After today’s weak market activity and Alcoa’s after hour plunge (not to mention JOEZ), it’s clear we’re entering Tuesday with a possible awakening of the bears. However, when the market gives back, it often creates good buys and measurable entries for swings.

So, with that, let’s look for new setups: PLEASE NOTE: I have not looked into the earnings calendar for any of these stocks. I rarely, if ever, trade stocks into earnings.

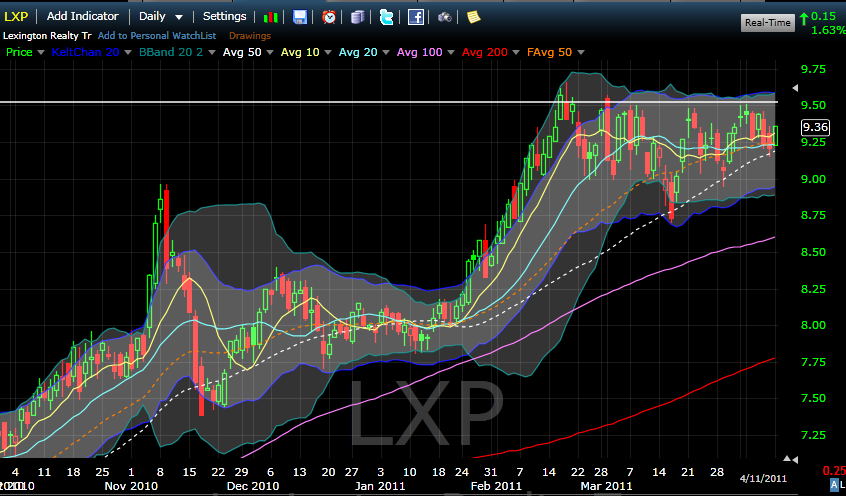

LXP – Nice SMA50 support on ascending triangle consolidation. I considered an entry today, but I think I’ll wait for a break or recent highs over 9.50

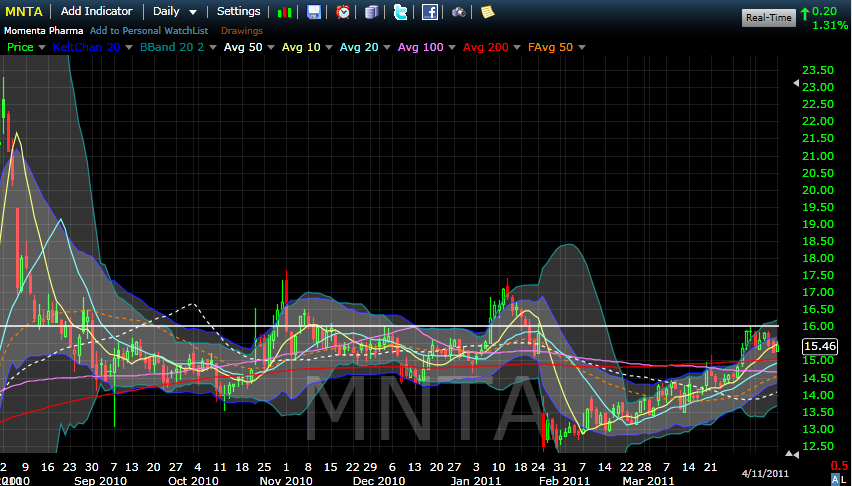

MNTA – Not the greatest looking bull flag, but worth watching if it can get to $!6

HEK – Nice strong move off SMA20 since February. Watch for a possible bounce off SMA20 and move through descending trendline.

