Hello, team.

It’s Monday night and as you all know, the market took another hard kick in the backside. We’re truly experiencing a kick-em-while-he’s-down market right now. I’ve been completely on the sidelines over the last few weeks – mainly because of other obligations restricting my trading time, but it has been fun to watch as a spectator. All of the crazy political games during the debt cieling nonsense pretty much pissed off all of the rating agencies. They were not impressed with our ability to work together to find meaningful solutions. Top that off with weak market data, the ongoing mess in Europe, and a generally slowing global economy. It all makes for a perfect storm of concern. Concern breeds great short side opportunities and opportunities to profit from gold.

So, where is the bottom? I don’t know and trying to trade off that prediction is a really good way to get hurt. The market is a falling knife right now and has no real catalyst to move back up. Day trades aside, when you look around, there isn’t much to be happy about – maybe the earnings reports were ok and companies have a lot of cash. But, the negative news far outweighs anything we’ve heard on the positive site. However, this collapse will end. Fear trades tend to over extend themselves to the downside and opportunities will start to show up…someday.

If I swing trade at all this week, it will be very small and less than 10% of my portfolio. When would I maybe take a tiny position in a swing this week? Hmmm. Maybe nothing. But, I am interested in hearing what the Fed says tomorrow and if they hint at QE3 – the twitter buzz phrase of the night. I don’t think announcing QE3 would indicate anything other than the government is REALLY concerned about the economy. They don’t want to do it. A good Non-Farm Productivity might dull the falling knife a little. Hmm. The more I think about it, there may not be a reason to swing long yet – all about the day trades.

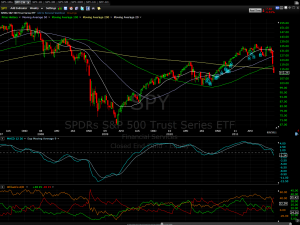

A quick look at the charts:

HA – Everything is so crazy oversold… or, is it?

The McClellan Oscillator is at -479.84. Either that’s a misprint of the lowest it’s been as far back as my chart show (1995).. That obviously implies VERY oversold territory.. we’ve fallen below the July lows seen last year.

The VIX is at the highs seen in mid May of last year… showing high levels of fear. BUT, last year when we saw this kind of spike, it quickly reversed back up – yeah, things are definitely different now, but just pointing out what the charts show.

Even though these two ‘stress’ measurements are showing oversold levels (as they obviously would), it’s important to look at the big picture. If you step back and look at the SPY weekly, the first thing that jumps out at me as that TODAY was the first day below SMA200 support. So, in other words, a major psychological level has been broken. Next support looks around the 100-106 range (amazing). That’s where I’ll watch for new entries long unless it bounces back above sma200 soon. You’ll also nice that MACD on the weekly didn’t fall below zero until today. Take a look at what happened to SPY in 2008 once SMA200 was taken out and MACD started to move under 0 – crash goes the market. So, from this big picture view, we could go much, much lower. Something to consider if you’re swinging – this is not the time to go in heavy to the long side.

Stay nimble, team and don’t rush to find the bottom.