No one likes to admit they were wrong. Especially when you spent hours planning that trade, and you know that the company is undervalued. Inability to keep losing trades small is the most common trait of failed traders.

Risk management is an essential component of a successful trader. It is even more important than having a high win percentage. But so many losing and inexperienced traders fail to exercise consistent risk management.

Often losing traders will have it backward: They will show patience with their losing trades, but not with their winning trades. Let’s talk about why so many traders have trouble with this, and how to resolve this issue that plagues them:

Combat Stubbornness

The most common reason why traders have issues cutting losses where they are supposed to be stubbornness. Traders don’t want to admit they are wrong because their ego is in control of their decision making. In trading, you will reach a point will you will know what you should be doing to succeed. But because we are human, we get in our own way and prevent ourselves from doing what we are supposed to do.

We are own worst enemy in trading. Not the market makers, the algos, or whoever else losing traders like to blame when they lose in the market. Our ego is the biggest obstacle to keeping losing trades small. The first step to overcoming stubbornness is to understand that you are in control of your trading results, not any of the other market participants.

Taking full responsibility for all of your trading results will allow you to subdue your ego, and allow you to change what is needed for you to become a successful trader.

Focus on Making Money, Not Being Right

If you find yourself consistently struggling to cut losses, ask yourself this question:

Do I want to make money, or do I want to be right?

If you want to make money, you should always cut your loss at your stop loss. The whole point of trading is to make money. What you think about the company and where it should be valued only matters if the market concurs with your opinion. Price action always matters more than your opinion.

Great companies can keep dropping lower. Terrible companies can go up 1000%. One of the best trading quotes:”Markets can stay irrational a lot longer than you can stay solvent.” Before every trade you need to have a plan if your trade thesis is disproven. There is not a single trading strategy out there that wins 100% of the time. You always need to have an exit strategy. Use hard stops to take yourself out of the market if you are having trouble taking yourself out of the market.

Small Losers Allow Your Winners To Grow Your Account

Look back at your day to day PNL at the end of month. Note how many winning days do your losing days wipe out. If one red day wipes out ten green days, you can have a month with 20 green days and two red days, and not make any money. When you flip this, and make one green day equal to 10 red days, it becomes so much easier to grow your trading account.

It is more realistic to maintain a risk vs reward ratio of about 3:1 on your trades. This means your winning trades are on average 3 times as big as your losing trades. With risk management like this, it becomes so much easier to be a profitable trader. You can have a win rate as low as 40% on your trades, and still make money in the long run.

Let’s say your average winning trade is $300, and your average losing trade is $100, and your win rate is 40%. If you take ten trades, on average you will be making $1200 (300 x 4) from the winning trades, and lose $600 (6×100). This means you will make $600 in profit on average at the end of 10 trades.

In trading, it only takes one really bad day where you didn’t cut your losses to end your career. Focus on consistent, steady results in the market. Being a successful trader is just as much about keeping the money you make, in addition to actually making money. In order to keep the money you make, you must be able to keep your losing trades small.

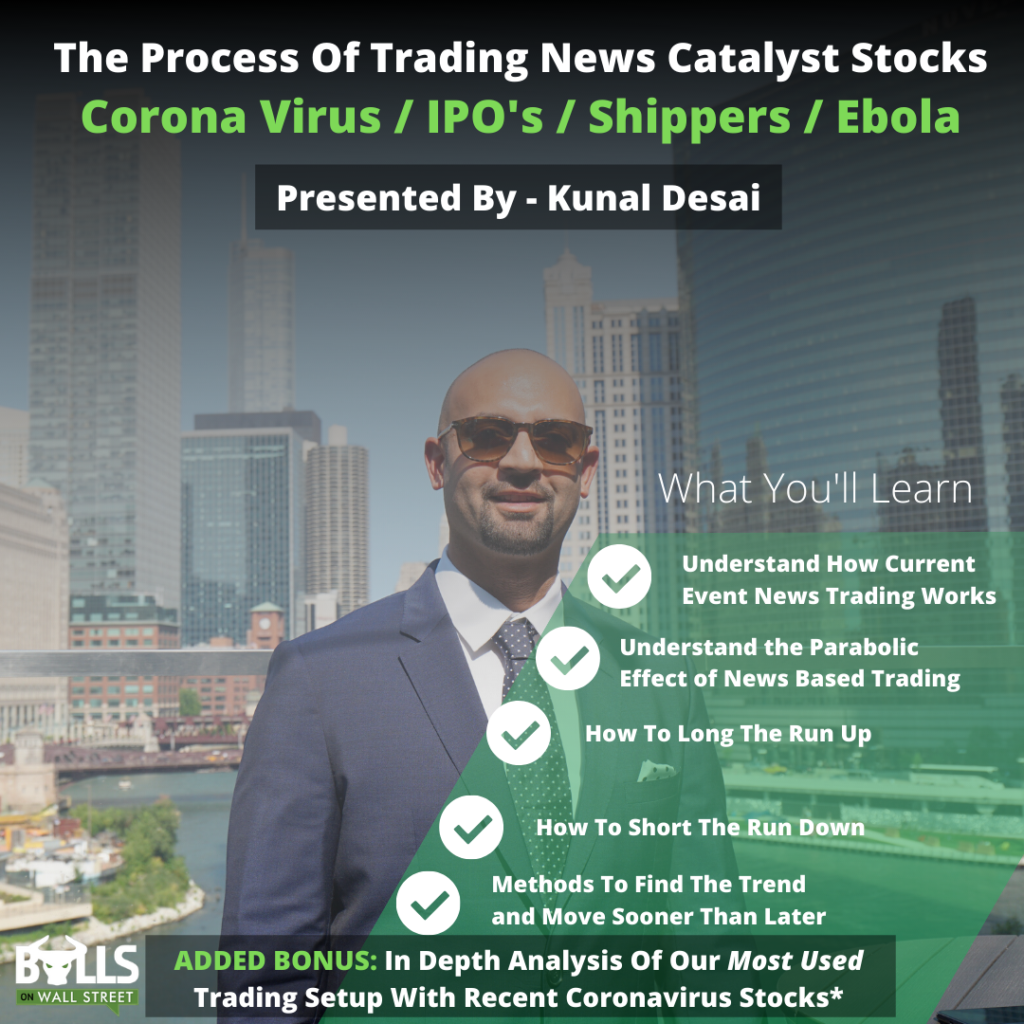

Important Live Webinar This Week

We are seeing a MAJOR shift in trend in the overall market in the past week. We want you to be prepared for these unique market conditions. Join us for our live webinar this week and learn how to trade in market conditions with major news catalysts like the Coronavirus. Don’t miss this.

Click Here to Sign Up For the Webinar