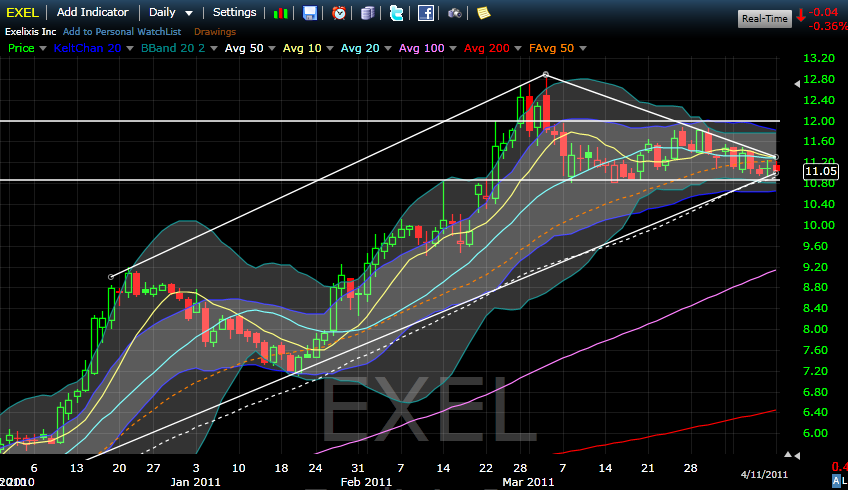

EXEL – Just a great looking setup..period. Horizontal support…descending triangle. A break through SMA20 and it could set it loose.

STEI – Nice horizontal support here. We’ll need confirmation that it will hold, but it marks a good entry point for possible long swing.

PPO – Nice ascending triangle – Watching for move through $60

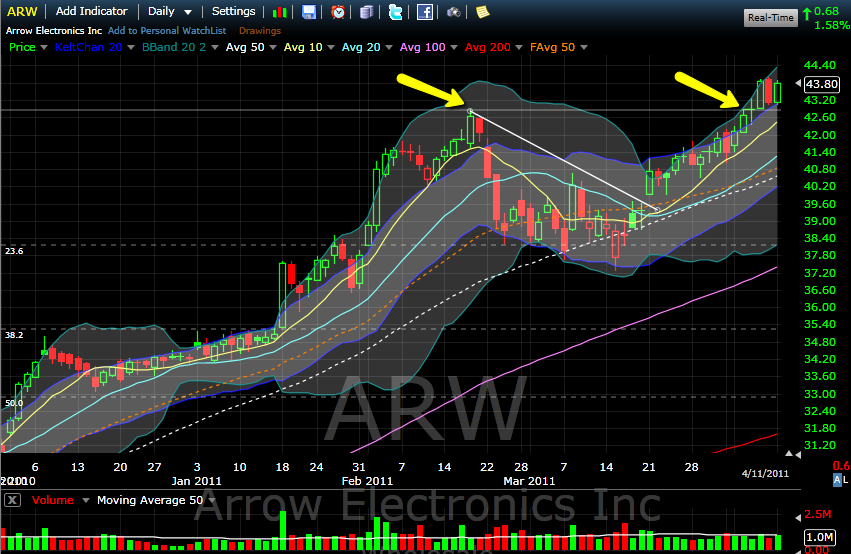

ARW– Building a base on recent highs – watching for move above.

