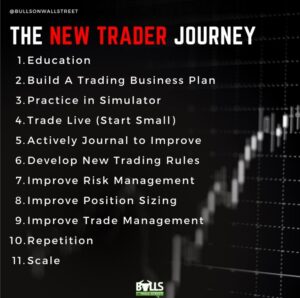

The journey from a beginner day trader to an expert day trader is one of trials and tribulations. But, it is achievable for anyone!

In today’s blog, we will talk about the path from progressing from Novice day trader, to a good day trader, and finally to an expert day trader.

The Novice Trader

Inexperienced traders must adhere to checklists. Much like a pilot, every trade requires stringent rules with no deviation. This minimizes errors and prevents overanalysis paralysis. Most beginners lack the experience to develop expert intuition. Asking them to improvise leads to significant errors. This is a major difference between the novice and the expert day trader.

Novices can still learn, progress, and earn profits. However, adhering strictly to rules and using a cheat sheet is crucial. Novices generate profits through disciplined behavior and strict adherence to their trading system. Although their win ratios might be low, maintaining reward-to-risk ratios and following the checklist enables them to make money. Every element must remain fixed, such as risk per trade, position size, and the number of trades executed.

Deviating from the checklist leads to account damage, shattered confidence, and inconsistent results.

The “Good” Trader

Proficient traders no longer rely on checklists, strict rules, or trading mantras. They can make spontaneous decisions during the trading day and alter their plans. Good traders might still make a few mistakes each week, but they reduce emotional errors and refine their processes. They can earn substantial profits. The checklists are ingrained in their minds. They operate instinctively and adapt swiftly to changing circumstances.

These traders have documented thousands of trades, allowing them to differentiate between stocks. They navigate stocks based on their behavior and manage them according to their levels. They comprehend various scenarios and adjustments based on market conditions. They tailor setups to specific stocks and possess a library of setups in their playbook. Within this playbook, they have detailed guides for each pattern and have structured their scans and trading processes accordingly.

The Expert Trader

The expert day trader operates with an intricate understanding of their trading setups, down to the tiniest details. Their market awareness, trading intuition, and process loops flow effortlessly. They can react without conscious thought and anticipate moves. Describing this level of expertise to novices is challenging.

This trader has acquired experience from tens of thousands of trades, understanding all aspects of trading setups and their variations. They can predict shifts in setups before they manifest in certain stocks they have observed for years. Consequently, they can modify trades based on real-time information and subtle market changes, deviating from their original plan as they comprehend the trade’s complete picture and context. These are all great qualities of an expert day trader.

A Comparison to Mastery in Other Fields

Master musicians, athletes, and professionals in various fields exhibit similar traits. They operate fluidly, and their actions feel as natural as breathing. Achieving this level of proficiency requires accumulated experience and unwavering self-confidence. To reach this stage, mentorship is vital. Seeking guidance and consistently analyzing charts, potentially a thousand per day, helps traders amass a wealth of visual data, enhancing their trading capabilities.

In conclusion, the journey from novice to expert involves continuous growth and learning. Through discipline, adaptation, and experience accumulation, traders can confidently navigate the complexities of the market.

Ready to kick off your trading journey the right way and become an expert day trader? Click here to apply for our LIVE 60-Day Bootcamp!