Quick Summary

Shorting SPY on strength, and going long on pullback to converging areas of support. MCK added to focus list stocks. TLT setup still available.

The Market

Key Pivot Levels: 196.05: new high resistance, 190: old high support 188.80: 50 day moving average 181.31: recent low

Under the Hood and Trading Plan:

SPY pulled back a little today, but nothing that changes the character of the market. SPY is still extended, with improving volume pattern and now a strong RSI (before there was a bearish negative divergence). As we know, markets can stay extended for longer than expected periods before the big drop. Thus, we can still play individual stocks to the long side and continue to take stabs at SPY as a short. I will still look to short on strength.

The overall pattern is turning more positive. If we get a pullback that works off the overbought coniditon, a strong converging area of support is forming where the 50dma and the old highs were, in the $189-190 zone. That would be an ideal spot to go long SPY. For those who like extra leverage, SSO can be used to go long SPY, just as we shorted by going long SDS.

Focus List:

Here we find actionable setups culled from “the watchlist” for the coming trading day.

Focus list stocks YELP, YY, KORS, GMCR, BIDU, CAT and AAPL are still all near entry zones. Remember AAPL is a speculative short on strength.

These are the 18 stocks that I am watching closely. Many of you want smaller lists, but I am providing this because you may get an alert with one of these stocks, as you did today with YELP, which was not on yesterday’s focus list. If you would like to investigate these, click here.

See yesterday’s report for more on the above setups.

New Additions:

MCK is a watchlist stock that has pulled back and showed confirming strength off oversold stochastic levels. An entry on weakness in the $185-186 range provides good entry. The stop is tricky. We have the $185 support level, but also the bottom of the breakout bar at $182.50. If we choose the bottom of the breakout bar and enter at $186, you must have a target no lower than $191 to get a 2:1 reward to risk ratio.

Watchlist:

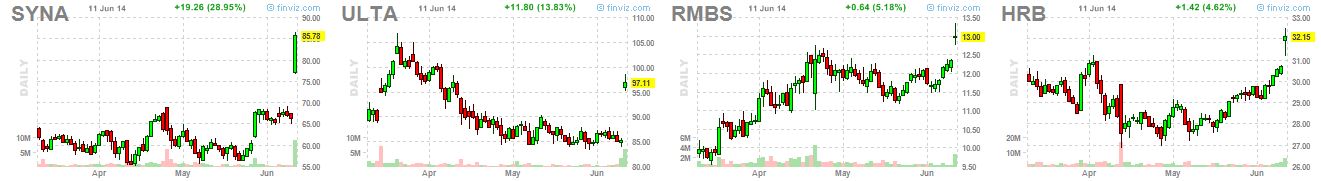

I am still in the process of weeding and adding to the watchlist. Take a look at these breakouts that I am considering adding:

Market Leaders:

PCLN and Z bounced at support levels.

Current Trades:

I am still holding GMCR, KORS and YELP.

Here is the trade journal.

ETF and Sectors:

The TLT setup is still there.