One of the biggest decisions you’ll make as a trader is where you will trade. If you make a poor initial choice, or outgrow your broker, you can certainly go elsewhere, but its usually a hassle. So finding a broker that fits your individual needs and circumstances is paramount. There is no one-size-fits all option, unfortunately. What works well for one person might have another pulling out his hair. But, there are a few criteria you should always consider when evaluating brokers.

Commissions

Commissions are an inescapable cost of doing business for retail traders and investors of every level. Commissions are the cost of executing trades. Every time you buy, sell, short, or cover a stock, you are charged a commission. For example, if you purchase 100 shares of $GOOG through Etrade, you will be charged their $7.99 rate. If you then sell all 100 of those shares at once, you will be charged another $7.99, for a ’round trip’ cost of $15.98. But what if you want to sell half of your shares once the stock has risen 3%, then sell the remainder when it reaches a 5% increase? Then you will pay an additional $7.99, for a total of $23.97.

Most commissions are charged on a flat fee basis, as stated above. But there are a few brokers who offer a per-share commission option. Perhaps the best known example for retail traders is IB – Interactive Brokers. IB has several pricing tiers, offering discounts for those who trade more often and in larger amounts, but the basic rate is $.005 a share, with a minimum total fee of $1.

For small retail traders, the size of commissions can determine success or failure. Retail brokers range in price from $4.95 for the deep discount brokers like TradeKing, with the average running from $7.99 to $9.99. Note that its sometimes possible to negotiate a lower commission once you’ve shown that you are an active, profitable trader.

Account Minimums

Most brokers require a minimum initial investment, and often a minimum ongoing account balance. The exceptions to this are the deep-discount brokers, like TradeKing and OptionsHouse. A common minimum range is $500 to $2500, though it can be significantly more – Interactive Brokers, referenced above, requires a $10,000 initial deposit. Also note, these are minimums for cash brokerage accounts, not retirement accounts like IRAs or Roth IRAs. Fees and minimums are often different for those than standard brokerage accounts.

When you are looking at account minimums, there is something very important to keep in mind: if you are trading actively at all – swing or day trading – you will need a margin account. With a standard cash account, trades can take several days to clear. This means if you close a position by selling all your shares, it can be up to three days before those funds are available for you to use again. It’s incredibly frustrating to sit on your hands, waiting for your cash to be available again, so most day and swing traders use margin accounts. With a margin account, you aren’t locked into that waiting period – as soon as you sell your shares, the cash is available for reinvestment. Federal law requires a minimum account balance of $2500 for margin accounts, but brokers can demand more on top of that.

Platform

As an active trader, you will be spending a great deal of time on your trading platform, so you want to be sure it meets your needs. If you were wondering how some brokers can charge $4.95 while others charge twice as much, platform is the main reason. The more expensive brokers generally have faster and more robust trading platforms, and often better mobile apps too. Here are a few of the things you’ll want to consider when evaluating platforms.

- Desktop/Browser/Mobile

There are three primary types of trading platforms – mobile, desktop-based, and browser-based. Desktop platform are generally considered the most robust. A desktop-based is one that is downloaded and installed on your computer, much like any other program. This type of platform allows for more features and higher speed, as a general rule. A popular example is Etrade’s Pro Platform, which provides scanning tools, point and click trade execution, and endless chart customization options.

There are three primary types of trading platforms – mobile, desktop-based, and browser-based. Desktop platform are generally considered the most robust. A desktop-based is one that is downloaded and installed on your computer, much like any other program. This type of platform allows for more features and higher speed, as a general rule. A popular example is Etrade’s Pro Platform, which provides scanning tools, point and click trade execution, and endless chart customization options.- Browser-based platforms are accessed via browser, obviously enough. You login to your broker’s site and have access to their trading tools. You can look at charts, buy and sell, and check your PnL. All brokers have a browser-based platform, while some also have a desktop-based platform. They usually offer fewer tools and sometimes slower execution than desktop-based platforms. One advantage, however, is that you can access any computer with internet access. So if you want to trade at work and cannot install a desktop platform on your work computer, you can simply access via the browser-based platform.

