There’s a comfortable, convenient trap into which many new traders fall: buying stock of companies they love. With thousands of stocks and ETFs listed in the US, there’s an overwhelming amount of information to sift through, and as a new trader it’s difficult to even know where to begin. So, the inclination is to stick with what you know. You look down at the Starbucks latte you are holding at the mall on a Saturday, and remember how much you love Starbucks. In fact, you stop in for a coffee almost every day of the week. Then you see that many of those around you have a Starbucks product in hand too, and it occurs to you that this is a phenomenon – Starbucks must be killing it! The next morning, you place an order for Starbucks ($SBUX), going all in.

Three months later, your brokerage account is down 23% and you aren’t sure why. There’s still a line of customers wrapped around the closest Starbucks every morning. You’ve even seen two new locations open in your city. What happened? Is it time bail out, or do you wait for the inevitable rebound? Let’s dig into why making trading decisions based on personal preferences simply doesn’t work. After that, I’ll show you a better approach.

Preferences are Subjective

By definition, personal preferences are subjective. That seems obvious, right? If Starbucks was everyone’s favorite coffee, Tim Horton’s, Dunkin Donuts, Green Mountain Coffee, etc. wouldn’t even exist. Furthermore, what’s considered a great product or brand in your location might not be elsewhere. To go back to the coffee example, Dunkin’ Donuts is on every street corner in New England, and it would be easy for someone living there to make assumptions about its nationwide popularity. But there are large sections of the country that don’t even have Dunkin Donuts at all.

But even if you could determine the popularity of a particular brand, that doesn’t tell you anything about true health of the company and what’s happening behind the scenes…

Behind the Scenes

Every publicly traded stock, particularly the well-known brands like Starbucks, have a lot going on behind the scenes. In fact, pretty much everything important about the company happens out of the public eye. Your personal enthusiasm for that brand, and the enthusiasm you see among those around you, gives you no insight into these crucial factors about how the corporation is functioning.

- Profitability: Even a great brand might not be profitable. A surprising number of companies go through long periods of unprofitably. They might be struggling with failing locations, dealing with higher production costs, negotiating with labor, shifting resources into new markets or R&D, etc.

- Expectations: The stock market is all about expectations. Stock analysts sift through all of the information about a company, its current functioning, and its history and then predict where it could go next. So, Starbucks could have a highly profitable quarter, yet still fail to meet expectations. In that situation, the stock would likely fall, as the market was expecting it to do even better.

- Competition: Starbucks might be doing well, but their competition could be doing even better. No company exists in a vacuum. Perhaps the competition just unveiled a popular new product, or cut prices, expanded in a new region, etc. What seem like minor changes from one market participant can shake things up for the entire sector, sometimes.

- Market Changes: As noted above, personal preferences are constantly shifting. Extrapolate, and its obvious that every company’s customer base is also shifting and evolving. People might consume less Starbucks coffee due to a streak of hot weather, an economic downturn that reduces disposable income, the rising popularity of tea, or any number of other factors.

- Debt. As with individuals, companies take on debt. Sometimes its to fund growth and expansion; in other cases, its a matter of survival. But the debt to equity ratio is an important component of a company’s overall financial health.

- Saturation. At a certain point, a successful company will run into the market saturation issue. For a brick and mortar business, this usually means they have extensive geographic coverage, and building more locations doesn’t make sense, as they’d just be competing with their own stores. What they do next is vital. Some companies expand overseas, launch new product lines, or buy out the competition. Others stagnate.

Limited Knowledge

As you can see, there’s a lot more to a company’s success than personal preference or anecdotal evidence can provide. And the above items are just some of the forces that impact the price of a stock at any given time. That brings us to our next challenge: accessing and interpreting all of the above information. While far superior to simply going on personal preference or gut instinct, collecting and analyzing all of the above information (called fundamental data), and more, for a company you like, is difficult.

As you can see, there’s a lot more to a company’s success than personal preference or anecdotal evidence can provide. And the above items are just some of the forces that impact the price of a stock at any given time. That brings us to our next challenge: accessing and interpreting all of the above information. While far superior to simply going on personal preference or gut instinct, collecting and analyzing all of the above information (called fundamental data), and more, for a company you like, is difficult.

As a retail trader, you have access to much less information than large trading institutions, like hedge funds and mutual funds. Funds hire full time, professional analysts, have access to the officers of the companies they are investing in, and tools for analyzing that data. The rest of us, unfortunately, do not. Much of the data we have access to lags by weeks or even months. That might work if you are making a long term investment – years – but it won’t work for swing trading or day trading, certainly.

Timing

But wait, there’s one more piece of the puzzle. Let’s assume that your instincts are correct, and that the company you regularly patronize is doing as well as you think and hope. Maybe you’ve even done some research into the fundamental aspects discussed above. You’re still missing something absolutely vital – timing. Proper timing is the  difference between making money and losing it. When you enter a stock and when you exit it are as important as what stock you actually trade. And thinking – or even knowing – that a company is doing well now, doesn’t help you time your trades.

difference between making money and losing it. When you enter a stock and when you exit it are as important as what stock you actually trade. And thinking – or even knowing – that a company is doing well now, doesn’t help you time your trades.

