One of the most common questions we get from new traders when they first open up a platform is:

“How do I actually execute an order and place a trade?”

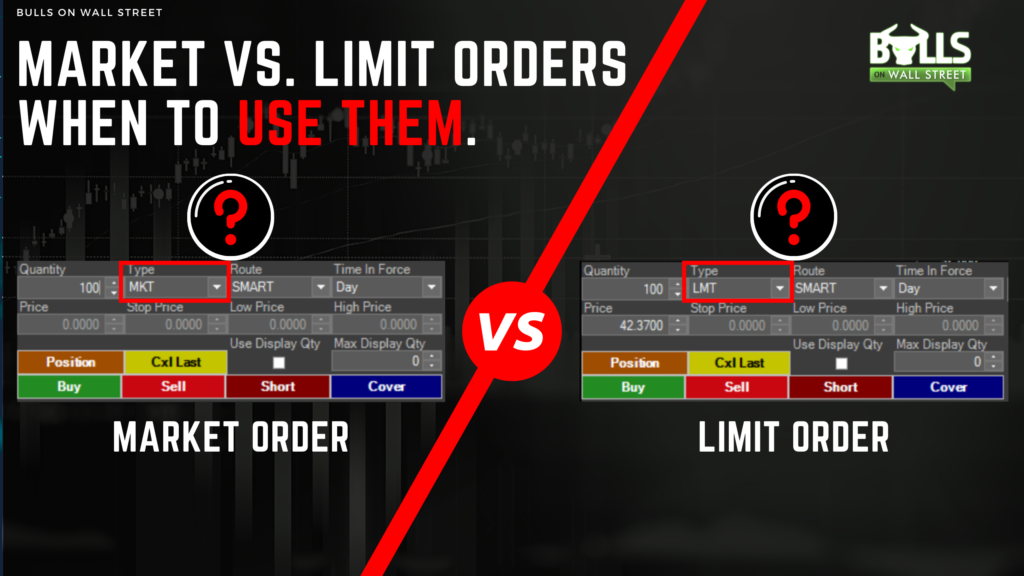

In trading, there are several types of orders that you have to be aware of when placing a trade. To get into a long or short position, the two most common and useful order types you will see on any platform are limit and market orders.

It is crucial that you know the differences of both of these orders and have a strong grasp on when to use one over the other. Choosing the wrong one at the wrong time can cause a lot of headaches and potentially some dangerous losses, so make sure to study these two types and practice them before you dive into live trading.

Let’s take a look at what each type of order is and when to use them.

The Basics of Market Orders

A market order is the quickest way to enter a stock. When you place a market order, you will be filled almost immediately at the nearest bid or ask on the level 2. It ensures that you will get into the trade, but it does not specify a price you will enter. You are buying/selling the stock at the market’s best available price point. These types of orders are great to use when you need to execute a trade immediately and are ok with potentially taking on some slippage.

If you are buying shares of a stock, you will immediately purchase shares of a stock at the market price, which is the lowest seller on the ask side of your Level 2. If you are selling stock with a market order, you will immediately sell your shares to the highest bid in the market.

Take a look at this screenshot of a Level 2 screen below. The ‘bid’ orders are on the left, and the ask orders are on the right.

If you wanted to buy the stock above and placed a market order, you would get filled right at the best price on the ask which is $20.48 at the given moment. If you wanted to sell the stock above and placed a market order, you would get filled right at the best price on the bid at $20.47

When to Use Market Orders

When speed of execution is required on a trade, market orders can give you an advantage over limit orders. You only want to use market orders on highly liquid stocks with tight spreads to avoid slippage, which is something we will get into shortly in the next section. If you use market orders on liquid stocks that are trading a lot of volume and are relatively stable, you won’t find yourself getting bad fills on trades.

Another good time to use market orders is on your stops during swing trades. Using market orders for stop-loss orders on swing trades ensures that you will completely exit your position when it hits your stop price. This is great if you aren’t watching every tick, and just set the trade and walk away.

