No matter how good your trading strategy is, losing trades are inevitable. Trading is one of the few environments where you’re forced to accept loss and failure, usually on a daily basis.

Successful trading is not the result of having no losers. It’s you respond to losing trades and move forward from these losses. Let’s talk about how you can handle losing trades, and not let it affect your trading performance:

Good Losing Trades vs Bad Losing Trades

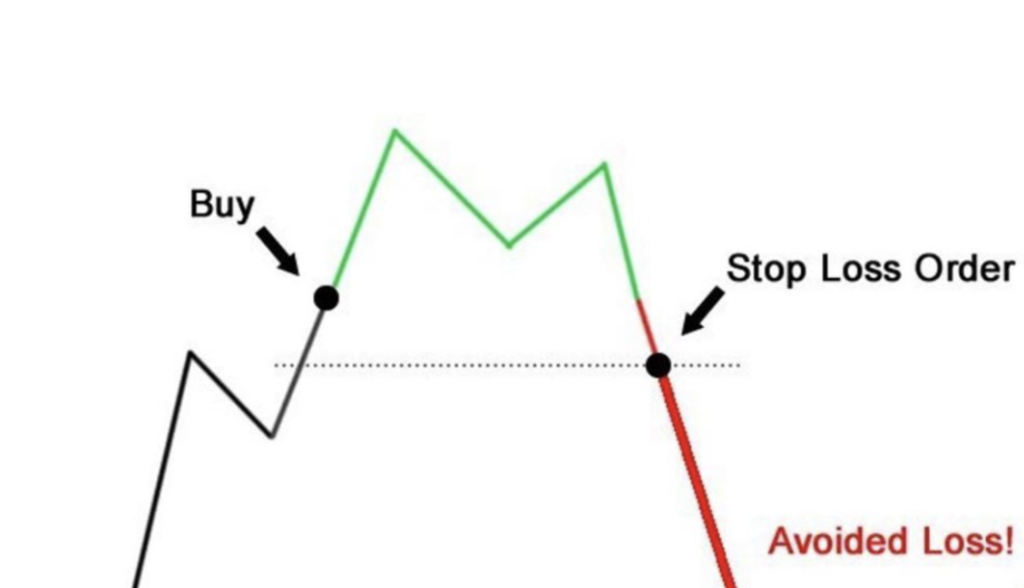

This is one of the hardest concepts for new traders to grasp. Traditional society conditions us to perceive failure as a negative event. But in trading, losing money doesn’t always mean you did something wrong. Look at this example above:

In the example above, you can see how stopping out early on that trade saved the trader from a much bigger losing trade. In any profitable trading system, you have to have strong risk management measures in place. A few hours where you lose control and throw risk management out the window can end with your account blowing up.

Should You Be Taking That Loss?

Once you categorize the losing trade, you will know if it is a loss that you should be taking or not. The example above is an example of a losing trade. Here’s an example of a bad losing trade:

This trade was an obvious chase by one of our students. This is the type of losing trade to be concerned about. Any losing trade where you KNOW you shouldn’t be in the trade in the first place is a bad loss, EVEN if it is a small loss, and ended up preventing a bigger loss.

Don’t try to justify a dumb trade by saying “it was a small loss.” It’s still losing money for no reason. You can justify taking any trade by saying “I’ll keep a tight stop if it doesn’t work”. You will overtrade and can end up having a big red day by taking a bunch of small losses.

It’s even worse to have winning trades result from bad decision making because you get the positive reinforcement behind the behavior. ALWAYS know whether every trade you take is a scenario you have an edge in, or not, supported by data.

What to Do After a Big Losing Trade

We’re human. Sometimes we lose our discipline. Every great trader takes a massive loss at some point. But it shouldn’t happen more than once in your trading career. Here’s what you should do after a big loss:

- DON’T REVENGE TRADE AND MAKE IT ALL BACK IN 1 DAY

- Size down on your position sizes, slowly rebuild confidence

- Take some time off to recover emotionally

- Understand the patterns of behavior that lead to loss

- Create rules to prevent it from happening again

The recovery process from big losing trades is a long process. That’s why you NEED to have precautions and rules to prevent them from happening in the first place!

Summary: Step By Step Process

Step 1: Categorize losing trades: Losing trade you should be taking or not

Step 2: Figure out why it happened: Identify the cause of destructive behavior

Step 3: If big loss, take some time off, size down, and slowly rebuild confidence

Step 4: Create firm rules and precautions to prevent it from happening again

Save Your Seat for Our Next 60-Day Live Trading Bootcamp

We don’t sugar coat it. Becoming a consistently profitable stock trader is easy, or an overnight process. That’s why our 60-day Live trading boot camp is designed specifically to help struggling traders overcome their weaknesses, and expedite their path towards profitability.

Our next bootcamp starts December 2nd, and spots are filling up fast. Contact us ASAP to save your seat in our next trading boot camp!