Quick Summary

Looking to short SPY on strength. Analysis of 3 indexes and money flow. Focus list stocks Z, AAPL, KORS, CAT, YELP, YY, BIDU, GMCR plus a bigger list if you choose. Exited GOOGL today and entered YELP and GMCR. Holding KORS.

The Market

Key Pivot Levels: 196.05: new high resistance, 190: old high support 188.44: 50 day moving average 181.31: recent low

Under the Hood:

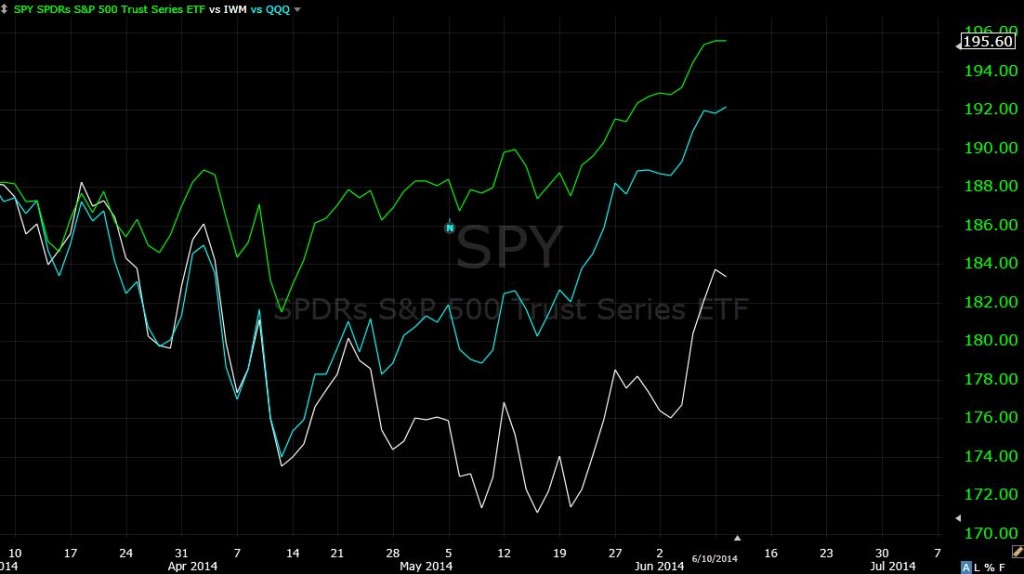

Nothing has changed since yesterday, so instead of rehashing the same thing lets look at a comparison chart of SPY, QQQ and IWM. In May the indexes were trading together but started to diverge. We saw QQQ take the lead, and while SPY and IWM traded together for a while, by May SPY was an easy second place and IWM was lagging big time.

The second chart shows the last week. IWM has easily outpaced QQQ and SPY. Money seems to be flowing back into small caps. We still need to see things play out more, but if this pattern of money flow holds, we could see more small stocks as trading vehicles. It also tells us that if we get a pullback, in the ensuing rebound IWM might be the best trading vehicle.

Trading Game Plan:

Short strength in SPY. Still looking to short above$196.

NOTE: If I short by going long SDS (inverted ultra short ETF) instead of shorting SPY, i will use SPY as my gauge for a stop. There will be no hard stop in SDS. If you can’t monitor SDS, either know where you want your stop to be or short SPY.

For individual stocks, I am looking for stocks that are not extended to go long.

Focus List:

Here we find actionable setups culled from “the watchlist” for the coming trading day.

Note: I have been asked what happens to stocks when they are off the focus list. It does not mean they are no longer good setups. They are just no longer near buy points. They go back to the watchlist unless I say they are removed from the watchlist.

These are the 18 stocks that I am watching closely. Many of you want smaller lists, but I am providing this because you may get an alert with one of these stocks, as you did today with YELP, which was not on yesterday’s focus list. If you would like to investigate these, click here.

Setups for KORS, CAT, Z, and AAPL remain the same. Another bounce in AAPL might be a good short. New additions YELP, YY and BIDU are all within entry range. GMCR (see in current trades) is playable within the big breakout range, buying bottom and selling at top. If you are looking for a smaller list, these 8 should be in focus.

New Additions:

YELP looks like it’s bottoming and has had a nice volume pattern since the May capitulation lows. It has mounted the 50 dma and is consolidating. I entered long today, an alert was sent.

BIDU also has bottomed and broke out of a flag pattern. Entry level $165-168. Stop $163-164. Target $180-185.

YY is also bottoming, with price and dma support converging. Entry level $64-66. Stop $62. Targets at $77 and 90. Great reward to risk.

Watchlist:

I am still in the process of weeding and adding to the watchlist.

Market Leaders:

FB broke out of range.

Current Trades:

You should have received three alerts today (if you did not get them, contact swing@bullson.ws).

I took full profits in GOOGL today. This came after entering YELP and GMCR, and already holding KORS. I decided I did not want too much long exposure with these overbought conditions. I still ended up with 2:1 risk ratio, which is not the 3.5 I was getting when entering the trade, but still acceptable.

The YELP setup is posted in the focus list and still there.

With GMCR, I decided to play the crazy break two day breakout range. The trade is to buy the bottom with a tight stop and sell at the top. I will look to exit somewhere in the $117-120 range.

{Note that stockcharts bar for today is incorrect. The high was $117.25, not $120. The site has been acting goofy lately.}

Here is the trade journal.