- Mobile platforms allow you to trade more easily on a smartphone or tablet than you could via the browser-based platform. Download the app, login, and you have access to trade execution tools, charting, etc. Today, most brokers, even deep-discount brokers, provide a mobile app. However, they are not all created equal.

- Charting

- As a technical trader, charts are absolutely essential. The biggest thing to look at with charting is that the charts are streaming. With charts that are not streaming – which you encounter with some browser-based platforms – they won’t update constantly and automatically. This means that you will need to manually refresh the page or chart. If you are swing trading only this can be OK, but for day trading you will want real time streaming charts.

- Execution speed

- There are two components to this. First, how easy is it to use the platform? As a day trader, you want to have the ability to execute trades with as few clicks as possible. If you have to jump through numerous hoops to get into and out of positions it will cost you a lot of money in the long run. The second component is how quickly the broker executes the actual trades. Some brokers, like Etrade, will guarantee a 2 second execution. Others offer a more vague guarantee, or none at all. This is another area where the higher priced brokers are often faster.

- Virtual Trading

- Trading simulators are a great way to hone your trading skills, develop new strategies, and familiarize yourself with a trading platform. Some brokers provide virtual trading via a trading simulator. ThinkorSwim is a broker with a popular trading simulator.

Borrows

When you short a stock – betting that it will go down, rather than up – you borrow those shares from your broker and immediately sell them. Once the trade is complete, ie it’s either gone done and you’ve covered at a profit, or its gone up and you covered at a loss, you buy those shares back and return them to your broker.

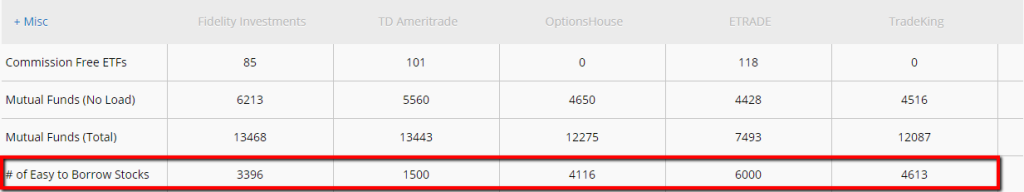

When you buy a publicly traded US stock, you will be able to do so through your broker. You might not be able to buy it at a price you are happy with, of course, and if its illiquid there might not be shares available (to anyone, anywhere) to buy, but your broker won’t be a barrier. But with short selling, it’s an entirely different story. Your ability to short stocks is dependent on what your broker has available, which is usually considerably less than entire US stock universe. As in all other things, some brokers have much better ‘borrows,’ also referred to as a ‘short list,’ than others. This is not something that brokers usually advertise themselves, so some research is required if shorting stocks is important to you. A good site for that data is stockbrokers.com

Customer Service

At some point, you are going to encounter a question or a problem that you can’t resolve on your own. Hopefully it will be something minor – a feature you can’t find or an indicator that spits out gibberish. But there’s always a chance that it will be more significant than that, and time sensitive. What happens when you try to sell your large, volatile position in a stock and the whole platform crashes? When that happens, you want to be able to pickup the phone or get on live chat and get speedy, knowledgeable assistance. Sitting in a long-distance waiting room while the smooth jazz plays and your PnL turns blood red will take years off your life.

Of course, every company claims to offer outstanding customer service, so you’ll need to do some research. Stockbrokers.com is one site that conducts customer service reviews periodically, using an anonymous shopper service.

Summary

There’s no one-size-fits-all broker. Traders have both varying needs and resources. But, there are a couple ways to point yourself in the right direction. The first question to ask yourself is how often you’ll be trading. If you plan to day trade, speed is important, so having a good desktop charting platform and reliable executions is often worth paying a bit more in commissions. And remember, if you are a pattern day trader, you will need at least $25,000 in capital, so you will be trading with larger amounts anyway (making the flat commissions less significant on a percentage basis).

If you plan to mostly swing trade, and/or if you have a smaller account, a fast platform and streaming charting is probably less important than low commissions. Additionally, if you are trading while working, checkout the browser-based platform and mobile app of any broker you are considering, to be sure its functional and not blocked by your company’s firewall.

As with all things trading-related, do your due diligence before selecting a broker and you’ll avoid a lot of frustration down the road.