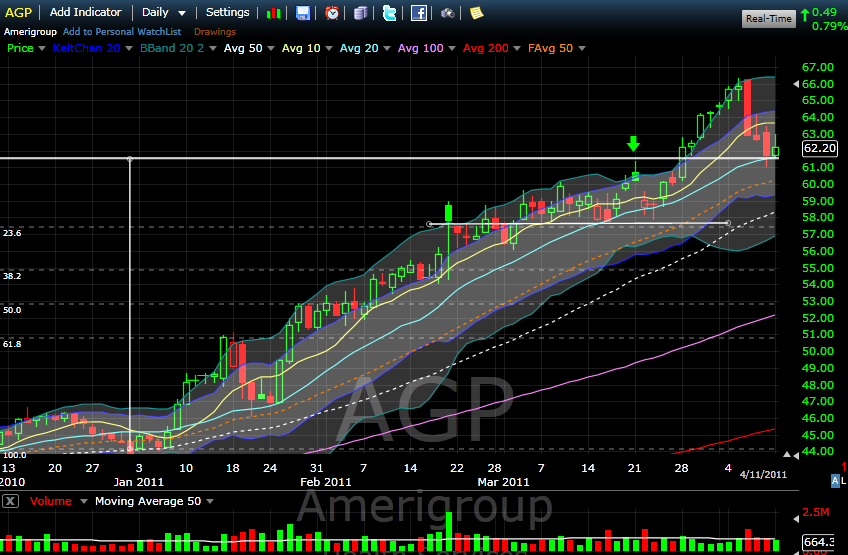

AGP – Pulled back to horizontal support and SMA20. Support time? On watch.

SRCL – Pulled back to a good level of horizontal support.

DECK – Careful here. Needs to hold SMA10 and horizontal support.

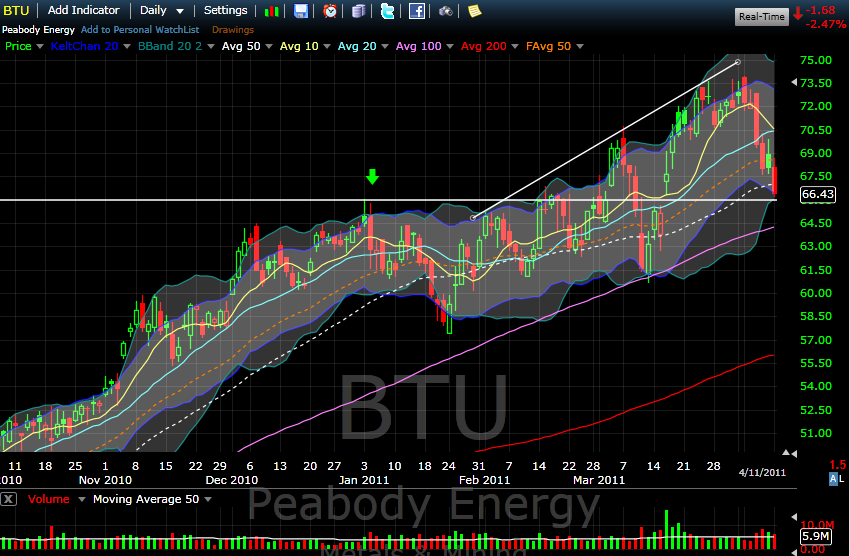

BTU – Horizontal support. Watch out. Not much other support and please of distribution volume. SMA100 right around the corner.

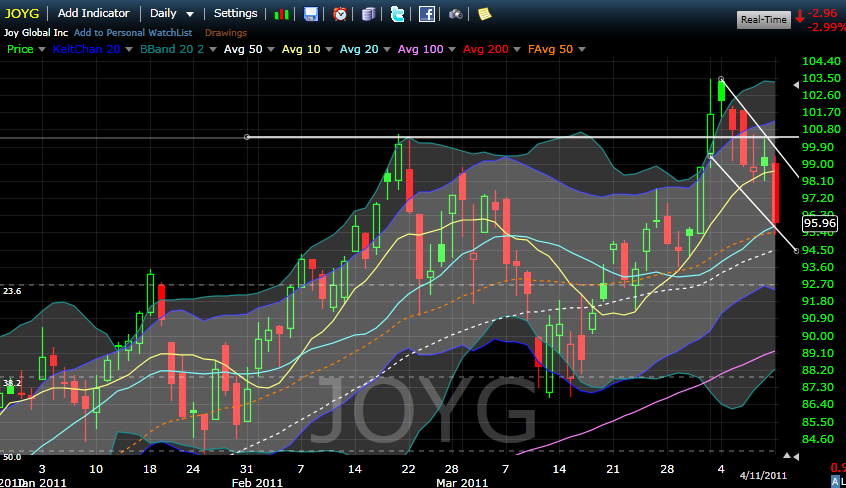

JOYG – finds Front Weighted MA50 in downward trending channel. I’m looking for 95.45 to hold and allow for a bounce back up into channel. We’ll see, I’m not convinced.