For example, let’s assume that Starbucks is at the top of their game right now. They’ve been making all the right choices and the market has responded as they have hoped, and their stock price reflects that, sending it to all time highs. You see the problem here. You are buying at a peak. Maybe the stock continues higher, or maybe not. Either way, you’ve paid a high price.

To continue that example, where do you exit the stock? You’ll probably still like drinking Starbucks in a year, and so will many other people, but that doesn’t mean it’s not time to sell. And if it goes the other direction and you lose money, at what point is it reasonable to cut your losses and move on to better opportunities? Knowing not just what to buy, but when to buy (and sell), is the very core of stock trading, and not something that buying because you like a company’s product can ever provide.

An Alternative

Buying companies you like, even if you dig a little deeper into their fundamental health, rarely works. It doesn’t provide adequate answers for what to buy, or when. Instead, we use and recommend technical analysis:

…technical analysis really just studies supply and demand in a market in an attempt to determine what direction, or trend, will continue in the future. In other words, technical analysis attempts to understand the emotions in the market by studying the market itself, as opposed to its components. (Investopedia)

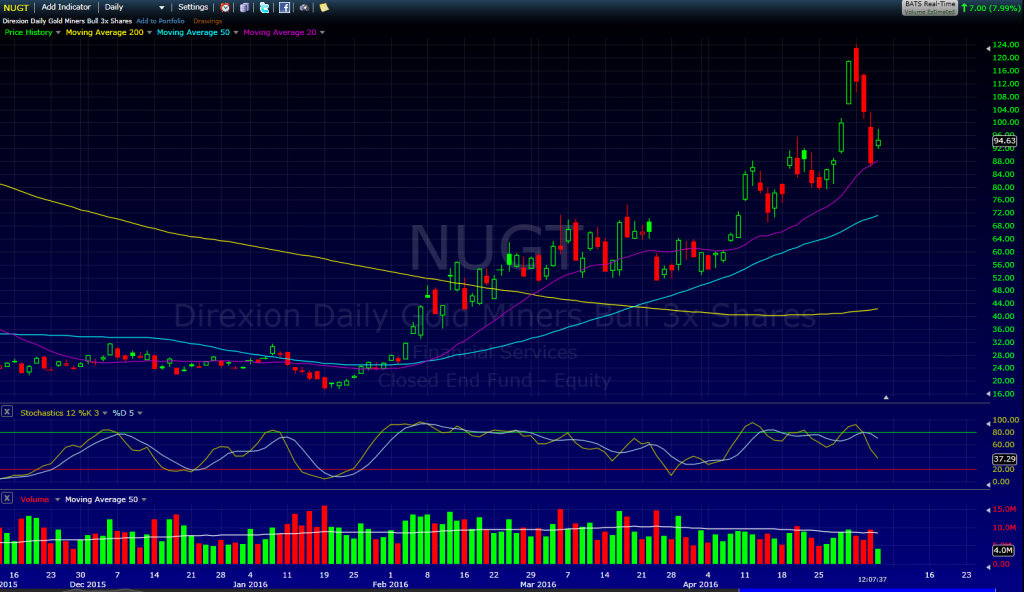

That means we look at the price history of a stock chart to determine where a stock has gone in the past, and use that information to help predict where it might go in the future.

Technical analysis is not a magic crystal ball; it cannot perfectly predict the future. But, it does provide several significant advantages over choosing companies you like and/or using fundamental data to make investment decisions:

Subjectivity: Technical analysis removes much of the subjectivity from trading. When you are looking at charts, scanning for opportunities, you aren’t thinking about whether or not a Five Guys burger tastes better than a Wendy’s burger – all you care about is how their charts look.

Levels the field: Technical analysis provides a much leveler playing field for retail investors and institutions. As a technical trader, you don’t need access to the board room, analysts, or other tools – the charts you are using are the same as those the institutions are using. The indicators are the same. The time lag is the same.

Expands your choices: If the beginning of your stock purchases decisions are based on brands you personally enjoy, you will never even be aware of the vast majority of stocks that are traded in the US. With technical analysis, you’ll have criteria for looking through the entire universe of publicly traded companies and selecting the few (or one) that seems strongest and best suits your needs. There’s a decent chance that stock won’t even be a company you know or care about personally.

Timing: Perhaps most importantly, technical analysis tells you when to buy and sell. It shows you where a stock has been in the past, and where it might go in the future, so you can avoid buying at peaks and selling in valleys. It helps inform your decision about when to cut a loser off.

Summary

Not buying companies because you like them is one of the first big traps any trader must overcome. It seems like a great idea, but in reality is no better than throwing a dart at the Wall St. Journal. Fundamental analysis provides a better picture, but still has significant limitations for retail investors and traders. Technical analysis, on the other hand, provides a framework for evaluating the wide world of stocks so you can determine not only what to trade, but when.