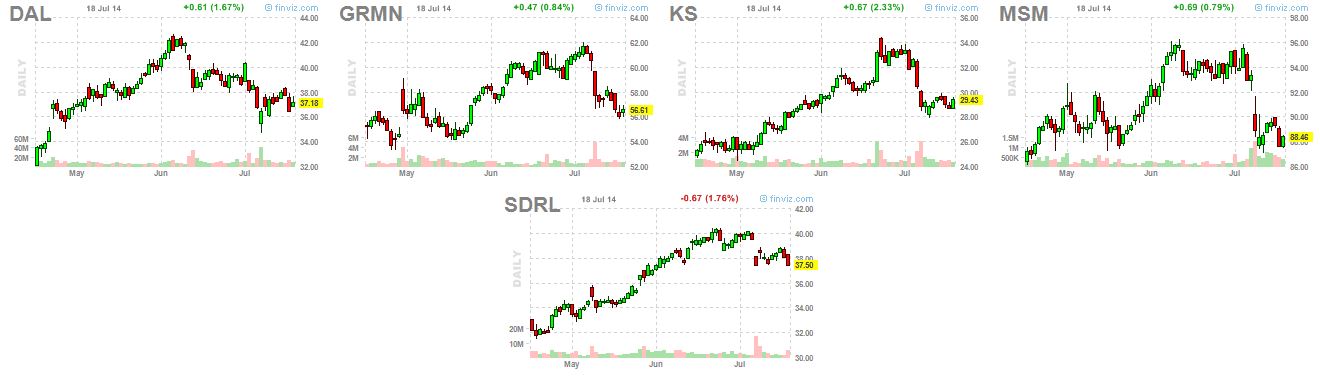

Market Leaders

These are stocks that I always watch, though they might not be in my tradeable watchlist, nor are they actually always leading the market.

GOOGL broke out nicely post earnings. We will watch this closely, as I expect it will be a focus list stock soon. Many here are on our focus list, and those that aren’t are still technically healthy. For the market to break, these will have to start breaking as well.

Please read the post 23 Laws of the Part Time Swing Trading the Market Speculator Way. It is important to know these rules if you trade off the Report.

New subscribers and trial members please leave me any feedback/comments in the comments, via email (singhjd1@aol.com) or twitter (twitter.com/PaulJSingh).