If you use a limit stop order, you run the risk of not exiting your position fully, and the market going against you further with the portion of your position that didn’t get executed. If you are a swing trader who puts hard stop losses in and does not have time to watch the market often, you will want to use a market stop order.

The Cons of Market Orders

Like we mentioned before, market orders do not specify a price in which you wish to enter the position. That leaves room for ‘slippage’. Slippage is when there is a difference between the expected price of a trade and the price at which the trade is actually executed. It is common to get slippage on more illiquid stocks when using market orders, as there are fewer buyers and sellers willing to buy or sell your shares at the price you want to on the Level 2.

The ‘spread’ on the stock (difference between the best ask and the best bid) may be pretty wide, and you will get filled far away from the current trading price. If you use a market order, especially on a large position, you may also fill some of your position at higher prices, since it ‘eats’ through the current bid or ask until all of your shares are filled. This is very likely to occur if you are trading a stock with low liquidity and volume.

The Basics of Limit Orders

If you are looking to be precise with your entries/exits, limit orders are the way to go. A limit order sets the maximum or minimum price you are willing to buy or sell a stock. Unlike with a market order, you wait for someone to buy or sell your shares at the price you chose.

If you specify for example a Buy Limit Order of $25.50, that means you will ONLY get filled on the trade at the price of $25.50 or below. On the flip side, if you sell or short a stock with a Sell Limit of $23.00, you will only get filled at a price of $23.00 or above. The price you set on your limit order is just that, the limit or maximum price in either direction you are willing to buy or sell a stock for.

When To Use Limit Orders

In general, you want to use limit orders for the majority of your trade executions. Using market orders on liquid stocks like Apple, Microsoft, etc will not have any significant consequences since there is a huge market of buyers and sellers in these names. However, on more illiquid names with larger spreads, they can result in you losing a lot of money through slippage.

That is when limit orders come in handy because you can specify the exact price to which you want to get filled. Limit orders are also great to toss out at key levels of support and resistance on swing trades if you can’t be in front of the screens all the time. If you want to buy a stock on a dip to $25.00 for a multi-day swing for example, you can place a buy limit at $25.00 and as long as the order is open, you will get filled even if you are away from the desk.

The Cons of Limit Orders

Market Orders like we said before fill almost instantaneously. With limit orders, there is a chance you may not get filled because you are specifying a certain price point that the stock may never reach. For example, if a stock is trading at $27.00 and you are trying to buy it with a limit order at $25.00, the stock may never drop to $25.00 and fill your limit order.

There is also a chance with limit orders that your position will get ‘partially filled’, meaning the order only filled a portion of the shares you requested. Since you technically have to wait for another market participant to complete your order, you may have to be strategic about where you place limit orders if you are looking to add liquidity. To increase the probability of getting your limit orders filled, place your sell limit when a stock is trending upwards, and your buy limits when a stock is dipping.

Example

Let’s say you want to buy some Apple stock and it is currently trading at $140 per share with a bid of $139.95 and an ask of $140.05

If you use a market order to buy right now, you will get filled at $140.05 per share, assuming it is pretty liquid and has a tight spread at the moment.

If you use a limit order, you can potentially get filled at a lower price instead of taking that best price on the ask ($140.05) like the market order. Let’s say $140.05 is just too high for you, and you want to buy at $139.97 exactly. You can then use a buy limit at $139.97, and if someone is willing to sell their shares to you at that price, you will get filled.

Summary

For the most part, you want to use limit orders to complete the majority of the orders you place to buy and sell stocks. The only time you should consider using a market order is for a stop loss order, or when trading a highly liquid name with a small spread. If you still have any confusion about these concepts, feel free to apply for our live trading boot camp below!

Live Trading Classes From Experienced Traders: Join Our Live Trading Boot Camp

Space fills up fast in our boot camps. Apply for your seat to see if you qualify!

Click Here to Save Your Seat