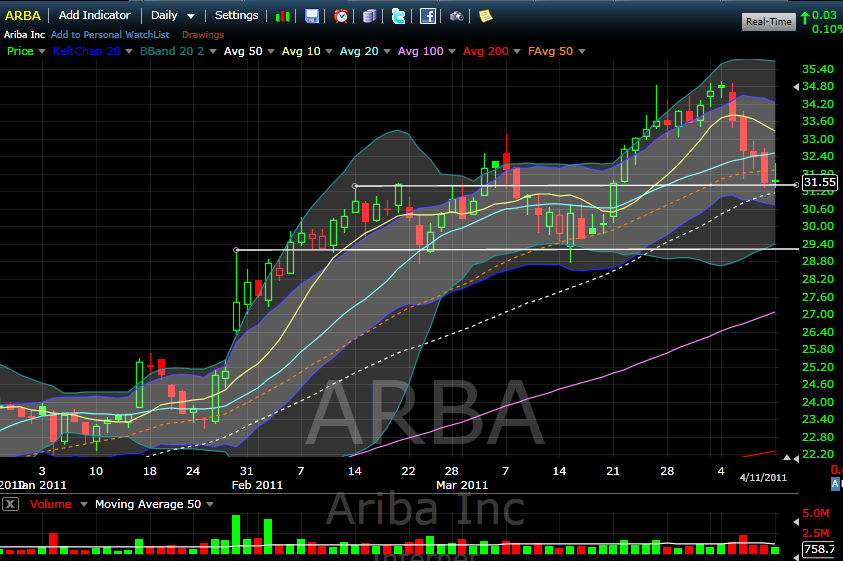

ARBA – Will it hold SMA50 and horizontal support..?

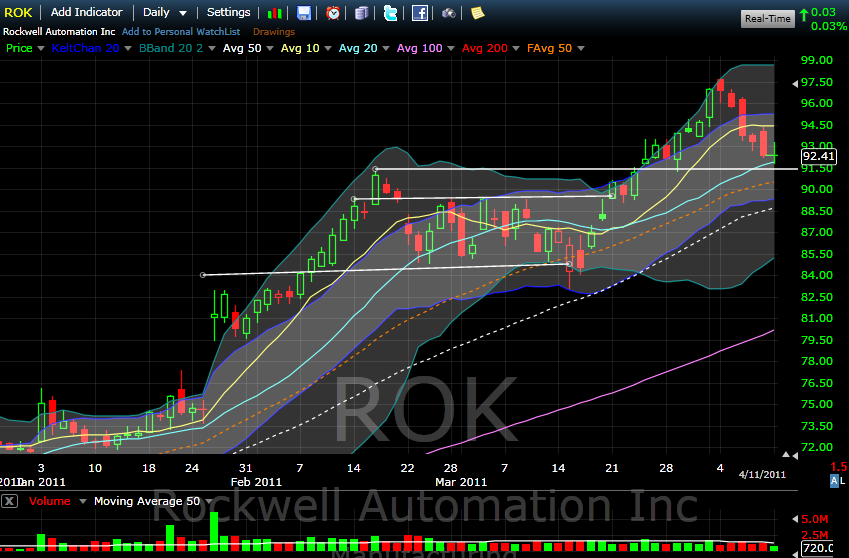

ROK – Another one with the same setup.. Pulling back to SMA20 and horizontal support. Like many, it’s do or die time.

NVAX over 2.60

HUN – nice extended tails on the last two daily candles – in other words, it’s trying to hold up. Watch above 19.25

SD may find SMA20 support. If not, watch for 11.60

ARUN – concerning bear flag possibly setting up. SMA50 will be key.