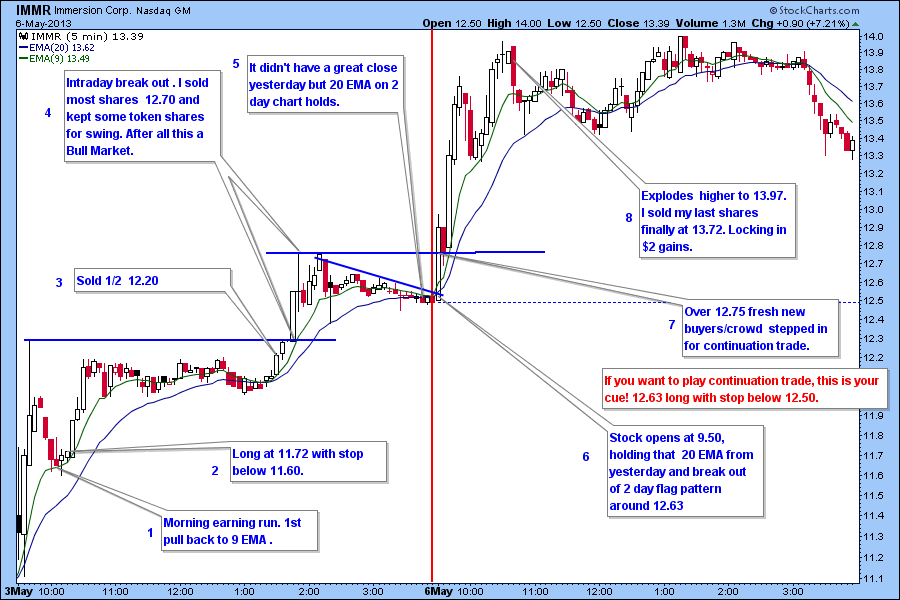

IMMR One of the trade I took on yesterday 5/03/13. Stock had earning on 05/02. Next morning it gapped up over the flag. For this type of trading I usually use the first orderly pullback to establish a position.

Let us check out the intrday chart for last 2 days to see how it played out. This chart will provide you some strategy for playing continuation trading setups. Basically it means stock had a strong run day before and whether it can “Continue” to run he next day.

1.Morning earning run. 1st pull back to 9 EMA .

2.Long at 11.72 with stop below 11.60.

3.Sold ½ 12.20 with .60c gain and .12c stop.

4.Intraday breakout . I sold most shares 12.70 and kept some token shares for swing. After all this a Bull Market!

5.It didn’t have a great close yesterday but notice 20 EMA on 2 day chart holds.

6.Today Stock opens at 9.50, holding that 20 EMA from yesterday and break out of 2 day flag pattern around 12.63 . If you wanted to play continuation trade, this is your cue! 12.63 long with stop below 12.50.

7.Over 12.75 fresh new buyers/crowds stepped in for continuation trade.

8.Explodes higher to 13.97. I sold my last shares finally at 13.72. Locking in $2 gains.

Hope this helps.

If you are interested learning this type of strategy and more for quick and explosive gains, check out Bulls Trading Boot camp starting in May 14th. New feature, I will share my explosive money making day trading strategies.

Email for info. thenyctrader@gmail.com

Follow me on Twitter and StockTwits @szaman