Today we shorted $MMR and $RIMM in the chat room for nice profits. Here is a review of the trades:

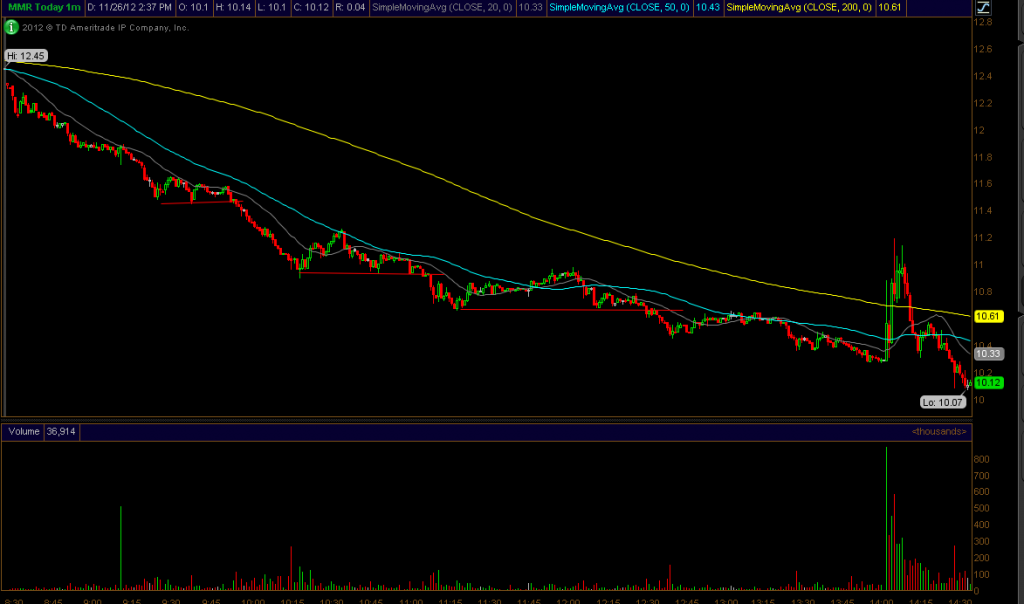

$MMR– we shorted this stock at the perfect spot on an intraday chart. We do this short alot in the chat room so it’s one that you really want to learn. Anytime you see a stock down trending for the majority of the morning and you also have a market that is down trending, then you simply short the breakdowns in the stock. The stock was basically straight down all morning until finally it flattened out and “bear flagged” right at the $11.5 level. The stock tested $11.5 twice and then the third time is where we shorted. Remember the more times a weak stock tests a level, the more likely it will bust through that level with force. Normally these are meant as day trades, so we covered this one fairly quickly. The only mistake we made was not re-shorting the next two breakdowns. These are meant to be scalps and should always be played that way. Especially if you are trying to short the third or fourth breakdown. Checkout the chart:

The second short that we did today was $RIMM. This was a rubberband snapback play. The stock was overbought on the daily and had gapped up in the morning. When this happens, you are looking for weakness in the stock out of the gate. We saw a flag develop. As soon as the stock broke the flag to the downside we shorted it in the $11.9 area. Once the flag broke, the stock ran all the way down to $11.4’s. A nice drop on the overbought conditions. Check out the flag intraday and see if you can tell why the short came in.

If you have questions, or trades you’d like feedback on, send me an email at maribeth@bullson.ws and I’ll get right back to you.