Money and emotions go hand in hand. Who likes losing money? Who enjoys making money, and then realizing you could’ve made 5x more if you didn’t sell early?

Our emotional attachment to money is one of the most difficult components of trading successfully. Kunal always says, “We are not trading stocks. We are trading our hopes and dreams.”

Money is just a possibility. And when we trade, we think about money and think about all the potential things we can do with that money. “That trade was my mortgage for the month.” “I just lost a whole month’s of my salary.” “That trade could’ve paid for my vacation next month.”

It’s all these possibilities that make money such an emotional object for us. In today’s blog, we will talk about strategies to combat trading emotions, and managing them so they don’t affect your decision-making ability:

Preparation

All of the best traders do extensive preparation before they make a trade. When the market opens, they already know which stocks they are trading, when they will enter, when they will take profits, and when they will stop out.

When the market opens and you don’t know the answer to any of these questions, you will get emotional. You will get FOMO because you will see stocks make big moves without you because you didn’t prep to find a good entry. You will panic when a stock makes a move against your position. You will take profits too early because you are greedy.

We are starting to sound like a broken record here at BOWS. Cannot emphasize enough how important preparation is in trading. Watch how much easier it becomes to manage your emotions in a trade when you know what you SHOULD be doing, versus guessing because you have no plan.

Pre-Defining Risk

Emotions stem from the unknown. When you don’t have a plan and don’t know how much money you could lose on a trade, emotions WILL enter your trading.

When you define the worst-case scenario, trading doesn’t seem so scary. When you know exactly how much money you will risk on the trade, you know how many shares you will buy or short, at what price you will enter, where you place your stop loss, and how much of your trading account you could lose.

Just like that, you have eliminated a ton of uncertainty in your trading. When you take these measures to eliminate uncertainty, managing your emotions become much easier. All you have left to do is figure out where your profit targets are, and how you will manage the trade if it becomes a winner.

Self Awareness

This is a tough trait to develop. But when you do develop it, you will see insane results in your trading performance, and in all other areas of your life. Every aspect of yourself shows up in your trading. Anxiety, stubbornness, impatience. You name it.

In trading, we are our own biggest obstacles to success. When you know yourself, you can take measures to stop yourself from getting in your own way. In trading, you are really protecting your own capital from yourself, not from everyone else.

Taking Preventative Measures

Once you develop the awareness of emotions affecting your trading, you need to put preventative measures in place to protect your trading account from yourself. Some good strategies to use:

- Daily Max Loss: Shut down your trading account after losing a certain amount of money

- Take a break and leave your computer to settle down

- Shut down your platform completely

- Place a daily trade limit

Key Take-Aways:

- Eliminate emotion with extensive preparation

- Pre-define your risk

- Know your weaknesses

- Put precautions in place against your weaknesses

If you missed yesterday’s blog where we talked about how to find a trading edge, click here to check it out.

Tomorrow’s blog we will talk about how to combat emotional attachment to companies, and how to eliminate noise from your trading.

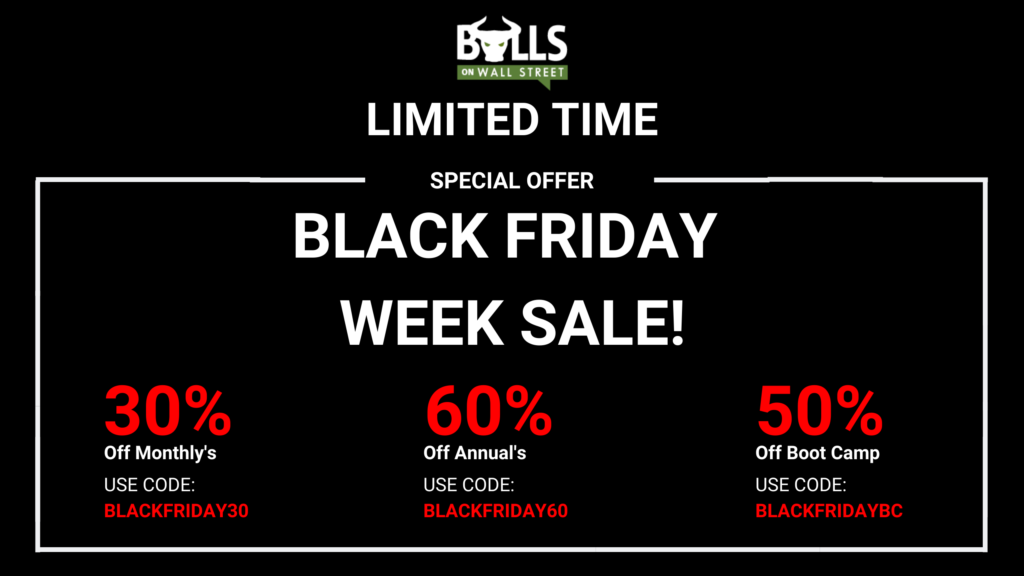

Take Advantage of Our Black Friday Deals

Regular Annual Price: $1499/year

Black Friday Annual Price: $599/year (Using code: BLACKFRIDAY60)

Regular Monthly Price: $199/month

Black Friday Annual Price: $139.30/month (Using code: BLACKFRIDAY30)

Regular Boot Camp + 6 Month’s Chatroom Price: $4,000

Black Friday Price: $1,999 (using code BLACKFRIDAYBC)

All of these deals will expire on December 1st!

NOTE: Space is running out in our next live trading boot camp. We only have 14 seats left. Contact us ASAP to save your seat.